Nearly two thirds of Brits who celebrate Christmas are planning a leaner, lighter celebration.

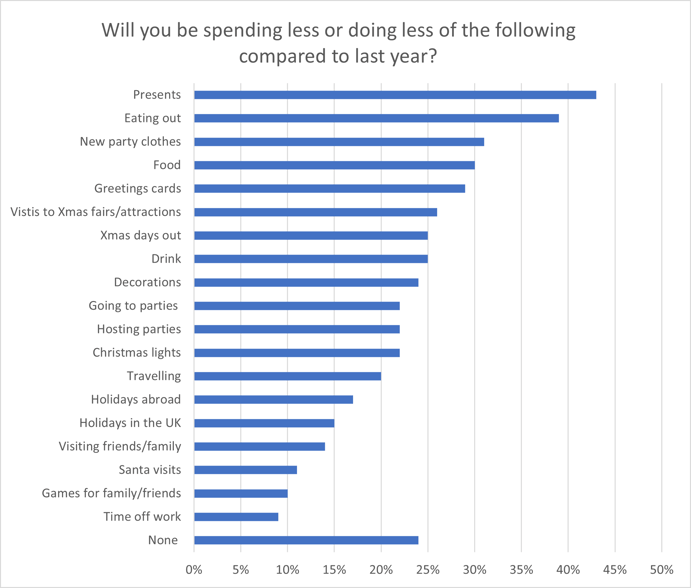

Gifting was top of the cull list, with 43% plan cutting down on presents, followed by 38% who will spend less on eating out. 30% plan on sending fewer greetings cards, another 30% will be spending less on food - and 25% less on Christmas booze.

Tis certainly NOT the season to be jolly in general, as fun continues to be a key casualty. Some 22% said they would go to and host fewer parties to save money, with 31% cutting back on new party clothes. Days out and Christmas attractions are off the table for a quarter of us - with 1-in-10 saying they won’t visit Santa this year to save money.

20% plan to travel less, and even at home it’s looking distinctly less festive - with nearly a quarter cutting back on the decorations, and a fifth on Christmas lights.

Gift giving declines

The general mood of belt tightening is reflected in the fact that as of last weekend, a fifth of us had yet to start our Christmas shopping - and half of us are looking to spend less money overall.

Of those seeking present-savings, 76% are planning to buy fewer gifts, 56% were looking for cheaper gifts, 18% were going homemade - and 7% were going for a Secret Santa strategy.

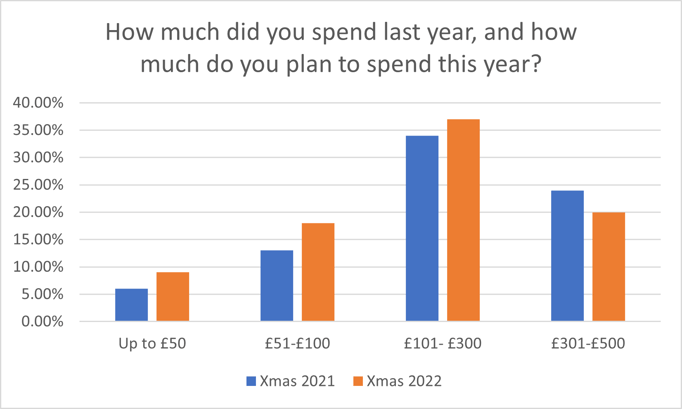

Budgets have clearly changed from last year, with the average planned spend dropping from Christmas 2021 as people struggle with other rising costs and bills.

Of those looking to save food-wise, people are seeking out cheaper shops (49%), cheaper product ranges (46%), cheaper cuts of meat (28%), making fewer side dishes (40%) and feeding less guests (37%).

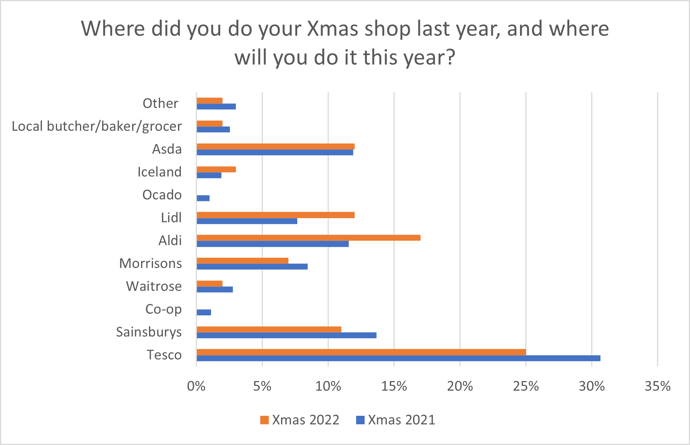

If there are any winners here, it’s the budget supermarkets, with Lidl and Aldi taking the big Christmas food shop away from rival supermarkets.

“What we can see from these latest Viewsbank results are the kinds of layered strategies people are deploying to try and save money. As the New Year comes round and people look 2023 in the face, the cuts they’re making are only going to get deeper – and that’s going to start impacting insurers directly and indirectly.

“We know the general insurance market is already responding to the FCA’s general pricing practices rules with essentials products – their own ‘basic’ ranges. But as an industry we might not be doing enough to be the safety net that newly financially vulnerable customers really need.

“We’ve got a job to do in tailoring policies, in targeting key groups of consumers, in creating value without stripping out quality - and in overhauling our communications - all directly in line with Consumer Duty principles.

“Those getting it right could well steal the march on competitors - and get the sort of business-boost Aldi and Lidl are clearly seeing on this year’s Christmas dinners. It’s definitely time to think about what your customers want, what they need, how to deliver it efficiently and possibly differently - and even what your own innovative ‘middle aisle’ extras might look like.”

[Report] Cost of Living Consumer Behaviour Tracker (November edition)

In a time of fast-changing customer trends, it is important businesses are up to date with new customer behaviours and buying intentions. Our Cost of Living tracker allows you to identify opportunities to tailor your products to meet evolving consumer needs.

Comment on blog post . . .

Submit a comment