.png?width=705&name=Copy%20of%20Untitled%20(2).png)

Many insurance brands have got into the habit of only communicating with customers at renewal or at the point of claim.

Coronavirus has changed that. There is a lot to update on. Driving and living patterns have changed, buying behaviours are changing, money worries are growing. There are requests that consumers go online first, and there are reassurances.

And at a time when people are clamouring for clear information, no news is simply not good news - it’s a void that can be filled with worry. That means financial institutions have an important role to play in offering reassurance, support and actual real life empathy at what is an incredibly difficult time for so many families. This may not be a familiar role: it must become one.

Speed is of the essence

Communications need to be fast, because people need a response before they draw their own conclusions.

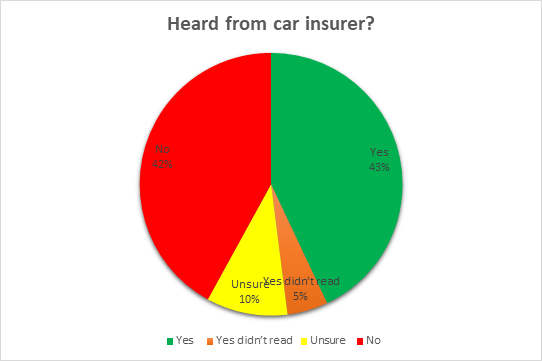

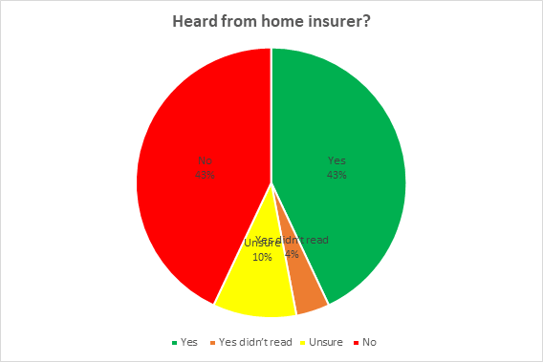

Too many insurance brands have failed to talk to their customers at all. A survey we conducted last week showed that nearly half of customers had still not heard anything from their insurer.

But they want to: most consumers told us they had read what their insurer had to say rather than deleting it.

If you haven’t yet written out to your customers, you should. It will mean creating comms more quickly than you might have been used to, and probably using quite a different tone.

It’s important to say something, but it’s also important to say the right thing in the right way.

Reiterating reassurance

We surveyed a range of Coronavirus communications from insurance companies and banks, and found that most had some sort of reassurance message for customers, often up front in titles or opening paragraphs - we’re here to help, support for you, we’re doing all we can.

It’s tempting to play ‘unprecedented times’ and ‘challenging times’ bingo, but it’s probably more helpful to look at what organisations are saying thematically.

Key messages

In terms of actual content, the most common message from financial organisations was to push people to online services first, mentioned in 79% of communications.

63% told customers they were reducing call service levels, hence the importance of online service channels, and 25% told customers they were reducing other available services, too, such as call centre opening hours.

70% of organisations were offering coronavirus information, with many having set up special web pages or information hubs.

Clear communications

Clarity is absolutely key in any sort of crisis communications, but with many organisations under pressure to get communications out fast - some haven’t broken down their information with any sort of formatting.

Nearly half (46%) of the communications we looked at didn’t include any sort of sections or sub-headings.

Reassurance is great, information is great, but now more than ever it needs to be conveyed into bite-sized chunks, so corona-news-weary, distracted, stressed customers can easily digest it.

It’s also worth noting that for many, links to coronavirus information came at the beginning of their communications, only then followed up with more direct information about services and personal impact.

When you are writing customer communications, think about what your customer really wants to know from you.

It’s not about we

It’s actually interesting to see how many financial organisations have struggled with personal empathy, and putting themselves into the customer’s shoes in this way.

The fact is that right now your customer is probably less interested in your staffing levels and coronavirus hub than in whether or not they’ve still got cover if they haven’t been able to take their car for an MOT, if they can get relief support for their premium payments , or what they do if they’ve got to make a claim - as just a few examples.

The good news is that 37% of communications were very customer-focussed, answering the main questions or qualms people might have about their money or policies, and focussing in on YOU.

For 21%, however, the focus was very much on WE, what we’re doing, how our business is impacted, all about OUR services and OUR actions - WE before YOU.

We’re here to help

As you might expect, there was a strong correlation between those focussing on customers with YOU messaging and those offering help – with only 15% of the ‘helpers’ using US messaging.

In many these communications, the offer of help was merely a sign off, an unspecified ‘if you’re in trouble get in touch’ message. But for a few, the support available was the main subject of the communication, and listed out very clearly. Indeed, a full third of the communications (33%) were offering extra support and services put in place for people struggling financially during the Covid-19 crisis.

On the other end of the scale, as you might expect, of those reducing services in some way 60% did not offer any other sort of help other than pushing their online services.

It’s no surprise that many messages left consumers cold.

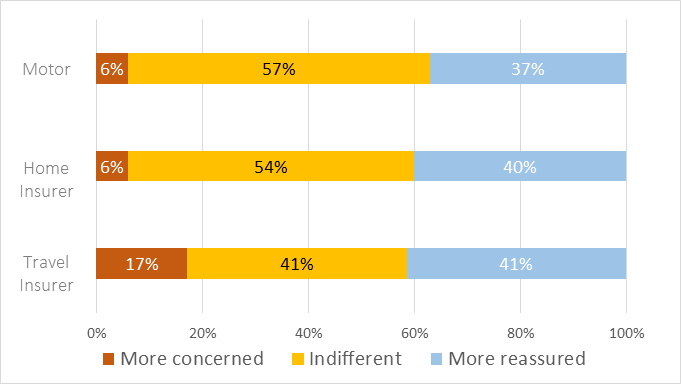

Some 57% of car insurance customers felt indifferent after reading a message from their insurer compared to 37% who felt reassured. 6% felt worse.

Be specific

In addressing any critical issues, laying out clearly what action you’re taking and what people need to do next is always vital. Just be careful not to create a gap between what you promise and what you can realistically deliver.

Interestingly it was banks that did this best, possibly because of clear FCA guidance, and measures included the possibility of mortgage breaks, the extension of credit card payment schedules, no fees, charges or interests on missed payments and no restrictions on accessing savings.

Only a quarter of those offering extra help were insurance providers, and 60% of the messages focused on internal measures were from insurers, too.

The clarity on what is practically on offer took these communications to the next level, and it’s something insurers should look to emulate. What relief measures could you introduce, and set out in your next communication? An extension to your unoccupied home insurance clause? The use to which vehicles can be put?

Try and be specific - not just a vague ‘call us and we’ll see what we can do’.

The personal touch

At the end of the day, or indeed the months of this crisis, you want to keep your customer’s business.

This is an opportunity for insurance companies to build their brands by forming a new sort of relationship with their customers. This isn’t about making a transaction, it’s about making a connection. One that your customer will remember in years to come. And that’s why how you talk to customers over the coming weeks and months really matters.

Who does the talking matters too.

If you’re trying to build trust, people need someone to trust in - and for communications to be personal and not just corporate. It’s a basic communications lesson that’s been learned in two thirds of the communications we looked at - with 66% coming from a named, real person and not just a ‘team’.

In 25% of communications, that person spoke in the first person. I. I wanted to write to you. I wanted to let you know. I’m here for you.

Beyond the written word

Your organisation should continue to communicate with customers via email and letter. Don’t bombard them with spurious information if you don’t have anything new to say, but do stay in touch with simple, honest, human messages.

Your next challenge is to make sure your new communications go beyond the written word.

The service your call centre staff deliver on the phones needs to reflect the tone you strike in your other communications. Training remote and skeleton staff won’t be easy. But like all good communications, it will be worth it.

Introducing the Consumer Intelligence Covid-19 Consumer Tracker

In response to the challenges faced by our clients across the general insurance industry, we have been working hard behind the scenes gathering data and insight that will help personal lines insurers and brokers navigate this difficult and challenging time.

We are pleased to announce the launch of our new Covid-19 Consumer Tracker, focusing on wider consumer behaviour trends during the COVID-19 pandemic but with a specific focus on the general insurance industry.

We are interviewing a nationally representative sample of 1,000 consumers every week to bring you timely insight on what your customers, your competitors’ customers and the general market think and are doing during these uncertain times.

Comment . . .

Submit a comment