In a time of economic uncertainty and heightened consumer expectations, the importance of quality customer service cannot be overstated. As consumers increasingly seek value and reliability in their purchases, exceptional customer service has emerged as a critical differentiator in the competitive marketplace.

This new environment, accentuated by the rapid advancement of digital platforms and social media, amplifies both positive and negative customer experiences, making them more visible and impactful than ever before.

Businesses that excel in delivering personalised, responsive, and empathetic service not only build stronger, trust-based relationships with their customers, but also enhance their brand reputation and loyalty.

In the past, investing in delivering superior customer service afforded brands a strategic advantage, but in this current climate, it’s a necessity if you want to stay relevant.

Leaders out ahead

Across 2023, the average market scores reflecting the quality of customer service remained steady across the board, indicating a consistent performance at an overall level. However, our data shows that the top-performing insurers demonstrated an increase in their customer service ratings.

This uptick suggests that certain companies capitalised on the opportunity to distinguish themselves by delivering exceptional service to their customers.

Kalle Myllärniemi, Insight Analyst at Consumer Intelligence, has been studying the changing customer service trends across the last year. He commented, “This increase in customer service scores at the top-end of the market occurred against the backdrop of heightened scrutiny within the insurance industry. Public criticism and negative media attention, driven by prolonged increases in premium prices, has placed significant pressure on insurers to improve their customer relations.”

Customer service performance across 2023

Each year, we use our Insurance Behaviour Tracker (IBT) to survey over 48,000 home and motor insurance customers. It’s from this data that we find out who the highest-ranking insurers are for customer service.

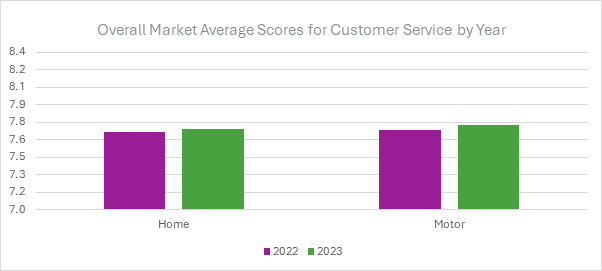

Overall market average levels for customer service have remained somewhat steady since 2022, across both home and motor.

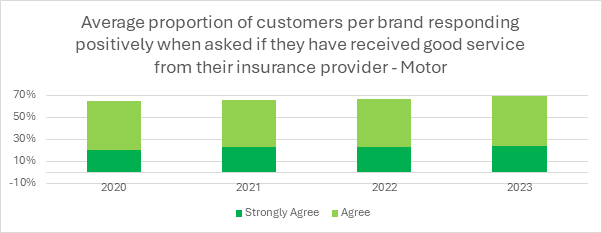

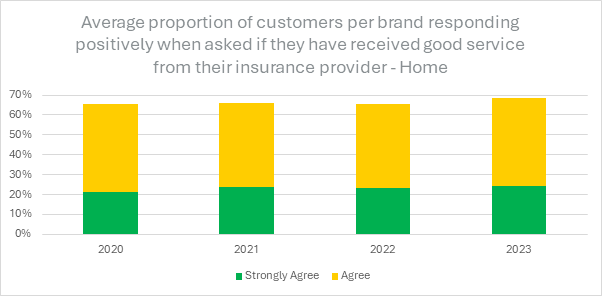

When looking at the proportion of customers responding that they either ‘agree’ or ‘strongly agree’ with the following statement: “I have always received good service from this company”, we see a slight increase year-on-year since 2020.

In the home sector, there has been a similar trend, although slightly less evident, with more yearly fluctuations going both ways.

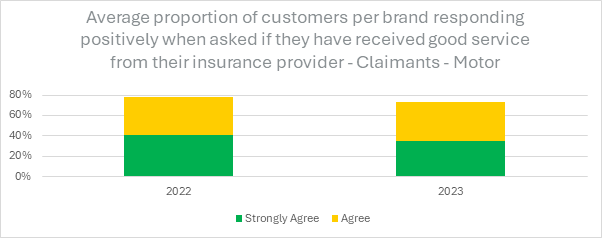

When looking at claimants however, the average proportions of customers responding positively has gone down year-on-year in 2023 in both sectors.

Conversely, for non-claimants the average proportions of customers responding positively has gone up in 2023, when comparing to 2022.

The importance of customer service

Service quality can be a significant differentiator in highly competitive markets such as this. Responsive customer support, clear communication, transparency in policy details, and swift claims processing, all encompass high service standards.

If providers fail to uphold these standards, they risk customer dissatisfaction, which can lead to increased churn rates, negative reviews, and a tarnished brand image – all of which can ultimately impact financial performance and ability to attract and retain customers.

In a market where trust and reliability are paramount, some have improved their service ratings through striving for excellence, despite the numerous and varied challenges faced by the industry.

Top performers revealed

We are thrilled to celebrate these outliers by sharing the Consumer Intelligence Awards 2024 winners for the Customer Service category.

|

Motor Insurance Winners |

|

Admiral |

|

A-Plan (now Howden) |

|

AXA |

|

Co-op |

|

Direct Line |

|

John Lewis |

|

Lloyds Bank |

|

LV= |

|

NFU Mutual |

|

Saga |

|

Home Insurance Winners |

|

Barclays |

|

Co-op |

|

Direct Line |

|

HSBC |

|

John Lewis |

|

Lloyds Bank |

|

M&S |

|

Nationwide |

|

NFU Mutual |

|

Saga |

*Please note: Winners are listed in alphabetical order

The top 10 providers across the home insurance sector for customer service in 2023 featured prominent names from the banking and high-street sectors, including Co-op and Nationwide.

Similarly, the top 10 list in the motor insurance segment comprised well-established brands such as Direct Line and Saga. Both of them featured in the top 10 in both sectors, highlighting their focus on maintaining competitive standards for customer service amidst challenging market circumstances.

Stand out in a competitive market

In a competitive and scrutinised market, maintaining high service standards is not merely a strategic advantage but a necessity for survival and relevance.

Leveraging insights from rich data sources, such as the Insurance Behaviour Tracker and consumer survey panel, Viewsbank, is crucial for refining service strategies. By understanding customer needs, preferences, and pain points, players in the insurance space can tailor their services to meet and anticipate the demands of clientele more effectively.

While primarily improving satisfaction, this also allows brands to position themselves as customer-centric and innovative leaders in the UK insurance market, driving competitive advantage and business growth.

Ian Hughes, CEO of Consumer Intelligence, commented, “This year’s Customer Service category winners have led by example in showing a deep understanding of the importance of putting customers at the heart of your business.

“What I love most about the Consumer Intelligence Awards is that it allows its winners to celebrate their accomplishments. And in a world where data and insights drive innovation, these brands’ ability to leverage these tools to enhance customer experiences demonstrates a commitment to raising the bar for excellence in customer service.”

Our research shows that consumers are over five times more likely to choose a company that had won an award based on real customer feedback, than a company whose award was based on the opinions of industry experts. That's why the Consumer Intelligence Awards are in their own lane of insurance awards.

If your brand has been one of this year’s triumphant winners, please get in touch, and a member of our team will be happy to speak to you about how we can help you capitalise on your win.

Are you a 2024 winner? Enquire about your award today...

Congratulations - what an achievement! Why? Because these awards are based purely on their feedback - and they say you are the brand to be with. Now it’s over to you to decide how you would like to maximise the value of your award win. Click below to find out more...

Submit a comment