The cost of living crisis has been hitting the headlines for months – and it could be hitting insurance soon, too.

In April the 54% rise in the energy price cap hit 22 million homes, an estimated £700 a year increase on the average bill. Food prices and fuel costs are also on the rise, and the Bank of England has warned inflation might reach 10% within months.

For some of the poorest households this is going to cause significant hardship - and impossible choices between fundamental needs like staying warm and staying fed. For many more, it’s going to involve sacrifices as belts are tightened and pennies are watched across the board.

In a recent Viewsbank survey, we asked consumers if they were making cuts, and where they were making them. Some 70% of Brits reported they had already reduced their spending because of rising costs.

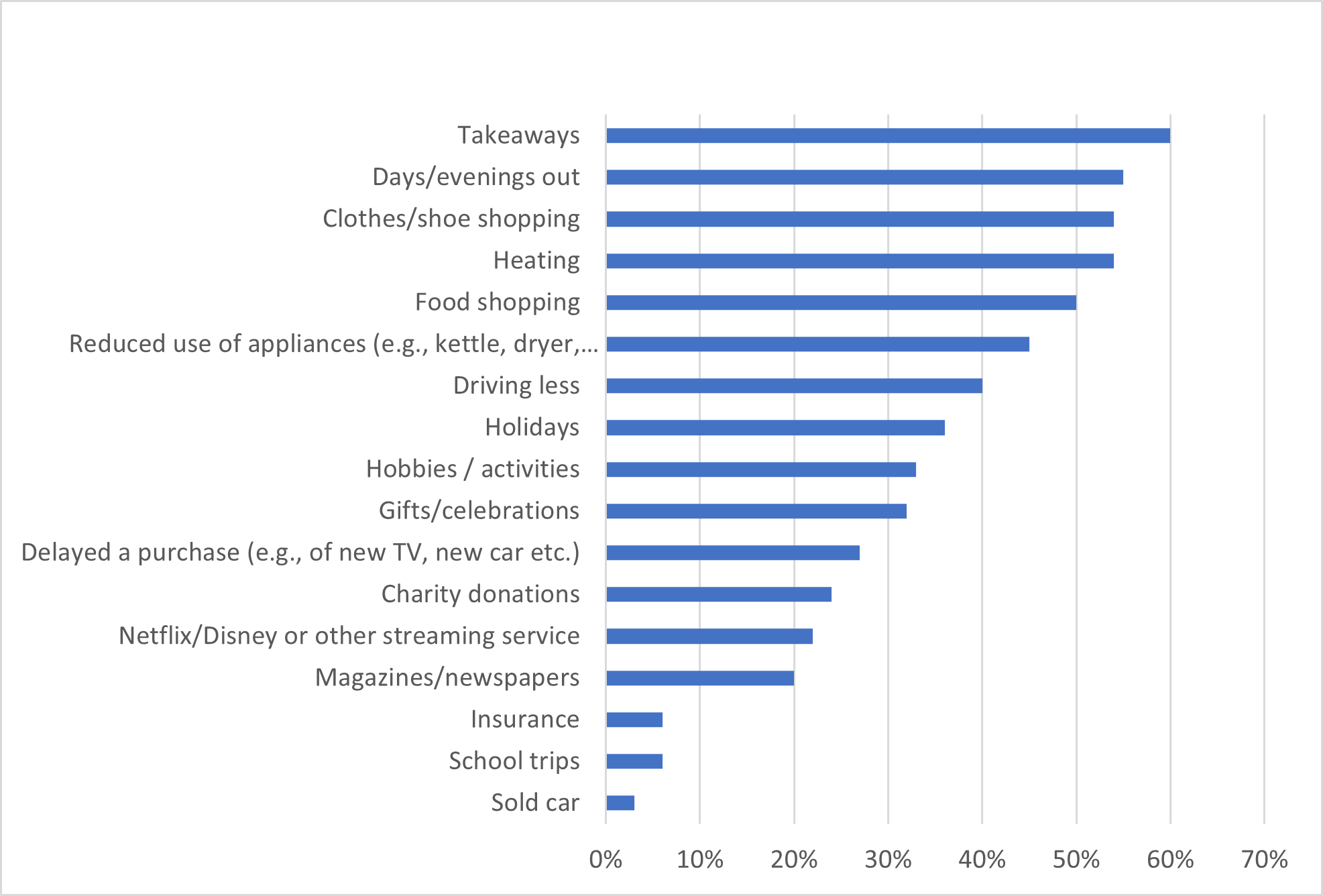

What have you cut back on to make savings in the last 3 months?

Viewsbank survey: 995 interviews conducted 6-9 May 2022

Insurance comes towards the very bottom of the list of areas that people are cutting back on – so far. As an often compulsory purchase, that should come as no surprise - but neither should it be surprising if it begins to come into play in the coming months, especially as people come up to renewal.

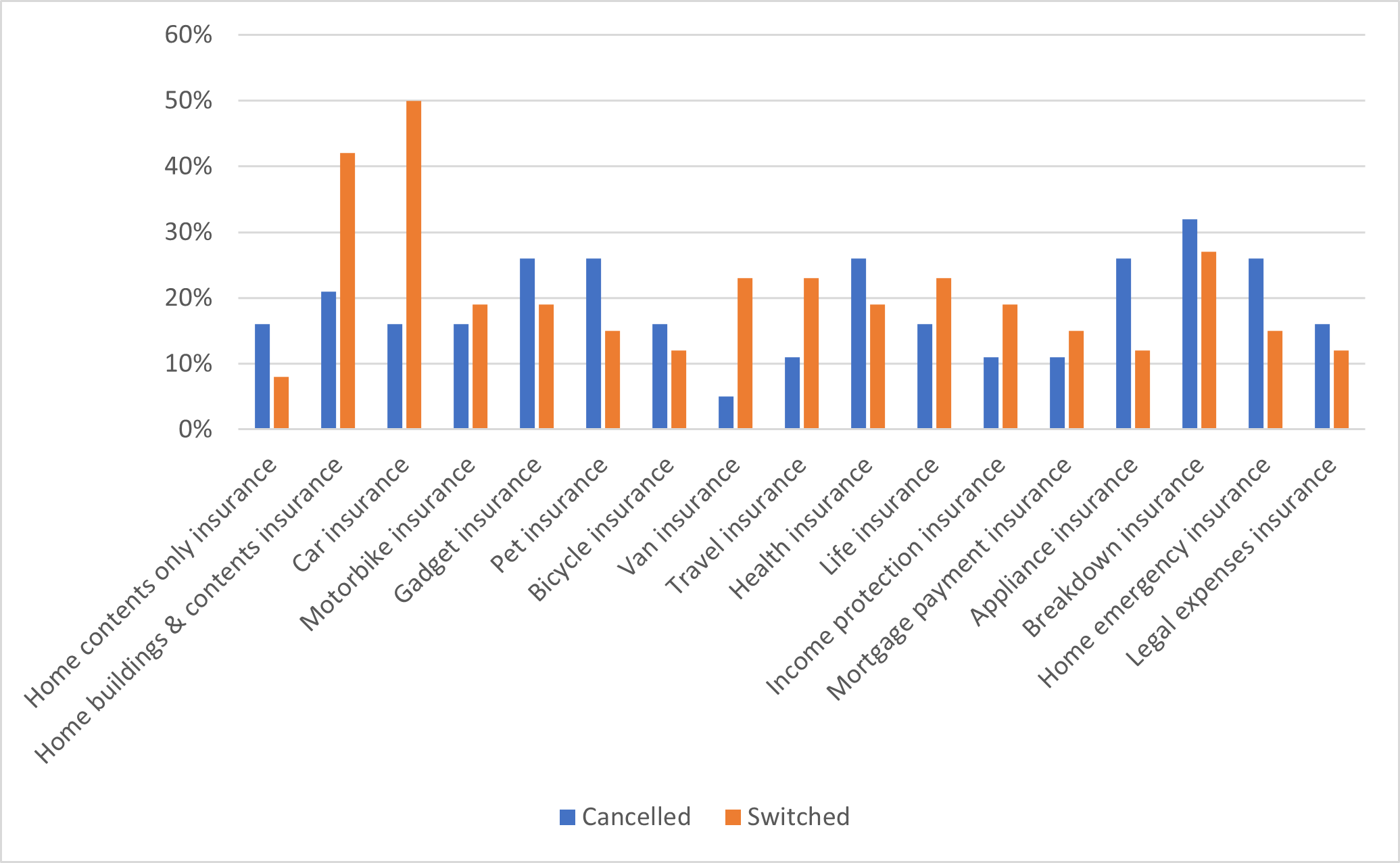

We found that of the 6% of consumers who had looked to save on insurance in the last three months, 60% had swapped to a cheaper policy, and 44% had cancelled a policy.

Non-compulsory insurances were the most popular to drop – with breakdown insurance the most cancelled insurance, followed by gadget insurance, pet insurance, appliance insurance, health insurance, and home emergency cover. Meanwhile, half had swapped their car insurance to cheaper cover, and 42% had swapped their buildings and contents insurance.

Which insurance policies have you cancelled or switched to reduce costs?

Viewsbank survey: 43 people out of 995 who reduced insurance costs, interviews conducted 6-9 May 2022

What all of this means is that consumers are more price sensitive than ever. And that makes the rise of the ‘value’ or ‘essential’ proposition particularly timely.

The arrival of the tiered product

In response to the FCA’s pricing reforms and its new emphasis on fair value, we’ve seen a proliferation of tiered offerings including essentials or basic cover options.

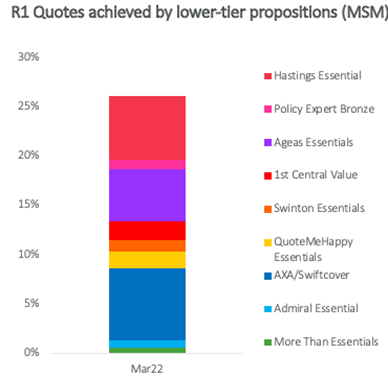

Four providers have launched lower-tier propositions into the PCW market since November 2021, taking the overall total to nine value or essentials-type propositions returning quotes.

It was a smart move, and could prove to have been a prophetic one. Not only does it directly and unashamedly link price with value, but it creates a stacking strategy to maximise presence on the price comparison websites (PCWs) to target customers, giving providers more chances at reaching the coveted number or rank 1 spot.

Looking at just one PCW in March, Money Supermarket, lower-tier propositions collectively achieved more than a quarter of all rank 1 quotes.

What’s more, 9% of that total were instances where that group would not otherwise have taken the top result with their other propositions – boosting competitiveness.

Essential strategies

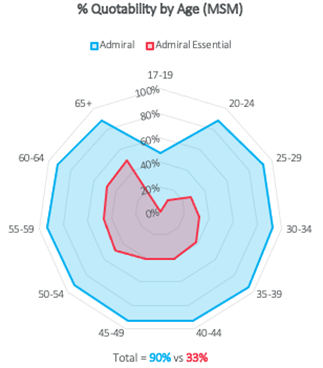

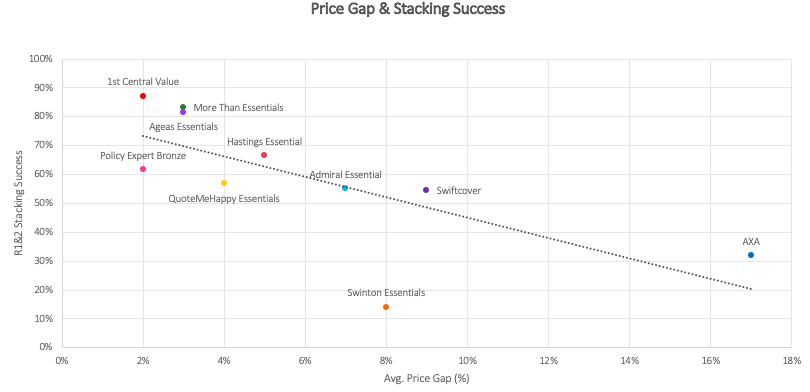

Approaches to essential products and brand stacking differ across the market. Some providers, including AXA, Ageas, More Than, QuoteMeHappy and Policy Expert have identical quoting footprints across their lower-tier and standard products, while others target different customers and only offer lower-tiered products to a smaller group of customers.

In the case of Admiral as an example, overs 50s are more likely to get a quote from their Essential proposition.

Those with the closest footprints and smallest price gaps between offerings seem to be most successful in their stacking strategies on the PCWs. Others are falling down with a higher cost of credit, dropping down the ranks when customers look to pay by instalments rather than one annual sum.

Tiered products may have emerged in response to GIPP, but they’ve arrived at a very opportune moment. The cost of living crisis is set to push many households over the edge and create new swathes of vulnerable customers.

Essential products are likely to become more popular over the coming months, as are pay-as-you-go options - and payments by instalments as people struggle to make ends meet. Providers without value products should consider their strategies to meet this deep consumer change, and all should be checking that products really are providing fair value at every stage of the customer journey.

Providers should also be looking to establish with existing and potential customers the value of non-compulsory policies, and the potential risks and consequences of not having them in place. It is a great and important opportunity for the insurance industry to do what it was always supposed to do – catch people as they fall.

Optimise your competitive position in a fast-moving market

Understanding and optimising your product mix, particularly in your competitive context, can make all the difference when it comes to winning new business. To learn more about our pricing insights, please click below.

Comment . . .

Submit a comment