We believe that organisations that adopt an unwavering focus on their customers are the ones which will survive and flourish. At Consumer Intelligence, we help businesses to see themselves through their customers’ eyes and keep them at the heart of what they do. Consumer insight allows you to hear first-hand from those customers what they think, need and do.

Beyond the ‘what’, we can help you uncover the ‘why’ and the ‘what next’. It opens a dialogue with consumers which ensures you continue to delight those who buy from you, and those who don’t but will in the future – which ultimately determines success, resilience and growth.

Consumer Intelligence‘s full-service Consumer Research team offers a range of research capabilities to deliver bespoke research projects which can

allow you to understand your customers’ behaviours, attitudes and motivations.

Our team of experienced research professionals will work with you to design, manage and analyse research which gets to the heart of your business questions and support you to take positive business decisions. We know financial services, and we can help you get to know your customers.

Fair value is set to be a revolutionary change for general insurance, making it a core focus for the FCA in the coming years. To help you step confidently into the world of fair value, we have launched two new services designed to give you in information you need to evidence your compliance to the FCA, embed fair value throughout your organisational culture, and generate positive business outcomes.

The Fair Value Framework provides a universal language across the insurance industry of what fair value is, determined by the people that matter most - your customers. The Fair Value Comparison is designed to help insurance brands get ahead of the game by establishing how they compare to their peers and identifying where improvements need to be made ahead of FCA intervention.

Our proprietary in-house consumer panel Viewsbank provides access to consumer opinions quickly and robustly whilst also offering value for money. Viewsbank surveys can support your insight based PR campaigns and help to secure national media coverage. The insights we provide are frequently reported in the national, local and online media.

Simply send us the questions you would like to ask our panellists and we'll do the rest. Or if you would like some help in designing your survey we can work with you to construct a bespoke questionnaire to meet your requirements.

Insurance Behaviour Tracker (IBT) is the most comprehensive insurance consumer survey in the market. It provides insight and understanding of consumer behaviour throughout the renewal process, giving you a view of market trends, and brand performance. This will enable you to make informed decisions to allow you to build robust marketing and business plans and track results.

IBT is an invaluable tool for companies within the General Insurance market and is used by brokers, direct insurers and aggregators. The different modules available in IBT can be useful to different areas of your business. These are retention, shopping journey, NPS and customer experience.

The Consumer Intelligence Omnibus runs weekly and allows quick, cost effective access to a representative pool of UK consumers and their thoughts.

We can provide insights that help inform decisions about your brand and new products or services and help you to develop metrics to track key outcomes such as customer satisfaction and brand sentiment. We'll work with you to understand your key aims and objectives and then we'll recommend the best methodologies and sample strategies to fulfil your requirements.

We often combine panel research with qualitative research to give you the whole customer view. We work with you to understand what it is you're trying to achieve. We'll recommend the best combination of research, design your project, carry out the fieldwork and present our insights to you.

Consumer Intelligence has a wealth of experience recruiting for and conducting mystery shopping projects — typically evaluating the customer experience transacting over the phone, in-branch or online to help our clients ensure that they offer service that is up to scratch, compliant and that is streamlined and consistent across their brands.

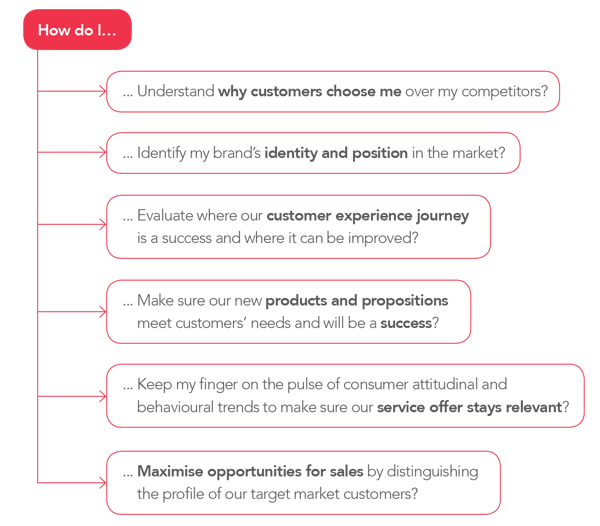

Consumer research can help you find answers to these kinds of questions to guide confident business decisions. We can create bespoke research which will take your key business questions and transform them into projects which gives you tangible results and invaluable insights into the world of your consumers.

Insurance providers remain at the bottom of the list for contacting their customers about the coronavirus pandemic.

Trust in insurance companies has fallen in the wake of coronavirus, suggesting that the reputational fall-out from the industry’s rejection of business interruption claims has spilled over into car and home insurance.

The cost of winning new customers, whether through commissions to Price Comparison Websites or introductory discounts, is a perennial concern of personal lines insurance providers.

We passionately believe in fusing data and insights in order to better help our customers... so we felt that Consumer Intelligence were exactly the right partner to work with

Ian Rowlands Vice President of Partnerships, GoCompare

[fa icon="quote-right"]

Complete the enquiry form below and our research team will be in touch.

We are an insight partner for financial services, inspiring confident decisions that build consumer trust. At the heart of every business are customers. At Consumer Intelligence, we gather unique data and intelligence about consumers and companies to understand the market.

[fa icon="phone"] 0117 317 8181

[fa icon="home"] Consumer Intelligence, Temple Quay, 3 Temple Back East, Bristol, BS1 6DZ