It cannot be disputed that customer satisfaction, particularly in these times, is a key contributor to business success. Ultimately, customer satisfaction is a reflection on how a customer feels about interacting with a brand.

The importance of this is plain. In one of our latest articles, we explored the correlation between customers’ ratings of levels of cover and service, and the likelihood they would recommend their insurer to others. Now, as we delve deeper into this new data around customer satisfaction, we hope to find evidence to support the theory that customers who are experiencing high levels of customer satisfaction, are more likely to display loyalty to their current insurer when it comes to the point of renewal. We have utilised data from our Insurance Behaviour Tracker (IBT) to uncover these insights.

We survey over 48,000 home and motor insurance customers through IBT each year, to gain insight into how consumers feel about their insurance provider, and to find the top performing brands within the market. Using this unique data set, we are able to announce the UK’s best insurers and Consumer Intelligence Award winners for customer satisfaction in 2021, as voted by consumers.

|

The top 10 highest rated insurance brands for |

|

|

Voted by drivers |

Voted by householders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| *winning brands are listed in alphabetical order | |

This last year has been tumultuous, and this has been reflected across the top 10 winners we have seen across our award categories. For ‘Customer Satisfaction’ we welcome new entrants Co-op, RIAS and Prudential into the Top 10 for home insurance, and in motor we see Churchill, Sainsbury’s and Zurich all edging into the rankings.

The full list of 2021’s Consumer Intelligence Awards winners is available to view here.

It may sound obvious, but satisfying your customers is good for business

To be considered for our Customer Satisfaction Award, brands require a minimum market share, measured by the number of customers that buy insurance with them. Our winners of this award category had the 10 highest customer satisfaction rates out of all our nominees.

Real customers rated their insurer based on the question, “how would you rate your overall satisfaction with your current home insurance provider?” on a scale of 1 to 10, with 10 being “completely satisfied”.

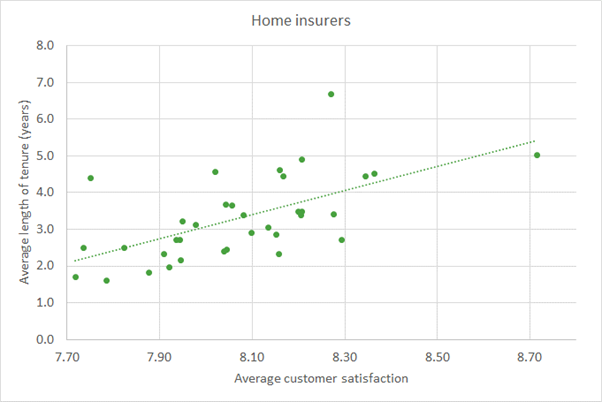

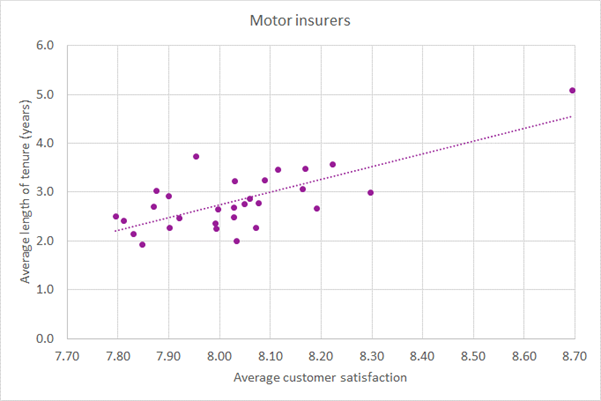

We have been able to dive further into our data to look at the relationship between customer satisfaction and length of tenure with that insurer. By looking at all our nominees, including the winners and the brands that lost out this time, we can reveal that for both the home and motor insurers, there is a positive relationship between average satisfaction and the average length of tenure.

The scatter charts below illustrate this relationship, with each point representing one of our nominees within the category. We then calculated the correlation coefficient to determine the strength of these relationships.

Correlation coefficients range from -1 to +1, and for positive relationships, a value greater than +0.5 is considered moderately strong. In this instance, the coefficient for the home insurers was 0.61, and for motor insurers, the relationship was even stronger, with the coefficient being 0.73.

These calculations may be simple, but they clearly demonstrate that insurers that fixate on satisfying their customers are rewarded with loyal customers who renew year on year, and this is ultimately good for business.

Using these insights from our Insurance Behaviour Tracker (IBT), our analysts have been able to determine that profitable growth is driven by a focus on renewals and that there is a proven link between brands with high levels of customer satisfaction and strong retention rates.

Congratulations to all of 2021's Consumer Intelligence Awards winners.

Becoming a Consumer Intelligence Award winner is no accident

This year we’re offering both winners and the brands that weren’t so lucky the chance to analyse their underlying performance across the Consumer Intelligence Awards. Our ‘Performance Package’ includes a bespoke and detailed workshop that can help you identify improvements you can make within your business over the coming 12 months.

Comment . . .

Submit a comment