If there’s one certainty about the Ogden rate changes, it’s that premiums will increase sharply. We have already seen them rise by 4.2% in the months to the end of March.

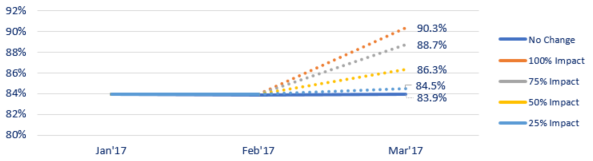

Currently 83.9% of motorists shop around at renewal each year anyway. What will happen to the 16.1% who don’t when they see a bigger rise than they may have expected at renewal?

Consumers that don't shop around give various reasons - we ask several thousand of them about it every year. We predict that those who give the three below reasons most will be most likely to shop around when they see the impact of price increases caused by Ogden:

- Couldn’t be bothered – 18% of non-shoppers

- Price was about the same as last year - 15% of non-shoppers

- My insurer offered me a lower premium than the previous year – 7% of non-shoppers

If all those non-shoppers were to look around for a new quote, the shopping around rate could rise to over 90%.

.png?width=710&height=268&name=Ogden%202017%20(002).png)

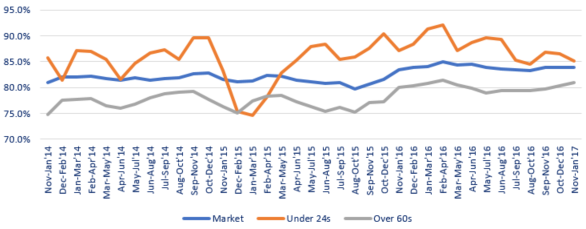

There is a precedent for higher prices leading to higher shopping rates. When Insurance Premium Tax rose by 3.5% on 1 November 2015, shopping around rates rose from 80.7% to 83.9%.

.png?width=710&height=157&name=Ogden%202015%20(002).png)

Even if 50% of those customers ‘at risk’ of shopping around do become shoppers, that would still mean a jump to 86.3% of consumers shopping around at renewal.

Predicted Market Shopping Rates

Those who cited other reasons for not shopping around – they like the company they are with, don’t believe in switching, didn’t have time/left it too late, forgot, required specialist insurance, leave it to my broker/IFA, shopping is too time consuming – are less likely to change their habits because of price rises and are not included in this model. However, it is of course possible that the sustained higher prices will change their priorities and they too will become shoppers.

Age differences

We predict the biggest increase in shopping rates will come from older drivers. Over 60s are less likely to shop around at the moment – 19% of those renew without getting alternative quotes. Of those, 6.8% of non-shoppers are in the ‘at risk’ category to become shoppers.

Although younger drivers will feel the impact of Ogden most as insurers increase their prices to protect themselves against the highest risk, they already have higher shopping rates than the rest of the market. All the same, the proportion of shoppers aged under 25 could increase from 85.1% to 90.9%

Shopping Rates by Age Group

This is all great news for price comparison websites. For brands, it depends on whether your strategy is to grow your market share from switching or if you rely on having loyal customers renew year after year.

In any case a market shopping rate approaching 90% would be unprecedented.

Are you winning the motor insurance renewal game?

Our research tells us that 58% of people switched their car insurer at renewal in the first 3 months of 2017. Even more were looking around to see how their prices compared, and that was before brands had to publish last year’s premium on the renewal notice. Whilst high levels of shopping around opens up an opportunity to brands to win new business, it also provides the threat of losing valuable customers. The brands with the strongest retention and acquisition strategies will be poised to take advantage of this state of change.

Our infographic highlights insights from our research on consumer behaviour at renewal and shows key factors at play in the renewal game.

Submit a comment