Anyone getting a quote for contents only insurance in the last few months would have noticed a couple of keen fresh faces on their search results - as new flexible entrants make a splash, and a play for young renters. Buoyed by a $30m Series B funding round in December, Germany-based GetSafe has been working hard to attract new customers in the UK with extremely low prices.

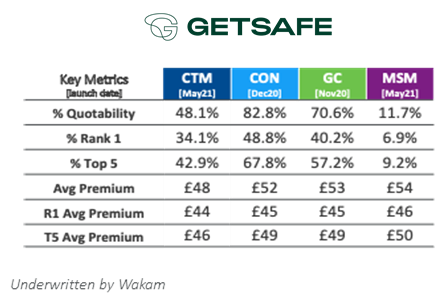

It provided a remarkable 68% of rank 1-5 quotes on Confused in May and offered the most competitive price for 49% of quotes. Figures may yet rise for CompareTheMarket and MoneySupermarket, which it launched on last month.

GetSafe has higher quotability for under 24s and is in the company of established brands including Sainsbury’s, Privilege, Post Office Bronze and Churchill for at least 30% of the time that it is in the top 5.

The average premium across the entire PCW market for contents-only insurance is £111, but GetSafe ranges between £48 and £54. Where they are number one on price, they are on average a quarter cheaper than the second placed quote.

GetSafe’s CEO Christian Weins has stated he wants to become the most well-known insurance brand for millennials and first-time insurance buyers in the UK within 1-2 years - and certainly seems to be targeting fast growth with new customers.

Incumbents may be worried about start-ups hoovering up new business with this sort of new pricing. However, we may see premiums start to rise when volume is established and if funds are depleted. But that might take a while…

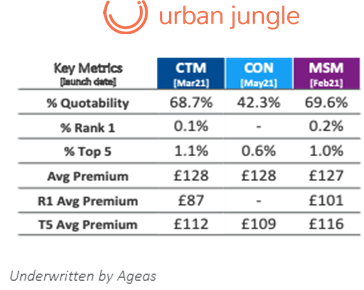

Another contents only insurtech, Urban Jungle, currently has a lower share of rank 1-5 quotes. But this month it completed an £8m investment round - its biggest yet - which could give it more firepower to also invest in lower prices to build its market share. All this, of course, is taking place while other established brands are still working through the ramifications of the price walking ban.

Both Urban Jungle and GetSafe offer flexible policies that can be set up via digital channels (or an app in the case of GetSafe) and which can be paid monthly and cancelled without any extra cost. They are unlikely to be the only or last start-ups to target the demographic of young renters with precious possessions, a market with comparatively low market penetration.

Homeowners are required to have at least buildings insurance as a condition of their mortgage, with combined buildings and contents policies the most common on the market. Renters, meanwhile, clearly don’t need buildings insurance, but they are not being encouraged by landlords to take out separate contents policies to cover the belongings they bring into their rented accommodation.

Our survey of 386 renters shows that only half (52%) have contents insurance. Different people buy it for different reasons. Peace of mind was cited by 72% of consumers. Nearly a third (32%) bought a policy because they have some expensive items they want to protect, 20% because they have children and want the accidental damage cover. Some 12% buy contents insurance because they work from home and another 12% because they are worried about being burgled. Under 24s were more likely to buy it because they are often away from home.

The two biggest reasons for not having contents insurance were that renters had never considered it (35%), and that they believed they couldn’t afford it (38%).

Younger renters were more likely not to have considered it (42%), and older renters were the most likely to say they don’t have many or any expensive things so are not worried about insuring their contents.

That all means that a sizeable minority of the target market for millennial contents insurance providers won’t be thinking about looking on PCWs in the first place. Sustainability will lie in education and awareness as much as it may do in low prices… but there’s an opportunity to be first to the marketing pass. Our homes have become our castles in the last 18 months, and as young people begin to return to workplaces, protecting them may well be front of mind.

Let’s see how the contents insurance market continues to change in the coming months.

Optimise your competitive position in a fast-moving market

Understanding and optimising your product mix, particularly in your competitive context, can make all the difference when it comes to winning new business. To learn more about our pricing insights, please click below.

Submit a comment