Most customers won’t have experienced the claims service of a provider, yet ultimately this is the real moment of truth in delivering on the promise of peace of mind.

Customers make a claim at a time of crisis, be that big or small. It can be a difficult and emotive experience, so ensuring they are clear on next steps and progress is important.

Knowing what to do after the incident, and the way it is handled can make a lasting impression on the customer. It is also an experience that will be discussed and shared with friends and family, which could prove good or bad for brand value.

While customers are increasingly used to shopping around, the search for insurance is no different, and knowing how they can expect an insurer to perform when it matters the most could play a key role in their decision.

It’s an exciting time of year for us as we announce the winners of the Consumer Intelligence Awards 2019. More specifically, the top 10 companies in the UK for claims satisfaction as voted for by the most important judges — customers.

Top 10 brands for claims satisfaction*

|

|

Voted by householders: |

|

Aviva |

Co-op |

|

Churchill |

Hiscox |

|

Co-op |

John Lewis Insurance |

|

Direct Line |

Lloyds Bank |

|

LV= |

LV= |

|

NFU Mutual |

NFU Mutual |

|

Privilege |

Prudential |

|

Quotemehappy.com |

RIAS |

|

Saga |

Saga |

|

Sheilas’ Wheels |

Sainsbury’s Bank |

*Listed alphabetically

Each year, using our Insurance Behaviour Tracker, we survey over 24,000 motorists and the same number of householders to find out about two key areas — customer service and claims — and what this means in terms of satisfaction, trust and recommendation.

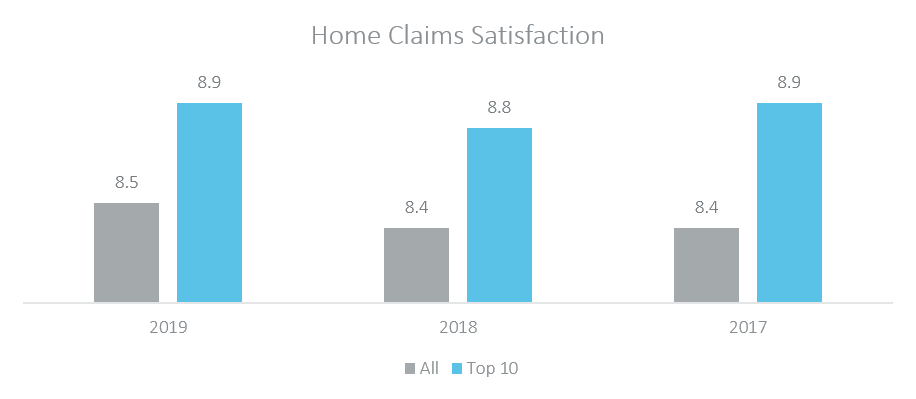

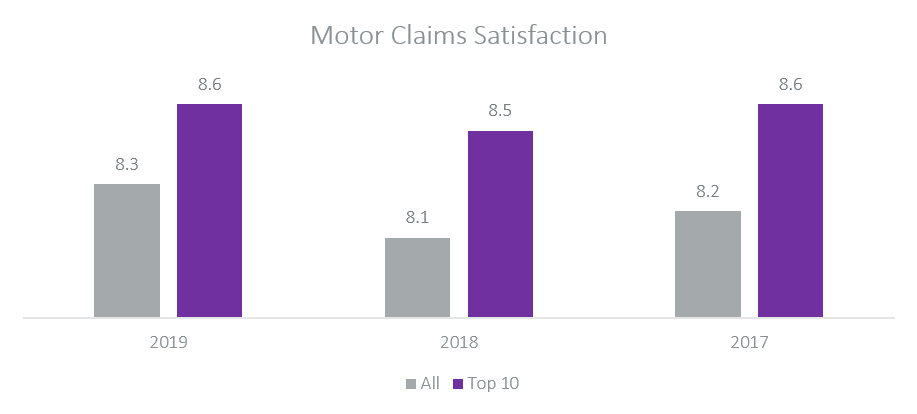

Customers who have made a claim rate their experience on a scale of 1 to 10. These are the results.

Let’s look at the numbers

The average scores for the top 10 brands were 8.9 for home, and 8.6 for motor. Across the market we saw average scores of 8.5 and 8.3, respectively.

Compared to 2018, we have seen a slight improvement for home insurance claims satisfaction, both among the top 10 group and across the wider market. The three-year trend is stable, with the market moving in a positive direction.

Considering the previous observation of a market-wide decline, motor claims satisfaction scores saw an unexpected improvement.

We will observe with great interest the positive impact that emerging technologies and claims management processes will continue to have on these numbers.

There were several dominating brands who featured in the top 10 for both home and motor: Co-op, LV=, Sainsbury’s Bank and Saga.

There were also a number of new entrants for this particular award this year. In motor we greeted Privilege and Churchill, and the home panel were joined by Co-op, Lloyds Bank and Prudential. This is positive confirmation that their efforts are being recognised by their customers.

To become a winning insurance brand fundamentally comes down to dedication, consistency and a successful customer strategy to deliver customer service at all levels of the organisation.

From our customer feedback and research, we have identified key areas that have a significant impact on the customer experience, and make all the difference between an average experience and great one.

A crucial area that has big impact refers to giving customers the opportunity to feedback.

Others include:

- Use the potential from existing and emerging technologies

- Develop agile, flexible products

- Remember that price isn’t everything — experience is

- Interrupt and re-route the consumer journey

In our annual survey, customers who were happy with the way their claim was handled said:

“Claim was settled with one phone call and cheque received within a couple of days”

“We made a claim and it was all sorted within a week”

“Excellent service with minimum fuss & very quick payment when claiming”

There are a number of brands who fall outside of our top 10 who didn’t fare so well and there are a number of areas where there are opportunities to improve the experience for customers.

Some of the negative comments made by customers were:

“Dealt with different people at HQ, so no continuity”

“A bit slow in confirming they would pay for the damage caused by minor earthquake”

“They failed to keep me informed”

To understand more about these changes, we asked consumers what they would want from their insurer and claims handling experience.

They gave us four key areas for development and focus — which include a clear message on the importance of service and the customer experience.

In the next blog of this series, we will be revealing the top 10 brands for customer service, and looking more deeply into what these brands did to be voted so highly by their customers.

Did your insurance customers vote you a winner?

The awards are based on an annual survey of nearly 50,000 home and motor insurance customers who rate their experience of brands like yours. So winning one of these unique awards in a crowded market is kind of a big deal.

Claim your awards today to find out how you can make the most of being a winner.

Submit a comment