.png?width=711&name=Untitled%20design%20(27).png)

Everywhere you look, there’s talk of the ‘new normal’ we’ve achieved, after the first weeks of extreme uncertainty that coronavirus brought us.

Here at Consumer Intelligence, we’ve tracked nine weeks of the pandemic and its impact on consumers and consumer behaviour. What we’re seeing is perhaps more accurately described as a ‘subdued’ normal - and it could just be the calm before the next storm.

So, what exactly is happening at this new stage of the pandemic? What does subdued normal look like? And what does it all mean for car and home insurance providers?

Anxiety is easing with lockdown

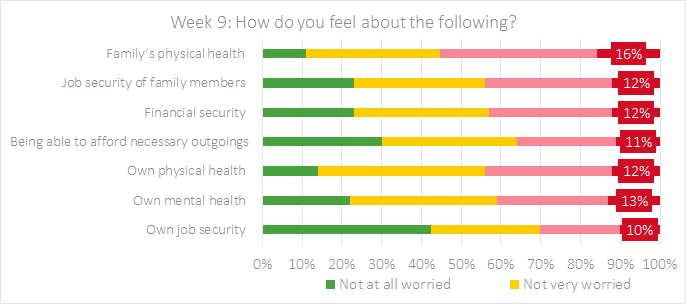

In week nine, there’s no doubt that concern levels around physical, mental and financial health have fallen, with people feeling generally less worried now the worst appears to be over. This comes as the country begins to emerge from lockdown, shops start to reopen, more people start to return to work and many start to open up their gardens for socialising with friends and family.

The easing anxiety is particularly noticeable amongst the under 34s, perhaps the group who struggled most with lockdown.

Those saying they were ‘very worried’ about financial security has dropped from 19% in week 1 to 12% in week nine, with job security concerns also at their lowest level since the crisis began.

Consumers are adapting to post-coronavirus life

Consumers are starting to get out and about again, with 1-in-5 saying they’ve met with non-household members this week.

With less restrictions we’re seeing how people are starting to adapt their lifestyles post-coronavirus and adapt their spending accordingly. There’s an increase this week in respondents saying they would try to find ways to reduce their spending across all the outgoings we asked about, should finances be strained, rather than prioritise or cancel payments and services – a go-to response we saw more of in the first weeks.

All in all, there’s very much the sense that with the initial panic over, people are taking more relaxed and logical approach to both their personal risk and their personal finances.

Expectations on insurers have lessened

The good news for insurers here is that consumers’ new sense of calm and control means their expectations of support from insurance companies has lessened.

Back in week one, 58% of people thought insurers should be providing payment plans for financially vulnerable customers, but only 46% expect that from insurers in week nine.

Trust in insurers has stabilised

At the beginning of the crisis, insurance came bottom of the list of industries that consumers trusted to inform and support them. Now it sits in the middle of the table, slightly above government, media, and the travel industry.

Before clapping ourselves on the back for a job well done, it’s worth noting that this isn’t the result of positive action. Admiral remains the only brand to go big on customer rebates, and most other insurers, and indeed financial institutions as a whole, have been relatively slow to introduce extra communications or relief measures – with some only doing so in the wake of new rules from the FCA.

Rather, it is the result of growing mistrust in government, media and the beleaguered travel industry, causing them to go down the charts, that has seen insurance as a whole achieve a middle of the board position.

Buying behaviour is recovering

In week nine, we can see the first glimmers of increasing consumer confidence trickling into more expected buying plans and behaviours.

For motor insurance, for instance, more people are shopping around at renewal with 12% of consumers reporting that they have visited a price comparison website in the last month, indicating higher engagement than we saw before.

Meanwhile for home insurance, there’s been a slow but continuing return to website visits over the last few weeks.

Rallying while we wait – the subdued normal

While there are tentative shoots of resilience and recovery, they are fragile. It might seem like good news all round, but this subdued normal isn’t anywhere near pre-pandemic normal.

At the end of May an estimated 8.7 jobs in the UK were furloughed – approximately 1 in 4 workers, all getting up to 80% of their salaries paid by government. From August, that support will be gradually withdrawn.

Many of those not on furlough are feeling the pinch in other ways. Of those in work, 13% have had their hours reduced, 9% had a salary reduction, 9% have seen their normal place of work shuttered and 7% have lost work or been laid off.

The businesses opening back up won’t be opening to the same market conditions, and will no longer have the back-up of financial support, leeway or ‘holidays’. Many of their customers too could be struggling with lower income and accumulated or deferred debt from the last two months.

As we ease our way forwards, we’ll be moving into precedented times - and the precedent is that the world will be facing a serious economic downturn.

If the first nine weeks were an unchartered rollercoaster, the next nine weeks will include dips that have, unfortunately, been chartered before. Understanding how the looming recession as well as a potential second peak of the pandemic will impact consumers through the rest of 2020 - and beyond - will be key for insurers.

Covid-19 Consumer Tracker

In a crisis, being able to make decisive and confident decisions is crucial

In order to take a confident step forward in the face of the coronavirus pandemic, businesses need to be armed with knowledge and information that allows them to understand how the current situation is impacting consumer behaviour and the wider market.

To follow the changes to come, gain insights into the next stage of the pandemic and examine how they affect consumer behaviour and attitudes, we have launched version 2.0 of the COVID-19 consumer tracker, which is now available to purchase.

Comment on blog post . . .

Submit a comment