Telematics policies, including pay as you go driving and black box monitoring, are generally thought of as niche tools to insure the young. But as telematics matures, technology advances and driving changes, brands are beginning to see telematics’ wider potential.

There’s no doubt that lockdown has driven pay-as-you-drive policies on by several years. Covid changed how people drive, and how they want to be insured. Road travel fell by more than two thirds during the first lockdown, people were forced to watch every penny - and talk of usage, fairness, discounts and rebates hit the headlines.

No surprise then, that brands started to respond to these changes in customer behaviour, circumstances and demand. Accordingly, we’ve seen the launch of new telematics and usage-based products, and the extension of old ones – and they’re no longer just for the kids.

Young drivers driven down

Partly of course, right now, that might be because the kids aren’t driving as much...

According to data from the DVLA, just 2.97 million people aged 16-25 in Great Britain now hold a full licence, down from 3.32 million in March 2020, and the lowest number in records dating back to 2012.

Driving lessons and tests have been an impossibility during lockdowns. When things open back up, waiting lists for lessons and tests are likely to be long.

Insurance is another barrier to driving. The average cost of car insurance for under-25s is £1,750 according to our latest car insurance price index.

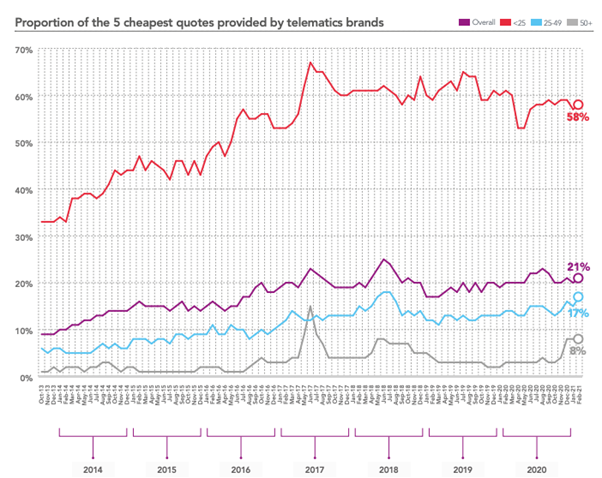

That would be even higher without telematics as 58% of the cheapest quotes for young drivers came from telematics brands.

Changing habits driving new demand

On the flip side, existing telematics brands – and those with an eye for opportunity – will be preparing to target the avalanche of new and probably cash-strapped learners as lessons resume on 12 April and tests ten days later.

But it’s not just the reduction in younger drivers about that have seen more and more telematics brands move up the age scale and begin to target older drivers, too. Many have recognised the wider gap in the market exposed by the pandemic.

The fact is, whether you’re now a permanent home worker, a carer mostly doing the school run, a city-based weekend-driving millennial, or a retiree or environmentalist sticking to short journeys, there are fewer miles driven and new thoughts and conversations around value.

In response, 17% of the cheapest quotes provided to those aged 25-49 now come from telematics brands, up 3% from a year ago. Similarly 8% of the cheapest car insurance quotes for the over-50s are now via telematics – a rise of 5% in the last 12 months.

With the rise of self-stall technology making logistics easier, and the lure of detailed customer data and insight to target and retain custom, there is a real market shift away from niche and only young drivers.

Big brands in the telematics driving seat

Some big brands are leading the way here.

Hastings YouDrive launched in November, and Zurich recently entered the market with a minority investment into telematics provider My Policy. Usage-based By Miles extended its footprint on Price Comparison Websits. Just this month, Atlanta secured a foot in the telematics market with the acquisition of young-driver and telematics specialists Marmalade and announced its intention to use the technology to launch telematics propositions its other brands including Swinton, Autonet and Carole Nash.

Its CEO Ian Donaldson told journalists: “We wanted to make sure that any customer wanting this solution has got it. This isn’t a product that’s going to appeal just to youngsters. The world has moved on and we dan now use technology and data to actually give discounts to customers correctly, without the customer needing to think about how many miles they’ve driven.”

As telematics gets older and wiser, so, apparently are its customers.

And so, very possibly, should their insurance brands.

Car Insurance Price Index [free to download]

Download our Car Insurance Price Index to gain insight into market movements, benchmark the major van insurance brands and help you understand the data behind the results.

Comment . . .

Submit a comment