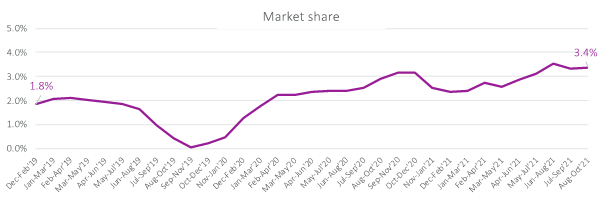

The rise of Policy Expert has been a persistent theme in our home insurance momentum reports. Launched in 2011, the provider is now the 10th largest home insurance band in the UK, with more customers than Lloyds Bank or esure according to our IBT data.

It grew its customer base by 27% in the six months to September 2020 and 22% the following six months. It is not uncommon for brands to ease off after a double-digit growth from one period to the next. However, Policy Expert has continued a firm march forward for years. According to Companies House filings by parent company QMetric customer numbers increased from 511,000 to 719,00 in the year ended 31 March 2020.

QMetric is ambitious. It wants to reach 2 million customers in five years and recently raised investment from the Abu Dubai Investment Authority in December 2020. It considers itself the UK’s largest GI insurtech disruptor, citing its proprietary sales and policy administration system which enable it to “access markets more efficiently and effectively than existing market participants and therefore to outperform the markets”. The group could not have grown as it has “without control of its own technology”, CFO Paul Gildersleeves wrote in the strategic report.

Of note is Policy Expert’s ability to execute on its strategy to only provide quotes to a restricted set of target consumers to deliver the best results (had it been an insurer, its home COR would have been 82.8% in the 12 months ended 31 March).

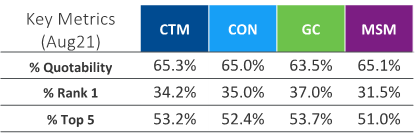

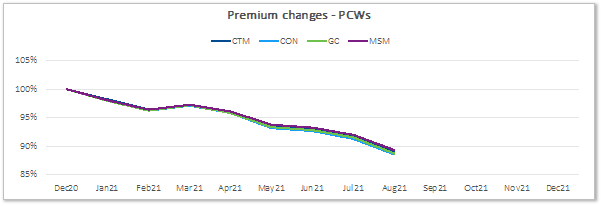

It shoots to win. Its quotability is deliberately selective, at around 65% of risks. But with a 35% rank 1 share on the PCWs this August, its share of the top spot was 20% pts higher than the next competitor.

Data from CI Annual View (Home BC)

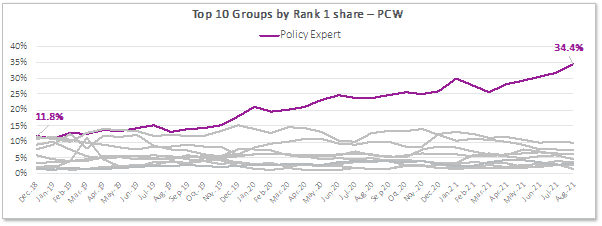

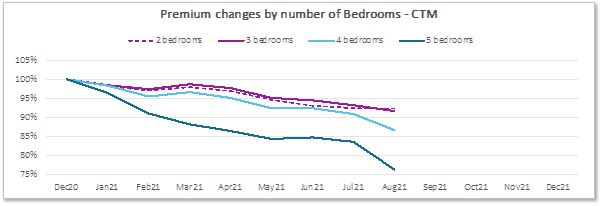

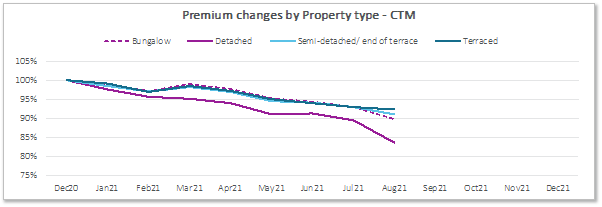

Driving this are its deep price cuts. As our latest price index shows, home insurance is already a deflationary market, with average premiums dropping 5.6% since the start of the year. Policy Expert’s have dropped by more than this, and are down by 10% since December.

Policy Expert’s greatest premium decreases so far in 2021 have been for houses with 5 bedrooms and Detached properties. Year-to-date the decrease for 5 bedrooms was 24% and for Detached houses it was 16%.

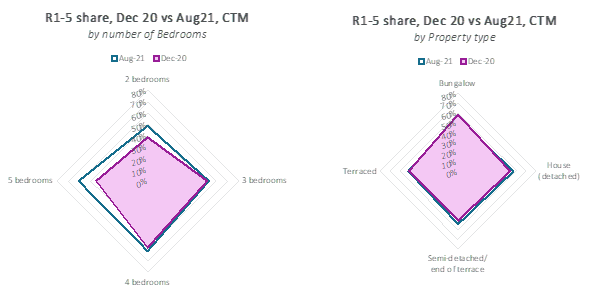

These targeted changes increased its R1-5 share of 5 bedroom and detached homes, while its share of 2 bedroom properties also increased. It did not return any quotes for 1 or 6+ bedroom properties.

In terms of number of bedrooms, across all PCWs they are most competitive for 4 or 5-bed houses and for property types it wins the most for detached houses.

Our IBT data indicates Policy Expert’s customers are savvy shoppers, as one would expect from a PCW-dominant brand. Some 87.8% of its customers with renewals Aug 20- July 21 shopped around, higher than the industry average of 74.4%.

But most of these (73%) said they did so on principle and only 11% because their premium had gone up a lot compared with last year. The market average is 59% citing shopping around on principle as their main reason, and 17% because their quote was a lot higher than last years.

The lack of price disparity meant that Policy Expert was more likely to retain shoppers at renewal – 65% of shoppers ended up staying, compared with an industry-wide average of 49%. The largest reasons for renewing after shopping around were being offered a cheaper quote (35%) couldn’t get a cheaper quote elsewhere (24%) and saving wasn’t enough to bother (17%).

This perhaps offers some insight into the rewards available for brands which can keep competitive prices come the dual pricing ban in January.

As a relatively new brand, 71% of who switched to Policy Expert said their cheaper policy was the main reason. More established and larger brands are more likely to be chosen by past customers or those with other policies at the same provider.

Policy Expert has taken some recent measures here too. A new website launched last week replaced mascots with photos of real people, adding the strap line of “Home insurance, for people like you”. The new logo has a squarer format, which will look stronger on mobile devices and on PCWs.

Precise customer targeting, backed up by connected claims and policy systems will instill confidence in QIC Europe, the Malta based insurer wholly owned by QatarRe, which underwrites many of Policy Expert’s policies at present.

It will also no doubt help negotiate its planned growth. QMetric believes its technology is scalable to other product lines and geographies. The disruption of Covid-19 delayed its plans to scale up in the motor market by 12-18 months, but with the acquisition of Sure Thing in July 2019, rebranded as Policy Expert as part of the integration, it has a car platform waiting in the wings.

Understand consumer behaviour throughout the renewal process

Enhance decision making, performance monitoring and planning by understanding consumer behaviours, attitudes and intentions at insurance renewal.

Insurance Behaviour Tracker (IBT) is the most comprehensive insurance focused consumer survey in the market. It provides insight and understanding of consumer behaviour throughout the renewal process, giving you a view of market trends, and brand performance. This will enable you to make informed decisions to allow you to build robust marketing and business plans and track results.

Comment . . .

Submit a comment