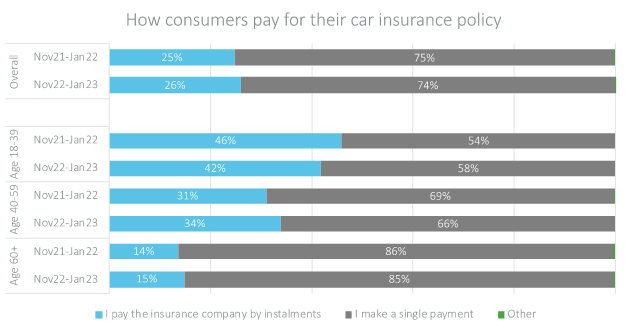

One-in-four drivers pay for their car insurance in monthly instalments, and so do one third of home insurance customers.

That’s according to Consumer Intelligence’s Insurance Behaviour Tracker (IBT), which extensively tracks thousands of real customers renewals processes and the reasons behind their decisions each year.

It’s a timely reminder for brands to understand their price position in relation to this sizeable share of the market, rather than looking at wins for annual customers in isolation.

Younger drivers pay monthly

The IBT data show a clear age divide in the motor market. The number of drivers aged 18-39 choosing to pay in instalments is 42% while only 14% of over 60s and 31% of drivers aged 40-59 pay monthly. The number of middle-aged customers paying monthly has risen in the last year.

When it comes to pricing, the top 10 most competitive brands are largely the same, although their share of top five (T5) competitive quotes on PCWs fluctuates between how customers choose to pay.

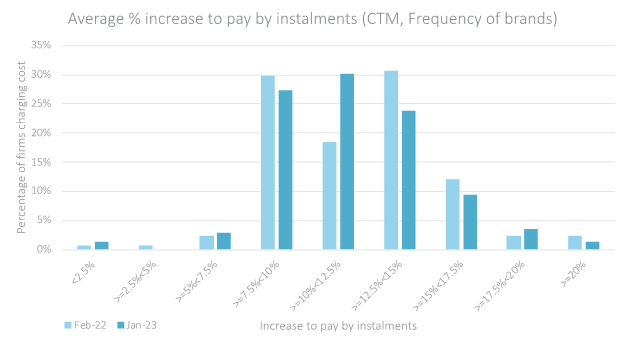

Overall, the average cost to pay by instalments has fallen slightly, from 12.6% in February 2022 to 11.9% in January 2023. Or to translate that to real money terms, customers paying monthly will pay an average of £147 over the course a year in interest costs.

Only two brands, charge 0% for instalments. Though one of these, as a usage-based telematics model, is slightly different as customers would get an indicative quote as and go on to pay based on how much they drive during the policy.

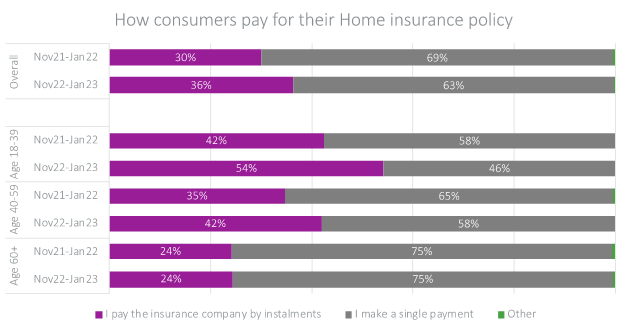

The home market and instalments.

In the home market, the top four most competitive brands are the same, whether it be instalments or annual. However, slightly further down the top 10 rankings, two brands are nearly twice as competitive for monthly than annual customers.

More home insurance customers are choosing to spread the cost over the course of the year, with a six point increase in the last 12 months.

Older customers are notably more likely to pay monthly for home insurance than for car (24% vs 14%). This could reflect the higher premiums they have historically faced as a result of price walking, or the rhythm of monthly household costs such as Council tax and energy bills being reflected in insurance payment preferences too.

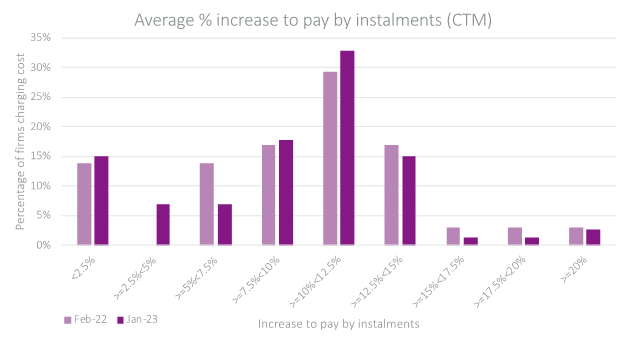

It is also the case that the cost of credit is lower in home, adding an additional 9.5% onto annual premiums. Premium finance income is less embedded into direct insurers’ business models than it is for brokers, and direct insurers dominate home insurance more than they do motor.

Indeed 12% of home brands don’t charge interest.

But this could be on the wane. The two biggest market entrants of late both offered 0% interest to pay by instalments when they launched on to PCWs.

But within a year of launching, they both started to charge this, in May and November 2022 respectively.

Regulatory reforms mean brands have had to assess whether the additional cost of paying in instalments is providing customers with fair value, and the FCA will be reviewing the first batch of disclosures and assessments.

Understanding your position in the market from both competitive and regulatory angles – for all types of customers – remains key.

For the purposes of this piece, we have omitted brand names from this article. If you’d like to find out more, please speak to a member of our team.

Submit a comment