A welcome announcement for their customers last week, Admiral kicked off Monday morning with news it would return £25 to every car and van customers “in recognition of them staying home during the lockdown.”

A total of 4.4 million customers will receive the money by the end of May, making a total of £110m given back.

The idea is not entirely original, with insurers in the US and France making similar pledges first. And it may not be out of pocket from the giveback as it will make savings on claims as customers drive less (road traffic is down 59% compared to February).

That said, its execution was masterful. Its customers like it more than they did before, people are talking about it, the press are writing about it, and customers of rivals have been asking if they can expect similar. Even if they do follow suit, Admiral can enjoy at least two weeks of first movers advantage and brand glory.

In deciding their next move insurance brands should consider what customers want and expect.

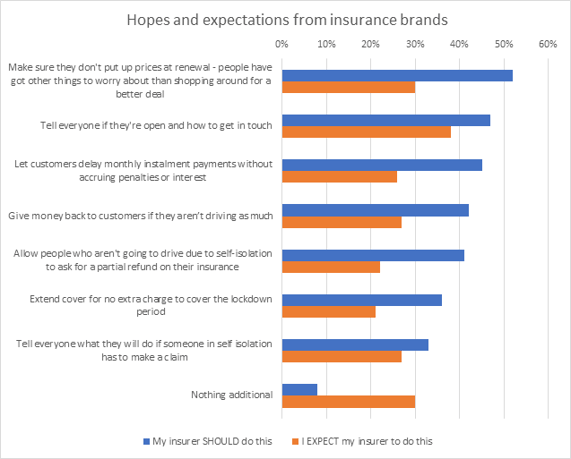

We asked our Viewsbank panel what they thought their insurance company should do for customers today to support them during Coronavirus to help guide these conversations.

Source: Viewsbank poll of 819 insurance buyers conducted online 24th to 27th April 2020

Top of the list was not to put up prices at renewal as people have other things to worry about rather than shopping around (52%). This seems particularly pertinent when viewed through the lens of customer vulnerability. We know that the number of people searching for car insurance is at an all-time low, seeming to confirm that people have more to worry about than how to avoid a loyalty penalty. Now is not the time to take advantage of those difficult distractions.

It’s also worth noting that a fair renewal premium is more important in the eyes of the consumer than a refund to customers who aren’t able to drive at the moment, which 42% of customers want insurers to offer and only 27% expect.

Consumers are also more concerned that insurers should let customers delay instalment payments without being penalised than indiscriminately hand cash back to customers.

All of this points to targeted, compassionate measures being just as effective as a something-for-everyone giveaway, at least with customers.

Brands can also take encouragement from the number of things customers want to see that won’t cost them a lot of money. Nearly half (47%) want to hear an operational update and how to get in touch and 33% would welcome reassurance about how insurers will deal with any potential claims from someone who is self-isolating.

The other striking thing here is that the expectational bar is low. Some 29% of consumers expect their insurance provider will in reality do nothing at all.

Not every brand will follow Admiral’s suit, especially not brokers which won’t make direct savings from reduced claims. But clear actions focused on supporting those who need it are still worth something.

Introducing the Covid-19 Consumer Tracker

In response to the challenges faced by our clients across the general insurance industry, we have been working hard behind the scenes gathering data and insight that will help personal lines insurers and brokers navigate this difficult and challenging time.

We are pleased to announce the launch of our new Covid-19 Consumer Tracker, focusing on wider consumer behaviour trends during the COVID-19 pandemic but with a specific focus on the general insurance industry.

We are interviewing a nationally representative sample of 1,000 consumers every week to bring you timely insight on what your customers, your competitors’ customers and the general market think and are doing during these uncertain times.

Comment . . .

Submit a comment