How a claim is handled is an extremely important part of the insurance experience, and it gives insurers a chance to provide value and deliver satisfaction. Lots of different factors can influence satisfaction in the claims process, from customers being kept informed and helpfulness of staff, to time taken for claim to be settled and outcome of the claim.

Each year, we use our Insurance Behaviour Tracker (IBT) to gain insight into how consumers feel about their insurance provider. We do this by surveying over 48,000 home and motor insurance customers to find the top performing brands within the market. Our Claims Satisfaction award asks customers who have claimed how satisfied they were with the claims process.

Winners of the Claims Satisfaction category provide excellent service to their customers around the claims process and experience. Brands that receive this accolade can be confident that they are doing right by their customers in their time of need. We are, therefore, excited to announce the ten insurers who have been rated highest for claims satisfaction in the Consumer Intelligence Awards 2021.

|

The top 10 highest rated insurance brands for claims satisfaction* |

|

|

Voted by drivers |

Voted by householders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| *winning brands are listed in alphabetical order | |

Against last year, we have seen Saga debut as a new entrant into the Top 10 for claims satisfaction in motor insurance, and in home we see both Barclays and Prudential joining the ranks of best brands. You can view the full list of 2021’s Consumer Intelligence Awards winners here.

The table above showcases the ten brands that our 2021 Awards insights have identified as the highest performing in claims satisfaction. For the home insurance market, average claims satisfaction (out of 10) for the winning brands is 8.8, compared with 8.5 for all other insurance providers outside of the top ten. For motor, the difference between winners and other brands is from 8.6 to 8.4, respectively.

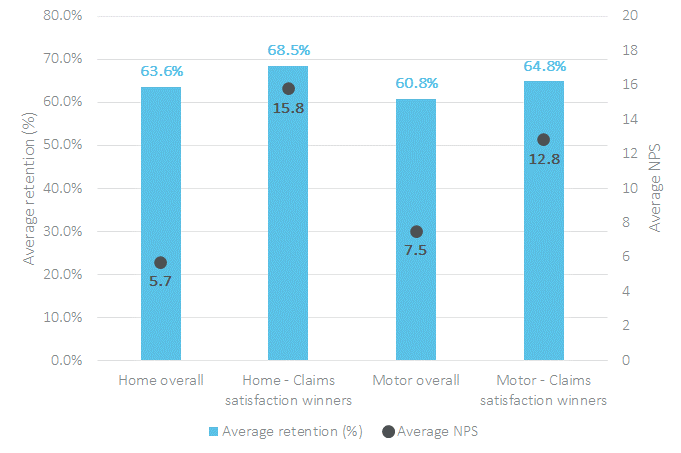

The average retention rates for the winning brands, and their NPS scores, demonstrate that brands that score well in terms of claims satisfaction, retain more customers and these customers are more likely to recommend the brand.

In the overall market, the average retention rate for home insurance brands is 63.6%. For the winners of the claims satisfaction category in the Consumer Intelligence Awards, retention is higher by almost 5%, at 68.5%. The increase we see in the motor insurance market is 4%; from 60.8% to 64.8%.

The figures across NPS are even more significant. Right now, the average score across all home insurance brands in the market is 5.7, but when we look at the award winners, this figure rises to an astonishing 15.8. For motor insurance, the increase is from 7.5 to 12.8.

This insight suggests that companies that are wholeheartedly focused on providing a good claims service will be rewarded with more customers choosing to renew their policy, and these customers will be more likely to promote their provider’s service.

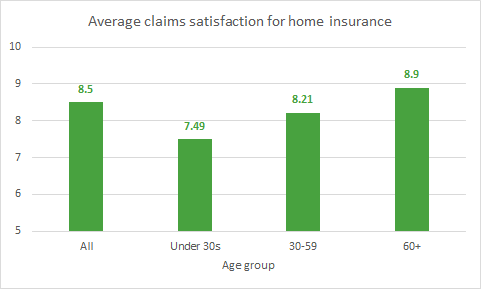

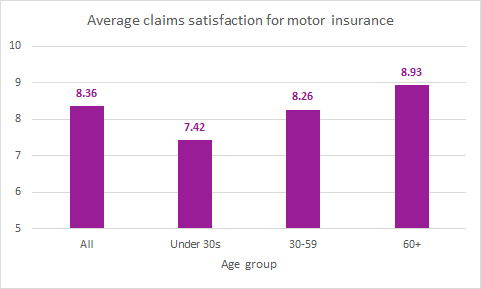

Our data also offers us insights into how claims satisfaction varies between different age groups. Overall, satisfaction among the over 60s is the highest among all the age groups, and satisfaction among the under 30s is the lowest. This is the case in both the home and motor insurance markets. Average claims satisfaction for the over 60s is approximately 8.9/10, whereas it seems the under 30s are a little more difficult to please, with their average rating sitting at a more modest 7.49/10.

It is important for providers to understand what customers need and want when they claim on their insurance. The differences in satisfaction scores may be due to different age groups placing more value on certain aspects of the claims journey. If insurers do not understand these differences and act on them in the service they provide, then it may result in some age groups feeling neglected.

If insurers want to retain more customers and provide a claims service that customers would recommend to their friends, then understanding the nuances between different customer groups is crucial.

Becoming a Consumer Intelligence Award winner is no accident

This year we’re offering both winners and the brands that weren’t so lucky the chance to analyse their underlying performance across the Consumer Intelligence Awards. Our ‘Performance Package’ includes a bespoke and detailed workshop that can help you identify improvements you can make within your business over the coming 12 months.

Comment . . .

Comments (1)