.jpg?width=704&name=Canva%20-%20Woman%20Wearing%20Face%20Mask%20(2).jpg)

The number of Brits who identify as vulnerable customers has doubled in a year as the coronavirus crisis sent concerns about health and personal finances rocketing, according to new research from data insight specialist Consumer Intelligence.

The FCA defines a vulnerable customer as someone who due to their circumstances is “susceptible to detriment, particularly when a firm is not acting with appropriate levels of care.”

Key drivers of vulnerability include health factors, life events, capability or skill levels, and financial and emotional resilience – and coronavirus has clearly pushed more people to and over the edge into vulnerability.

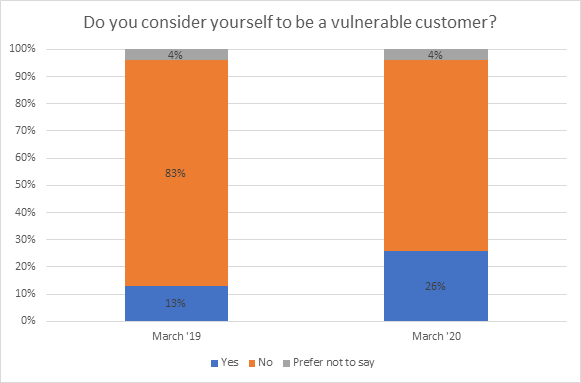

In a nationally representative poll of 1,000 consumers, some 26% of consumers said they fitted the Financial Conduct Authority’s definition of vulnerability in March 2020, compared to just 13% in March 2019.

So far more than 9 million people have been furloughed in the UK, and potentially hundreds and thousands more have lost work and income, with small businesses and the self-employed particularly affected.

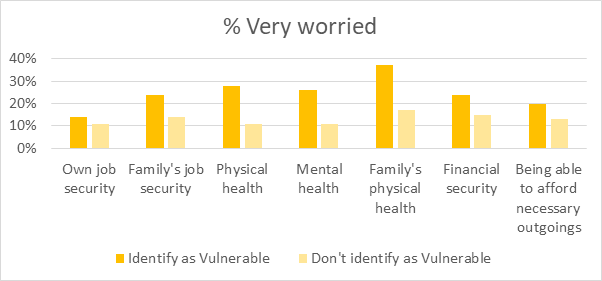

The research shows that those who identify as vulnerable have higher levels of concern than non-vulnerable customers, with 37% very worried about their family’s physical health, 26% about their own mental health and 1-in-5 very worried about being able to afford necessary outgoings.

The findings are contained in Consumer Intelligence’s vulnerable customer report, which will be launched on Monday 4 May.

Levels of concern

The findings raise a number of questions for brands to consider around understanding how vulnerability impacts consumer behaviour and what actions they should take to ensure they do not suffer a detriment as a result of coronavirus.

Consumer Intelligence CEO Ian Hughes says: “Stressed, worried, and distracted people – especially those under financial pressure - think very differently about insurance, interact differently with insurance companies, shop differently and claim differently.

“Understanding that behaviour and supporting the needs of those customers is vital - but not enough. Insurers must act now to make sure they aren’t contributing to the detriment vulnerable people are experiencing through their interactions, or lack thereof. This group makes up a large part of your customer base. They need the protection of insurance more than ever, and they need the protection of insurance companies to ensure they’re getting the right information at the right time, the right cover, and the right price.

“Given the FCAs recent focus on vulnerability, it’s highly likely they will require financial institutions to show how they’re supporting these customers, both during the coronavirus crisis and beyond. Now is the time to start finding your vulnerable customers, and start taking positive action.

“This is a crucial moment for insurers to develop their relationship with customers beyond purchase and renewal touchpoints. Those doing the right thing now will reap the rewards in customer loyalty and brand equity further down the line.”

Vulnerable Customers in the Insurance Market

Did you know around one in four customers are potentially vulnerable? This is a group insurance brands cannot afford to ignore, especially given the recent FCA communications.

The protection of the most vulnerable people in society falls not just to government but to the organisations and businesses they need to interact with – especially fundamental financial services. The coronavirus pandemic has only put more financial pressure on individuals, pushing some into vulnerability and exacerbating existing problems for others.

To help you understand vulnerable customers, the relevant risk and regulatory advice and get actionable insights we have launched our latest industry report for Home and Motor Insurance.

Comment . . .

Submit a comment