Last June, in a major shift to its distribution strategy, Aviva quietly began a car insurance PCW trial with Confused.com. While its QuoteMeHappy and General Accident brands had been on Price Comparison Websites since 2011 and 2013 respectively, Aviva decided to take its flagship brand where its customers are rather than waiting for them to seek out the brand unprompted. A full PCW roll out completed in November for motor and February for home. So one year on from its first move, has the shift paid off? And how has Aviva’s PCW strategy developed?

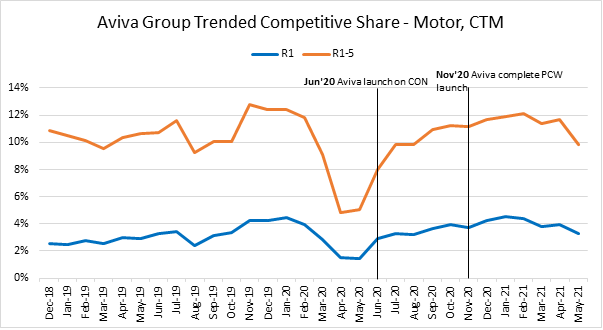

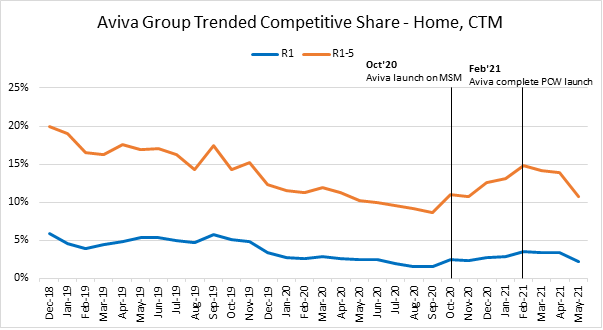

Competitive share

Reporting its Q1 financial results Aviva observed “Our personal lines business in the UK achieved stable sales and growing market share in a difficult market with weaker rates”. Overall its retail direct sales were up 4% on Q1 2020 which it attributed to “the successful launch of our Aviva brand's motor and home offerings on the major price comparison websites helping to offset the ongoing impact of the national lockdown on motor rates which continued to decline.”

Our MarketView figures show that with Aviva branded insurance in the stable, the group has rebounded from its first lockdown dip. In May it delivered 9.8% of Rank 1-5 quotes on CompareTheMarket and 3.3% of top quotes across QuoteMeHappy, Aviva and General Accident. It’s not a hugely dramatic change in pricing, but it has been enough to drive substantial gains in market share.

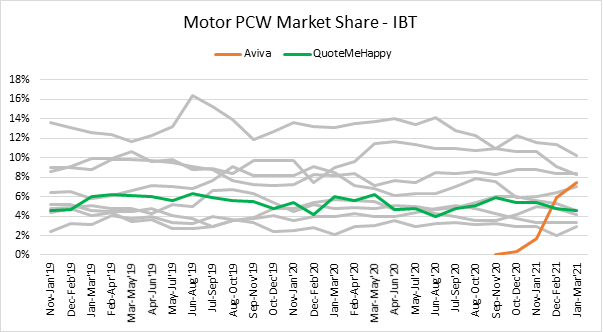

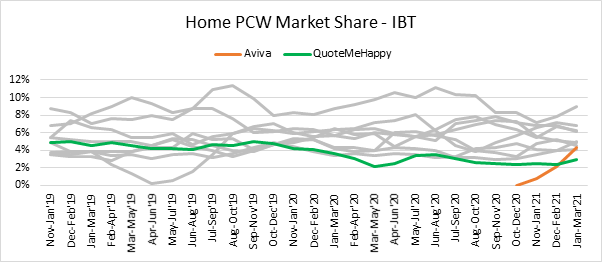

PCW presence

Aviva’s presence on the comparison sites has changed the shape of the top ten in both motor and home markets. Our IBT data shows the power of its brand strength on the PCWs. Over 7% of PCW shoppers now have an Aviva policy, making it the fourth biggest motor brand purchased through that channel and eighth in home. People recognise it, and that makes them comfortable to buy. That is remarkable growth in market share from a standing start.

Aviva’s PCW presence has clearly evolved over time. At first, the Aviva brand seemed to be copying the pricing structure of online-only QuoteMeHappy, but has since refined its positioning on the sites.

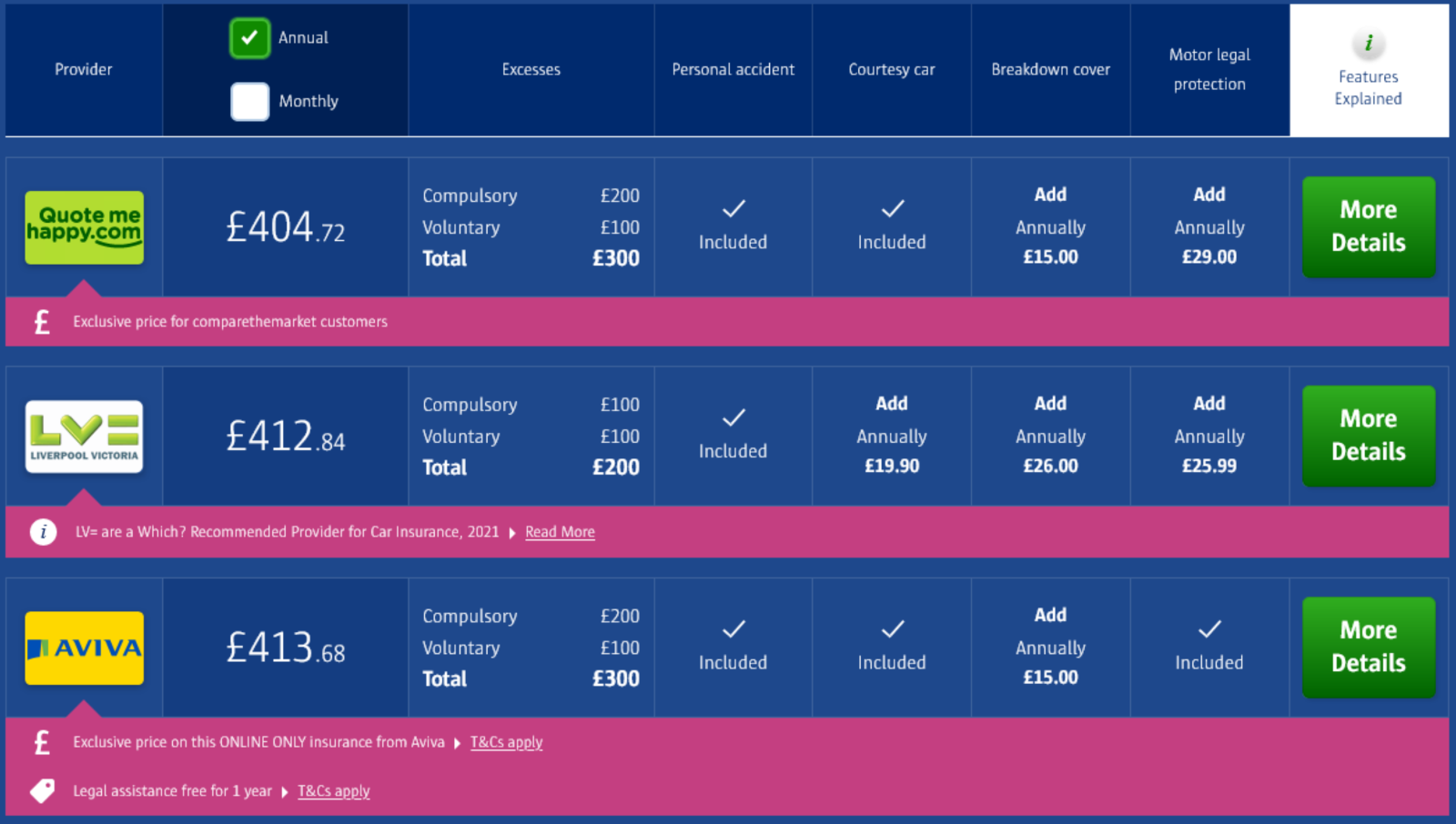

The Aviva branded product typically appears in rank 1-5 when QuoteMeHappy appears in rank 1-5 too – which could explain better conversions and a specific targeting of particular customer types. So if the less-well-known and cheaper QuoteMeHappy price doesn’t appeal, the strongly recognised Aviva product – in this instance just £7 more – might well be the one people go for.

It’s a good ‘wine menu’ strategy – i.e. catering for the budget ‘house’ wine buyers, and the ones that will prefer to select something further down in the menu, with a well-recognised label denoting superior quality.

Aviva has sweetened the deal with free legal cover for the first year of the policy too – another conversion draw layered on top of their strong brand and careful price point, although in the above example its compulsory excess is higher.

In another savvy channel-strategy move, Aviva also introduced ‘price cut’ online offers for the Aviva-branded product in motor, resulting in enhanced competitiveness on CTM and Confused.com.

All in all, PCWs have become a highly flexible and highly effective way for insurers to reach new audience segments, play with variables, and – done right - ultimately grow market share.

Brand strategy

As we’ve said all along at Consumer Intelligence, the new pricing practices rules aren’t signalling the death of the PCW, but the evolution. And Aviva plan to be ahead of the new game. Now firms are no longer racing to the bottom on price to convert customers, they need new ways to find competitive advantage, and Aviva are clearly playing up their brand strength to grow market share.

In April, Aviva launched its biggest ad campaign in five years. The ‘It takes Aviva’ adverts show one woman’s lifetime insurance needs, and is born from the company’s new brand purpose - strapped ‘With you today for a better tomorrow’.

While there isn’t yet the data for us to quantify the impact on brand recognition, we do know it’s their biggest campaign in five years. CEO Amanda Blanc says of it: “Aviva is the only insurer in the UK that can serve all customers’ needs, at every stage of their lives. I want our brand to reflect this, building trust and confidence with our customers that Aviva will be there for them. We have a very strong brand. It’s now time to go further and ensure we use our brand to maximum effect to deliver our growth ambitions.”

Clearly PCWs are a key channel for that growth, and competitors need to look out, and respond. Aviva is big, ambitious, and its brand is gaining traction.

Understand consumer behaviour throughout the renewal process

Enhance decision making, performance monitoring and planning by understanding consumer behaviours, attitudes and intentions at insurance renewal.

Insurance Behaviour Tracker (IBT) is the most comprehensive insurance focused consumer survey in the market. It provides insight and understanding of consumer behaviour throughout the renewal process, giving you a view of market trends, and brand performance. This will enable you to make informed decisions to allow you to build robust marketing and business plans and track results.

Submit a comment