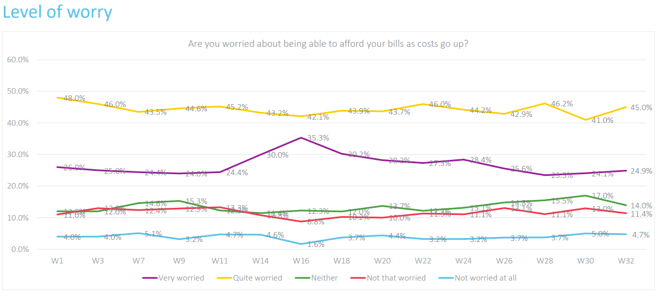

Our latest cost-of-living tracker shows that levels of worry were elevated in mid-December, with 70% of people now worried or very worried about being able to pay their bills.

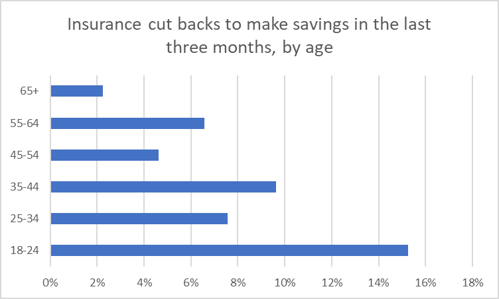

It’s 35-44 year olds who are most likely to be feeling the pinch, but people of all ages are continuing to make spending cuts across the board, from heating to holidays - with Christmas the latest casualty.

And insurance, often a compulsory purchase, is not immune.

In the last 3 months 7% have cut back to make savings, with 46% of those cancelling cover and 59% changing to a cheaper policy. Broken down by age, it’s 18-24 year olds most likely to be looking to make changes, with 15% cutting down insurance this Winter.

On top of that, 29% of consumers say they’re more likely to purchase a lower cover insurance product in the future, and 28% say they’re more likely to pay in instalments in the future.

For providers, the challenge now is to keep up not just with changing duties towards vulnerable customers – outlined in the new Consumer Duty – but to stay one step ahead in terms of identifying them as the cost-of-living crisis worsens, and two steps ahead in terms of providing products, services, communications and interventions to meet their needs.

Make no mistake, these are not customers outside of your footprint. They are now your core audience. In fact, the latest figures from our vulnerable customers whitepaper show that 41% of motor customers and 43% of home customers are vulnerable – nigh on half your customer base.

The good news is we do know something about how vulnerability changes consumer behaviour. Here are three vulnerable customer differences to pay attention to in 2023:

- They’re less likely to shop around

Potentially vulnerable customers are 9% less likely than non-vulnerable customers to shop around at renewal within the home insurance market, and 6% less likely to shop around in the motor market.

- They’re more likely to use PCWs

When vulnerable customers do shop around, they’re more likely to use Price Comparison Websites (PCWs). Within home insurance the vulnerable are 11% more likely to use a PCW, rising to 17% of the highly vulnerable, and within motor it’s 9% more likely, rising to 12% of the highly vulnerable.

- They’re more likely to want to buy over the phone

Vulnerable customers are more likely to want to purchase a policy by speaking to a real person – particularly over the phone. In home, 27% of vulnerable and 39% of highly vulnerable people purchased their policy this way, and in motor it was 23% and 32%.

This year, everything from your pricing strategy to your placement strategy, your premium finance provision to your cover quality and your call centre training needs to be reviewed with vulnerable customers in mind.

Organisations have a responsibility to ensure customers don’t suffer financial detriment because of their vulnerability. And those stepping up now are likely to see the pay-off down the line in terms of customer loyalty, brand equity, and ultimately commercial advantage.

Read our vulnerable customers whitepaper here

Find out more about our cost-of-living tracker here

[Whitepaper] Vulnerable customers in the age of the cost-of-living crisis.

We address how the cost of living continues to drive the number of those identifying as “vulnerable” and so much more! Helping you understand vulnerable customers, the relevant risk and regulatory advice, and get actionable insights to help create better outcomes for you. Download now!

Comment . . .

Submit a comment