Electric vehicle sales are at tipping point.

New vehicle registrations have increased so rapidly that more plug-in vehicles will be join Britain’s roads in 2021 than during the whole of the last decade, according to the SMMT forecasts.

Including hybrid vehicles, more than a quarter (26.5%) of new cars joining the roads during 2021 have been electric. EV sales have grown while petrol and diesel sales have declined, making their growth all the more significant in the context of a subdued market.

This is only the beginning (EVs and hybrids still account for less than 2% of cars on the roads). But which insurance groups trying to secure a solid share of electric vehicles, and which are sticking to petrol for now?

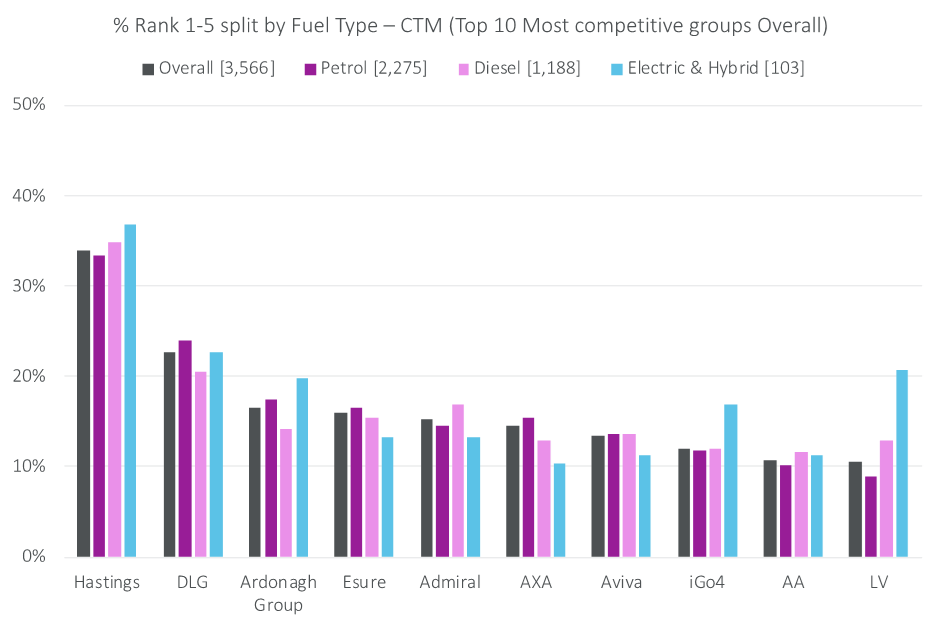

Our Market View tool shows that LV=, Hastings, iGo4 and Ardonagh group brands are more competitive for electric and hybrid vehicles than they are for petrol and diesel.

LV= in particular is making a big push for market share. It was the third most competitive group for electric and hybrid vehicles in October, but the tenth overall. It returned a top 5 quotes on CTM for over 21% of electric and hybrid vehicles, compared with 11% overall.

LV= has also led on marketing efforts to EV drivers and potential drivers. In September it claimed a market first by offering ‘out of charge recovery’ as standard as part of its electric vehicle insurance, something it also highlights on PCW marketing messages.

And then last week it published analysis of the reasons it receives breakdown callouts in an attempt to dispel range anxiety, something Consumer Intelligence has previously found is one of the biggest barriers to electric vehicle adoption. LV= said that electric vehicles are three times more likely to break down because of wheel or tyre problems than anything to do with the battery.

It has also recently launched ElectriX –an informational site to support customers who are considering buying an electric car.

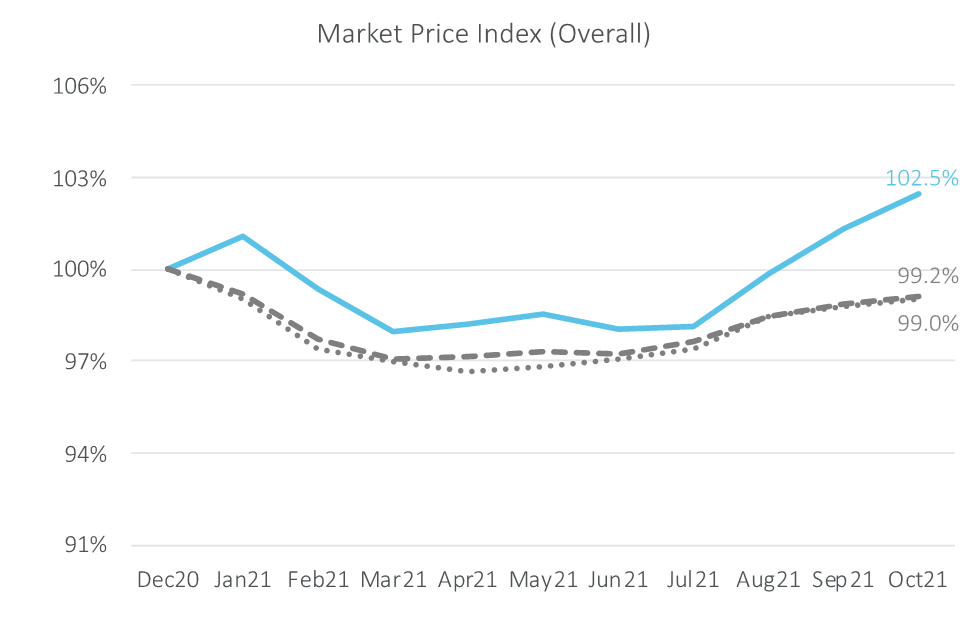

In terms of insurance costs, premiums for all types of vehicles increased over the summer when lockdown restrictions lifted and the resulting traffic resulted in a higher chance of claims.

However that increase was greater for electric (4.5%) than internal combustion engines (1.5%), potentially reflecting the higher repair costs and the looming skills shortage to repair and service these new vehicles. Longer repair times mean greater credit hire costs too.

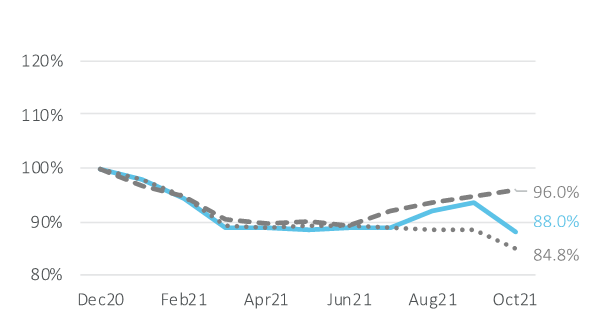

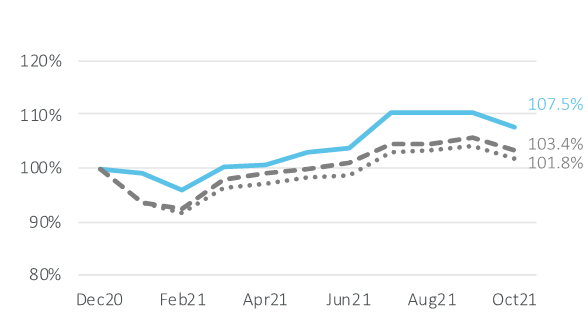

LV: group price index by fuel type

LV= has been particularly assertive in its pricing here, bucking the market trend by decreasing premiums for electric vehicles to a greater extent than for petrol or hybrid vehicles.

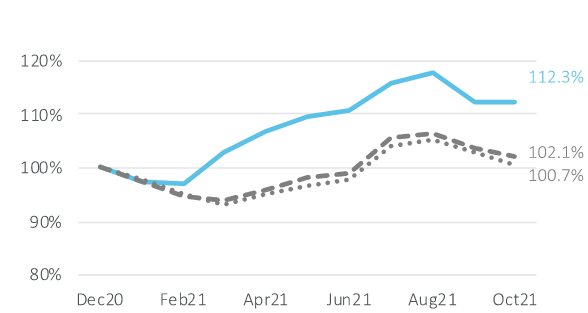

At the other side of the spectrum, Aviva and RSA were amongst the groups to increase EV premiums by more than they increased petrol and diesel insurance prices. Others including Hastings and Markerstudy have decreased premiums for electric vehicles in line with reductions for traditionally fuelled vehicles.

Aviva: group price index by fuel type

RSA: group price index by fuel type

The rise in new EV car sales is so recent that fewer than 2% of the 32 million cars on Britain's roads are currently hybrid or plug-ins. It’s also worth remembering that two thirds of new battery electric vehicle registrations this year have been to businesses, which enjoy tax breaks and grants to invest in plug-in cars. They will have their own large fleet insurance policies.

But with just eight years go to until the ban new petrol and diesel car sales, this will not be a niche book for long.

Optimise your competitive position in a fast-moving market

Understanding and optimising your product mix, particularly in your competitive context, can make all the difference when it comes to winning new business. To learn more about our pricing insights, please click below.

Comment . . .

Submit a comment