Brokers are taking the home insurance market by storm.

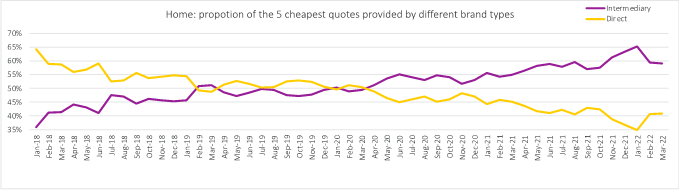

Intermediaries have consistently provided more than half of the top five cheapest quotes on Price Comparison Websites (PCWs) since April 2020, pulling ahead of the competitive position of direct writers and marking a strong role reversal. In the January peak, brokers were responsible for 65% of the most competitive quotes.

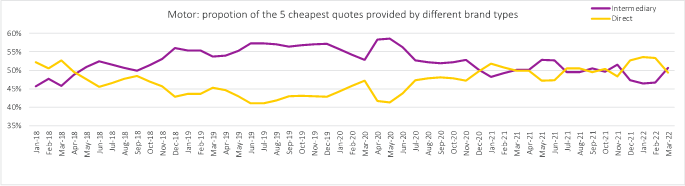

In motor, it’s a much closer race. Brokers had dominated between 2018 and 2020, but direct insurers have mounted a strong challenge over the last two years, widening the gap in the first two months of the year.

Behind the headlines are a changed group of underwriters on panels and powering MGAs, spotting opportunities to gain market share or target specific niches following GIPP implementation.

This is happening as some larger insurers scale back their panel presence in favour of directly written policies and PCWs.

Home growers

|

Position 1-5 by Underwriter - MoneySuperMarket |

March 2022 |

Year-on-year change |

|

Wakam |

29.0% |

29.0% |

|

West Bay |

14.1% |

14.1% |

|

Red Sands |

13.3% |

13.3% |

|

Advantage |

15.7% |

3.9% |

|

Arkel Insurance |

2.5% |

2.5% |

|

Position 1-5 by Underwriter - MoneySuperMarket |

March 2022 |

Year-on-year change |

|

Wakam |

29.0% |

29.0% |

|

West Bay |

14.1% |

14.1% |

|

Red Sands |

13.3% |

13.3% |

|

Advantage |

15.7% |

3.9% |

|

Arkel Insurance |

2.5% |

2.5% |

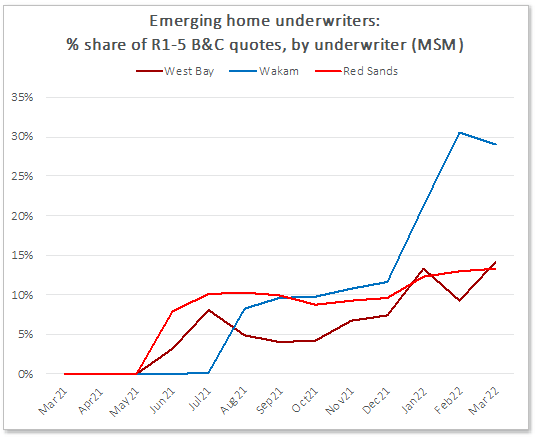

Wakam, which exclusively writes policies for Urban Jungle, has come from nowhere to sit behind 29% of R1-5 quotes in March.

Gibraltar-based Red Sands has also entered the PCW market in the last 12 months through a solus agreement with MGA Frontier Insurance, the rebranded now4cover, growing fast to provide 13% of the top quotes.

West Bay, the new name for Markerstudy Insurance Company and Zenith Insurance following the sale of Markerstudy’s Gibraltar insurance carriers to Qatar Re, provided 14% of the top quotes available through brokers, notably diversifying from its stronghold of motor into the home market.

There have also been departures, such as Accredited and Accelerant mostly present for their backing of Magnet Insurance, which has largely withdrawn from the PCW distribution channel.

Behind much of the decline in Direct share of R1-5 home quotes is Lloyds Bank, which has shifted Lloyds and Halifax brands to direct channels and launched a new suite of products. A year ago it provided 37% of top 5 quotes on PCWs, it’s now down to just 1%.

Lloyd’s Bank GI hasn’t abandoned PCWs all together though, joining Swinton’s and Sainsbury’s Bank’s panels in December, in addition to Hastings, Dial Direct and Budget and bringing its R1-5 quote share through brokers to 5%.

LV General Insurance is another large carrier to shift its focus away from PCWs, achieving fewer R1-5s and launching into the mortgage intermediary market for the first time earlier this month.

It has also doubled its share of R1-5 positions as its own brand on direct channels, providing over 1-in-5 quotes.

Motor biggest panel underwriters

|

Position 1-5 by Underwriter - MoneySuperMarket |

March 22 |

Year-on-year change |

|

Advantage |

33.7% |

10.4% |

|

West Bay |

13.3% |

-0.6% |

|

Pukka |

9.7% |

5.8% |

|

Ageas |

8.4% |

-1.6% |

|

Watford Insurance |

7.0% |

-9.5% |

Aviva is another big insurer to change its line-up, cutting its R1-5 panel appearance from 6% to 3% in the motor market, while growing the competitive share of its direct brands including Aviva (which completed its a PCW roll out in early 2021), Quotemehappy and General Accident from 10% to 13% on MoneySuperMarket.

The biggest growth, however, came from Hastings underwriter Advantage, which has increased its competitiveness with an effective range of products including Hastings Essential and YouDrive.

Amongst the direct insurers, we have seen big surges in competitive quote share from LV, including it new Flow brand, and Admiral, with 20% of R1-5 quotes in March 2022, up from 13% in March 2021.

But of course a reduction in competitive quote share does not have to correlate

with declining volume or profitability. UK Insurance (which appears on PCWs with brands including Darwin, Privilege and Churchill) is down for R1-5 quotes, but its renewal and retention strategy is highly effective.

The other element to watch for here is whether panel-led brokers are getting better at product tiering. Atlanta’s Swinton Essential share of R1-5 quotes dramatically improved towards the end of 2021 and into 2022, with West Bay and Geo Personal Lines, an MGA which is also part of Atlanta’s owner Ardonagh, the most competitive panel underwriters.

Others could follow suit. KGM Underwriting, part of A Plan and ultimately Howden, quietly promises its own direct brand Snnug, is ‘coming soon’ to car insurance.

As new underwriters come and go, and insurers reassess their customer acquisition strategies in the GIPP era, brokers’ ability to adapt and find opportunities in a changing marketplace remains crucial.

Become more agile. Tap into daily insurance price benchmarking data.

Our insurance price benchmarking service will help you understand the daily movements of your competitors and help you to quickly identify pricing changes you need to make.

Comment . . .

Submit a comment