Trust in insurance companies has fallen in the wake of coronavirus, suggesting that the reputational fall-out from the industry’s rejection of business interruption claims has spilled over into car and home insurance.

But not all firms have been affected equally – with just as many brands recording a rise as a fall amongst their customers.

Every month we ask 2,000 motorists who are coming up for renewal or have recently renewed questions about their buying decisions and the reasons behind them.

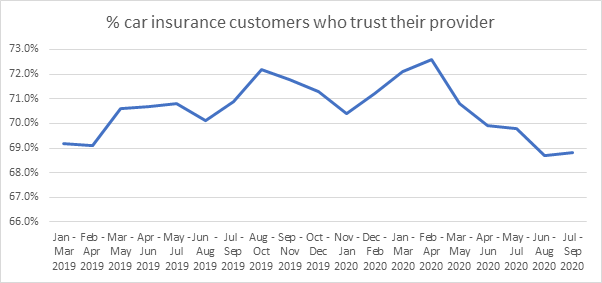

The consumer insight data reveals that number of customers who trust their provider after buying a policy fell from 73% at the start of lockdown to 69% in the most recent period.

The data also shows that most trust is cautious at best: only 19% ‘strongly trust’ their provider.

For a product that majors on delivering on a promise, that’s a concern.

Source: IBT post renewal survey. How many ‘strongly agree’ or ‘agree’ with the statement “I trust this company”.

Building trust makes commercial sense as those that trust their providers are more likely to want to renew with them. Next year’s ban on dual pricing will further see trust and customer service emerge as a growing battleground for competition as the deep price cuts of introductory offers are removed from marketeers’ toolkits.

But year-on-year comparison of trust levels amongst those coming up for renewal shows that some brands have done a better job of building trust during the pandemic than others.

Trust in Admiral, for example, grew significantly. We have previously seen how its £25 Stay at Home refund won a it a surge in loyalty and renewals.

There’s also been some sterling improvement from One Call, who were trusted by 71% of customers surveyed between June and August 2020, compared to 47% a year ago, making it the most improved for trust.

But not all brands fared as well. One entered renewal season with just 36% of its customers saying they trusted their company.

Brands building and losing trust

|

2019 Trust |

2020 Trust |

Change |

|

|

Brand A |

73% |

90% |

17% |

|

Brand B |

48% |

63% |

16% |

|

Brand C |

38% |

48% |

10% |

|

Brand D |

65% |

73% |

8% |

|

Brand E |

64% |

71% |

7% |

|

. |

|||

|

. |

|||

|

. |

|||

|

Brand T |

72% |

66% |

-6% |

|

Brand U |

67% |

58% |

-9% |

|

Brand V |

72% |

62% |

-10% |

|

Brand W |

72% |

61% |

-11% |

|

Brand X |

62% |

50% |

-12% |

|

Brand Y |

72% |

57% |

-15% |

|

Brand Z |

75% |

36% |

-39% |

Source: IBT pre renewal, motor. Trust in company June-August 2019 vs 2020

Understanding how your brand compares and building trust through engagement will only becoming more important in coming months as customers consider further changes to living and working patterns from Covid-19 and brands prepare to overhaul their models.

Understand consumer behaviour throughout the renewal process

Enhance decision making, performance monitoring and planning by understanding consumer behaviours, attitudes and intentions at insurance renewal.

Insurance Behaviour Tracker (IBT) is the most comprehensive insurance focused consumer survey in the market. It provides insight and understanding of consumer behaviour throughout the renewal process, giving you a view of market trends, and brand performance. This will enable you to make informed decisions to allow you to build robust marketing and business plans and track results.

Comment on blog post . . .

Submit a comment