The number of customers shopping around for Motor insurance has spiked since November 2015. This is as a direct result of the rise in insurance premium tax (IPT) and also a general rise in insurance premiums that took place in Q4-2015.

The highest level of switching since 2013

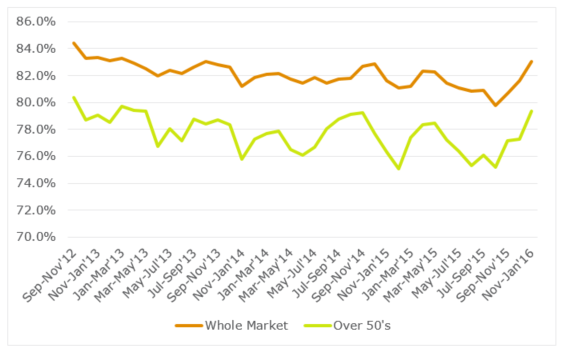

83% of consumers now claim to be shopping around at renewal, the highest level since 2013. This is causing a massive amount of upheaval within the market.

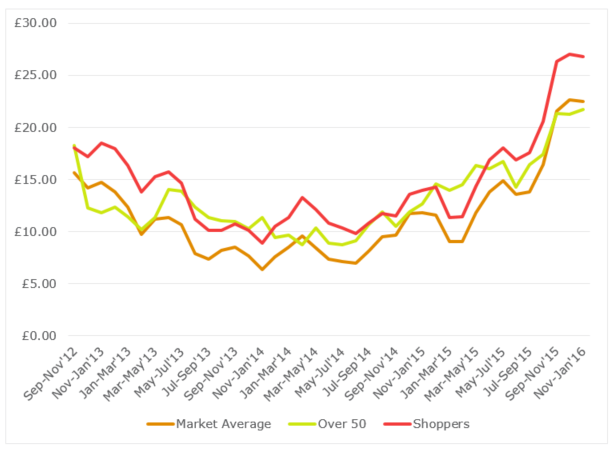

Massive jump in renewal premiums

The reason for the big change is the massive jump that consumers are seeing in their renewal premiums. Consumers are reporting an average rise of £22.46 (this includes consumers who didn’t shop around), up from £9.08 this time last year. Those who shopped are reporting average rises of £26.79. We have also seen the patience of the over 50's snapping with the increases they are seeing. For the first time this quarter, the over 50’s have become less tolerant of premium increases than the rest of the market.

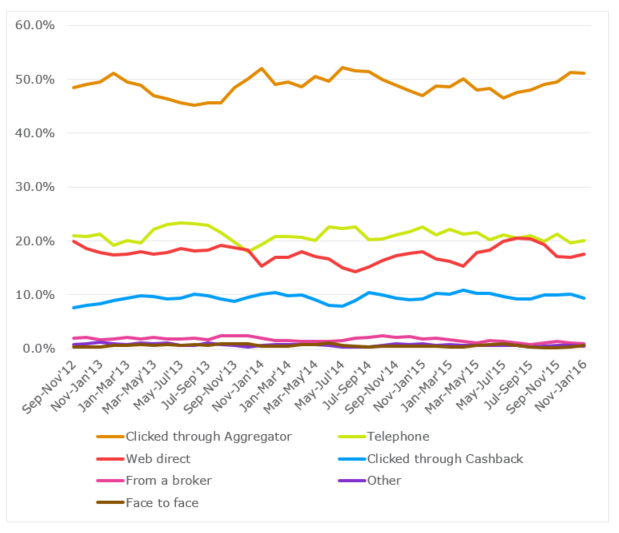

The purchase channel most affected is the telephone

Clearly larger numbers of people shopping around leads to an increase in switching. Of those who shopped about 50.5% stayed with their existing insurer as opposed to 51.5% this time last year. A 1% change in the consumers switching is an additional 270,000 consumers a year switching insurers.

The other dramatic change is how consumers are buying their insurance. 53.1% of consumers switching their car insurance in the 3 months to Feb 2016 are after clicking through from a PCW which is a massive jump from 48.8% for the same period last year. The purchase channel most affected is the telephone, which has fallen from 21.1% of all sales to 18.6%.

Shape of the Motor Insurance Market Report

All this data and more will be available in our report which will be published in May.

Register your interest in finding out more about the report and to find out how all of this has effected your customers and prospects.

Submit a comment