There have been a flurry of announcements and activity from the home insurance challengers in recent months.

Urban Jungle last month announced a £16.5 million raise led by Intact Ventures. If that name looks familiar, it’s because Intact Ventures is the $400 million investment fund backed by Intact Financial Corporation, the Canadian insurer which bought RSA in the UK last year.

It follows GetSafe, which operates in Germany and the UK, raising an additional $63 million of fresh capital in October 2021, extending the Series B round initially announced in December 2020.

And then there’s Policy Expert, one of the first mass market insurtech MGAs, which sold a minority stake to the Abu Dhabi Investment Authority, and which is moving from QIC to R&Q subsidiary Accredited as its main capacity provider.

With almost weekly ‘insurtech’ and ‘disruptor’ proclamations, it can become easy to dismiss the whole category as hype and ambitions. But as our MarketView data shows these challengers are making some serious market share gains.

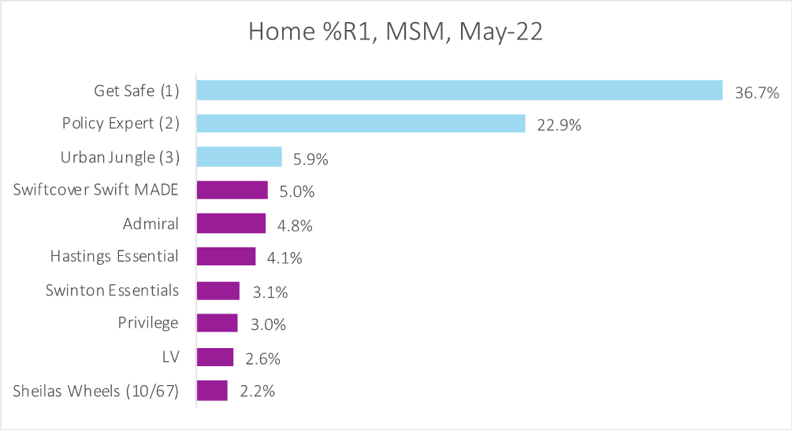

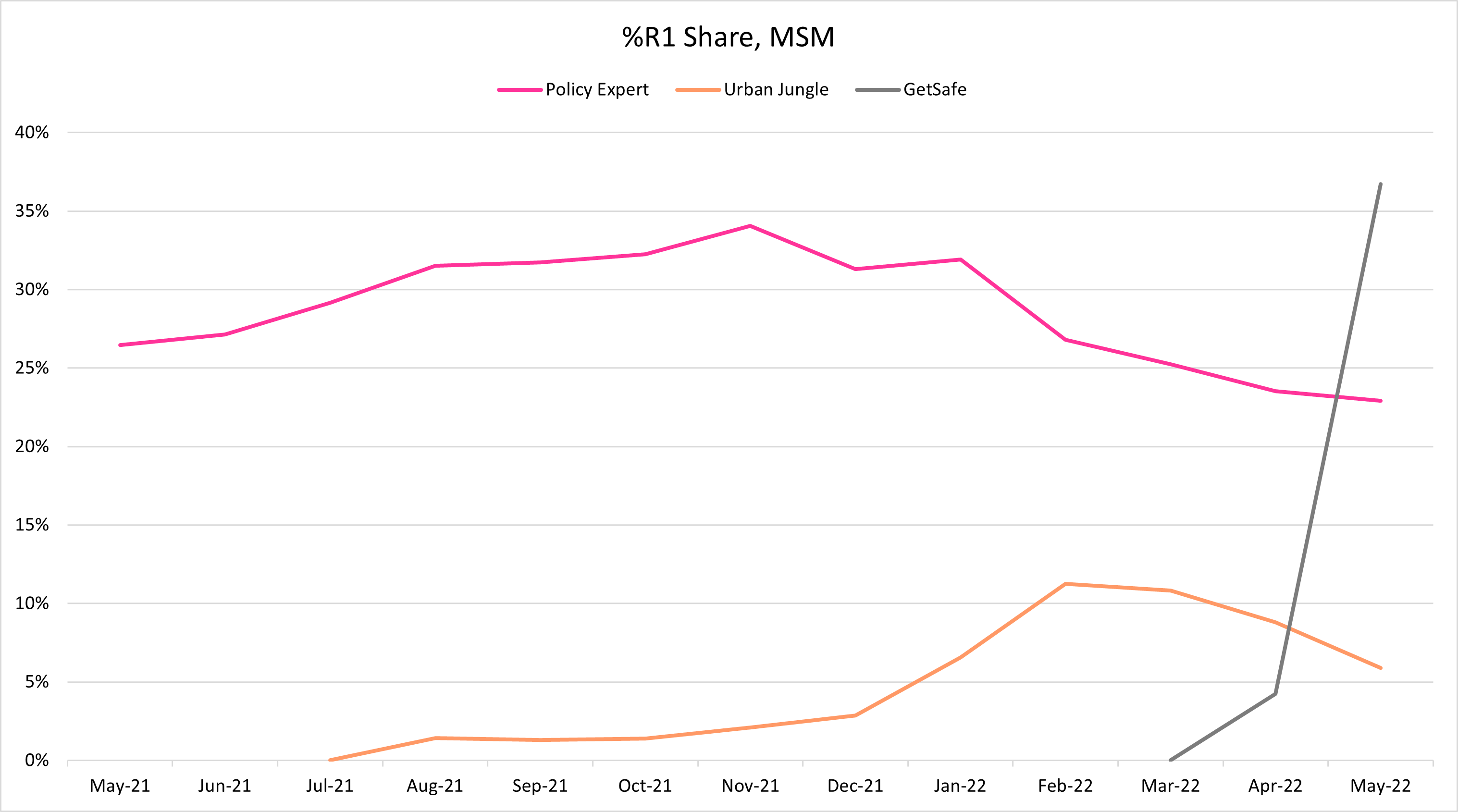

In April, GetSafe, which began as a contents brand for renters, launched its full buildings and contents product. In its first full month of trading, it offered the most competitive quote for over a third of new business customers on MoneySuperMarket.

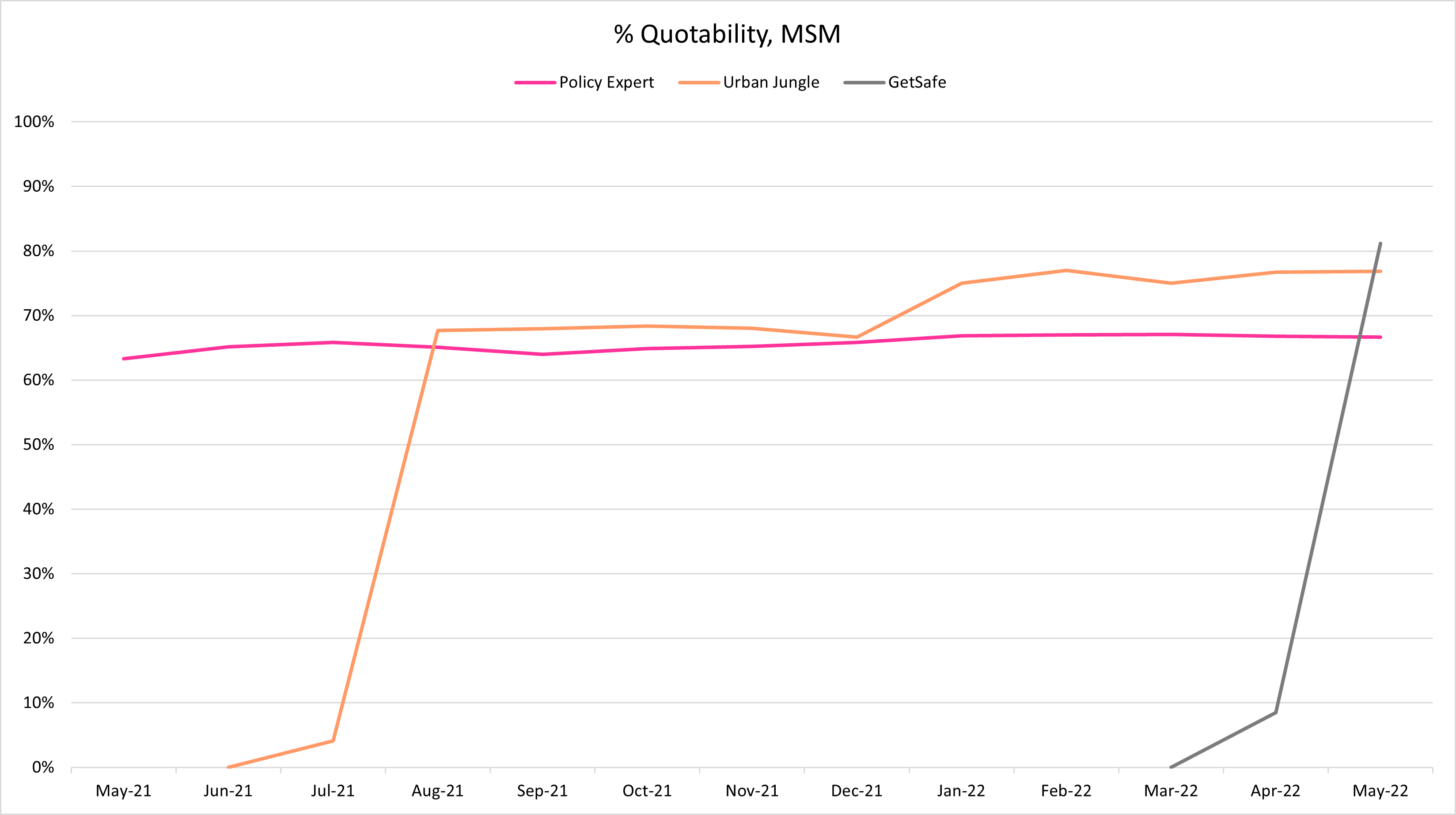

GetSafe detailed that it had doubled to 50,000 customers in the UK in six months before launching buildings insurance. In looking to grow further, it is going toe-to-toe with Urban Jungle, another brand targeted at younger home owners with app-led flexible policies at the heart of the customer proposition. It was third for Rank 1 shares last month, and has scaled up steadily since launching B&C a year ago.

*GetSafe launched 26 April 2022

*GetSafe launched 26 April 2022

Where they differ is on underwriting composition, with Urban Jungle working with a panel and some policies administrated by Atlanta’s Paymentshield, whereas GetSafe operates as an MGA and has a full insurance license in Germany.

Both will be hoping to gain real ground with their latest investments and are doing so at a time of flux. Most incumbents are pricing less aggressively for new businesses following the FCA’s dual pricing ban, and these challengers don’t have a back book to worry about. Conversely, shopping and switching rates are at an all-time low because the same price walking ban has encouraged consumers to renew.

The pie is smaller, but they’re able to take bigger slices of it, in other words. How this all translates to long term profitable growth, customer loyalty and loss ratios is too early to say.

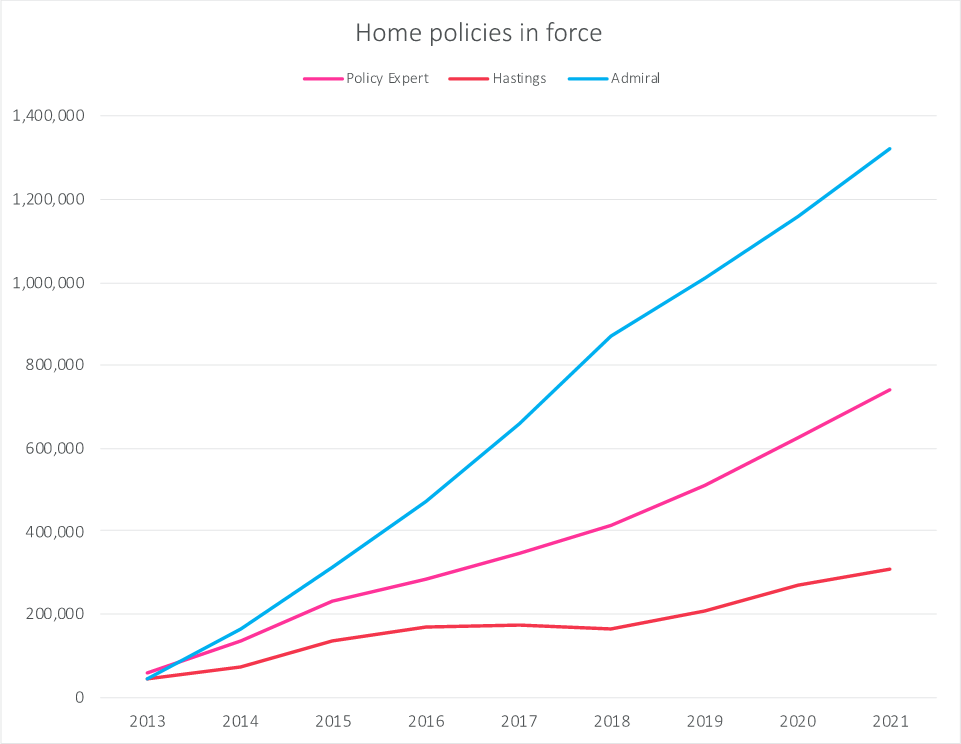

Policy Expert is more advanced in its journey, and the below chart shows consistent 20% year-on-year growth has translated into approaching one million policies from a standing start, whilst more established motor providers have been using their experience and scale to diversify into the home market.

Since gaining private equity backing it has launched a new brand and a tiered offering in home which rolled out over April and May.

Source: Company reports and accounts

If 1st Central, Admiral, Hastings and telematics technology have changed mass market motor in the last years, these well backed challengers will be using their latest investments to reshape home from the GIPP-changes starting line.

Motor challengers

While the home challengers are casting the customer acquisition net wide, motor insurtechs are more focused on underserved niches and different ways of doing things.

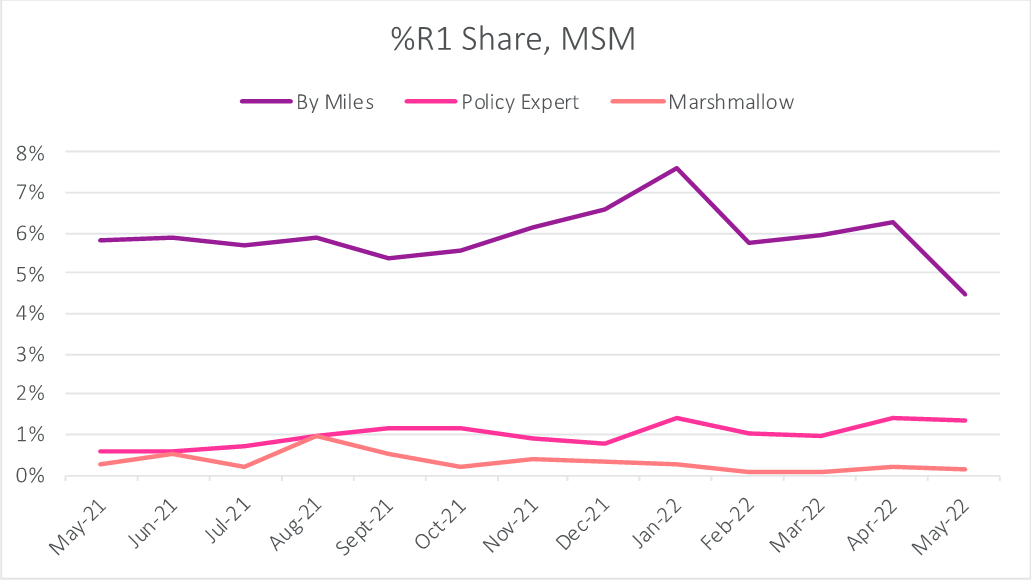

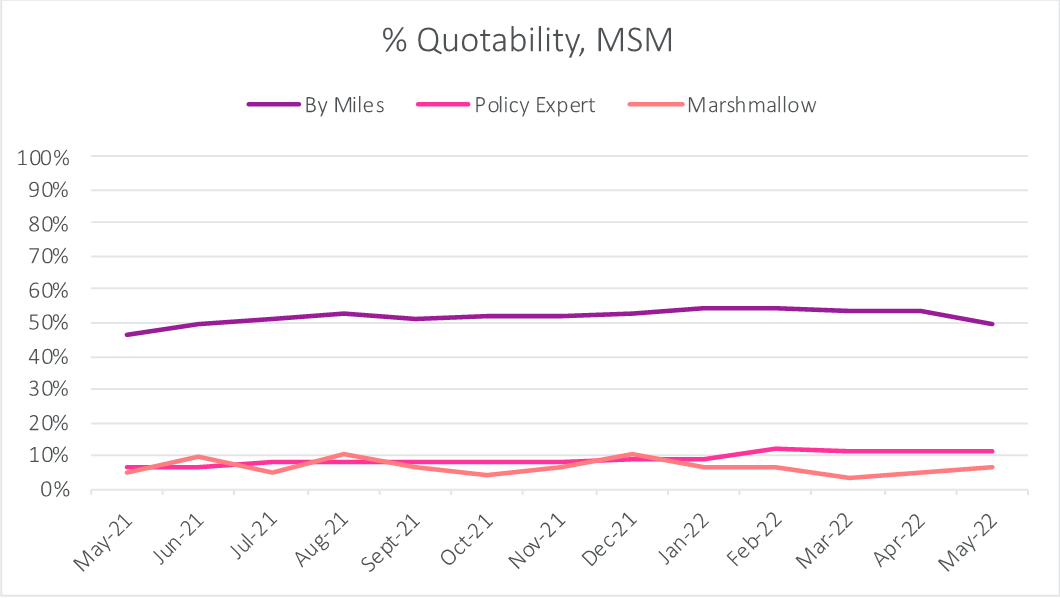

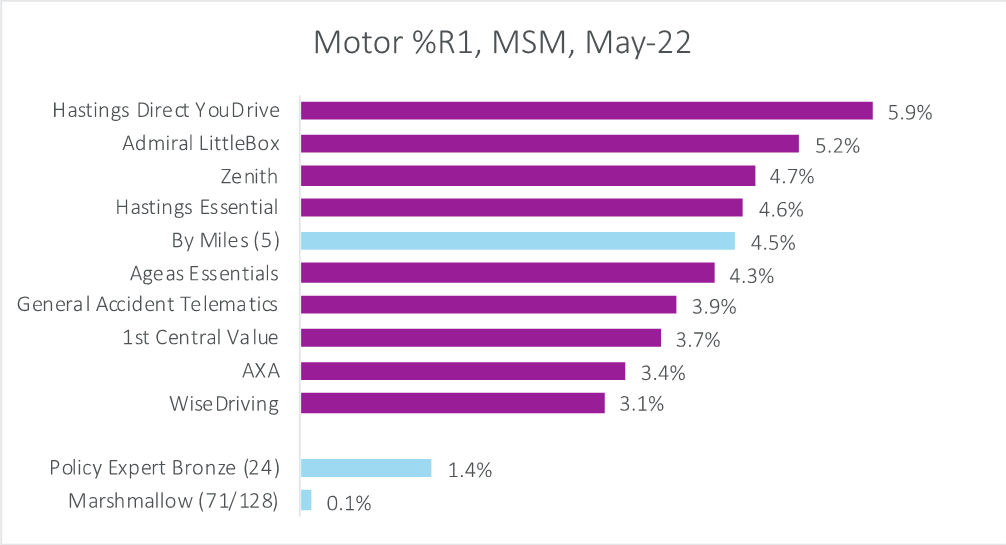

CommerzVentures backed ByMiles consistently quoted for around 50% of drivers on MoneySuperMarket with its usage-based telematics, and is very effective when it does, delivering c.5% rank 1 quotes, which makes it top five for competitiveness. This is, of course, in addition to its direct marketing efforts to encourage people to download its app.

Meanwhile Marshmallow, which raised $85m last Autumn, has a very focused and defined risk appetite, quoting for 6% of risks on MSM last month and delivering less than 1% of rank 1 new business quotes.

Policy Expert is exercising caution in its home expansion, quoting for around 11% of risks since the start of the year, as opposed to two thirds of homes it quotes for.

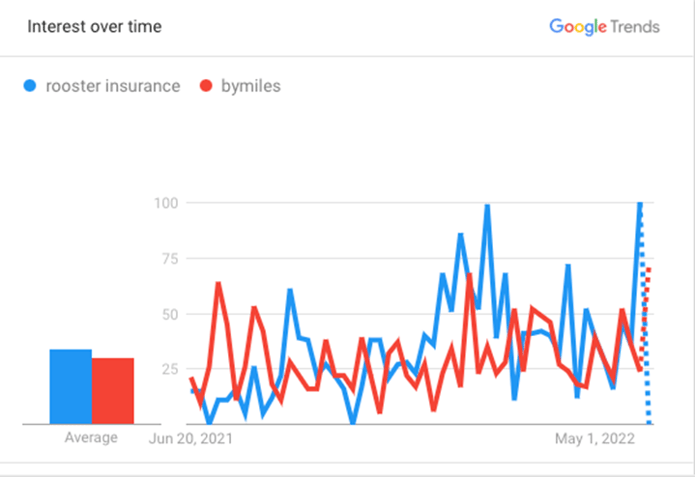

It is perhaps Policy Expert, with its new capacity, which is positioned to challenge the mass market incumbents most of all. Others are waiting in the wings to join them. Peppercorn and Adiona have seed funding and are preparing to launch their products. People are searching for Rooster Insurance, which concentrates its marketing efforts in TikTok as much as they are for ByMiles.

The changes continue. Proven large businesses remain attractive to private investors and Bloomberg reported at the start of the year 1st Central could be looking at a private equity sale.

1st Central also looks set to apply its fast motor growth to the home market. As its latest set of accounts detailed that its board had approved plans to launch in home, as well as to develop a telematics based motor proposition.

Any businesses which base their plans on a stable competitive landscape should watch closely.

Optimise your competitive position in a fast-moving market

Understanding and optimising your product mix, particularly in your competitive context, can make all the difference when it comes to winning new business. To learn more about our pricing insights, please click below.

Comment . . .

Submit a comment