Over the last few years, the behaviour of insurance consumers has changed – in ways we wouldn’t always have predicted.

During Covid, people re-evaluated their priorities and we saw shopping and switching fall. Then new regulation saw a ban on price walking, which has seen consumer satisfaction rise, and shopping and switching come down again to a record low. Now as the cost of living crisis really begins to bite, early indications are that it could be all change again…

Last week at Consumer Intelligence we launched our cost of living tracker, and while the data is in its infancy, we can already see trends emerging.

70% of Brits have already reduced their spending, and 6% have already made cuts to insurance. Higher up on the cull list are things that will also have a knock-on impact on insurance, including the 40% who are driving less, 36% cutting back on holidays, and 27% delaying purchases of big ticket items like cars.

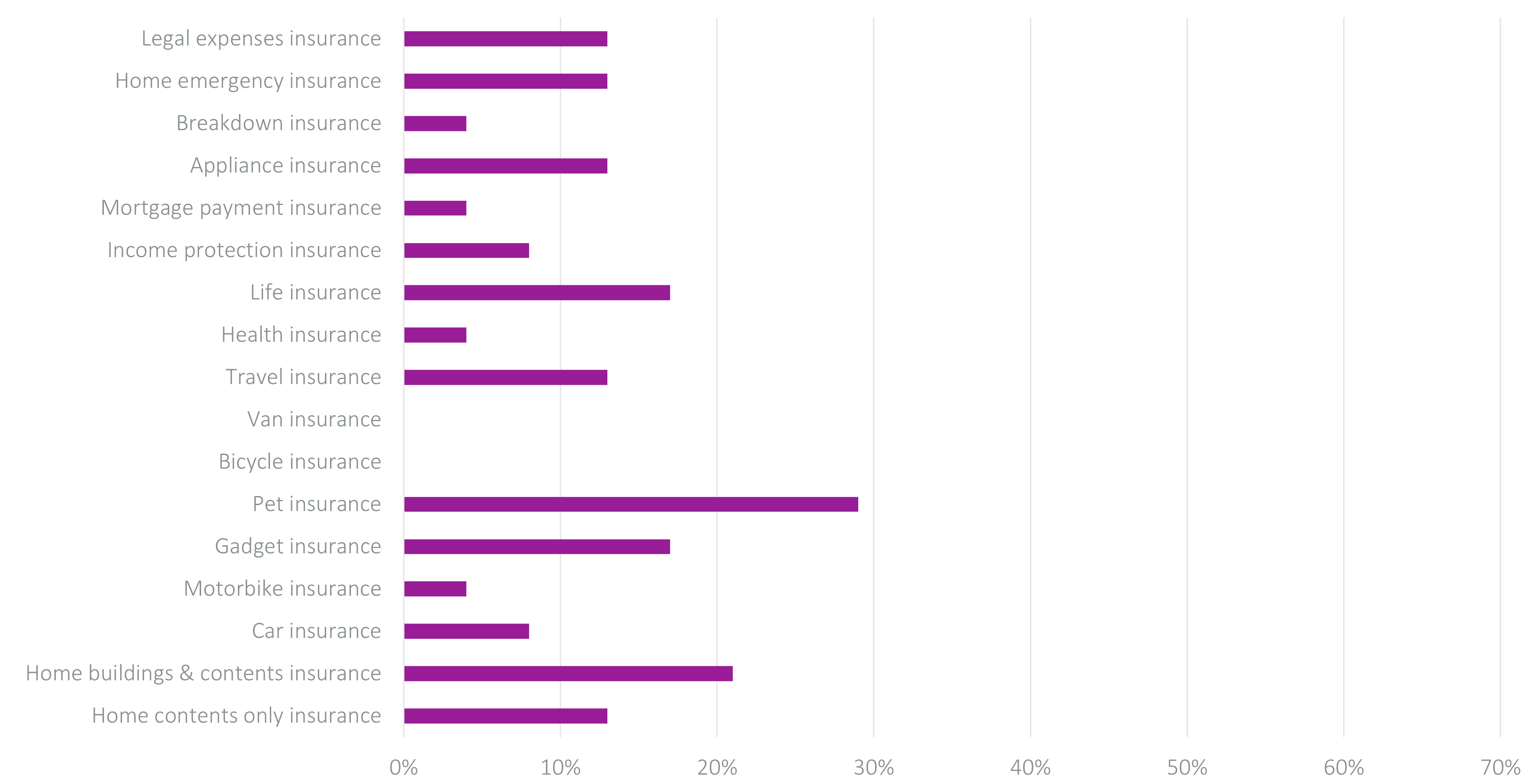

Of those making insurance cuts, 44% have already cancelled a policy, and 60% have moved to a cheaper policy. Pet insurance was the most popular type of policy to drop, followed by home buildings and contents insurance, gadget insurance and life insurance.

While the numbers at this stage are low, the insurance industry would do well to sit up and listen.

We know that in times of economic hardship both cancellations and claims go up pretty quickly. We know that more people will fall into vulnerability as their financial stability is rocked. We also know that if inflation continues it will hit insurance pricing – and trigger more shopping and switching if premiums go up at renewal by more than £30.

So what can providers do to prepare? Here’s 8 ideas from our recent webinar, The turning tide of consumer behaviour.

1. Articulate value propositions

When it comes to something non-compulsory like pet insurance, it’s very tempting for consumers to cut the monthly outlay. But if something happens to a pet, vet fees can run into thousands of pounds – which cash-strapped owners can ill-afford. Now more than ever providers need to step up to articulate the value of their products – preferably before the point of renewal/cancellation.

2. Look at tiered products

Following GIPP we’ve seen a whole raft of new tiered products, and new entrants to the market with alternative propositions like pay as you go or telematics options in car insurance. Providers should continue to look at what they can do to support people with basic or essential options – but with very clear communications about what they’re getting, and without hollowing out all the product value.

3. Re-think fair value

With Consumer Duty on the horizon, there will be more regulatory scrutiny of fair value and good consumer outcomes in the coming months - and with more customers falling into vulnerability what constitutes fair value and a ‘good outcome’ is actually going to change. Thinking through what that might look like for your brand and staying one step ahead will be key.

4. Create a vulnerable customer plan

At the height of Covid, many providers were left scrambling to communicate with and support vulnerable customers. Now is the time to dust off or create a plan for how to deal with the vulnerable customers who will begin to struggle with the cost of living crisis – and their insurance. Discounts, payment holidays, alternative cover options and repayment plans should all be considered.

5. Provide extra renewal support

Standard renewal communications should be tailored to the behaviour trends we’re seeing. They could, for instance, cross-sell or offer take-outs instead of add-ons - aiming to secure some of the high levels of retention providers are currently enjoying.

6. Look at instalment plans

When people are short of money, paying monthly can help them manage their cash flow. While this is considered higher risk for providers, most consumers are currently paying a 12%-20% uplift on an annual policy for the privilege of spreading out their payments. Whether that constitutes fair value is questionable. We’re already seeing some providers grab rank 1-5 slots in the instalment view on PCWS – and market share – by cutting or scrapping those fees, and there’s considerable opportunity for others to do the same.

7. Add wider value

Not all of the value within your products has to be insurance-based. Savvy providers are starting to team-up with other services to pack more value into their propositions – for instance pet-food discounts with pet insurance.

8. Be prepared to change your strategy

We’ve seen so many different strategies emerge in 2022, and so many different levels of success across new business and retention, big players and start-ups. Things might feel like they have settled down after GIPP, but anyone taking their eye off consumer behaviour and failing to adapt their strategy in response to the next wave of change could come unstuck. Agility, innovation and compassion will be essential in weathering the coming storm, and coming out on top.

Listen to the full webinar discussion here, or find out more about our cost of living tracker here.

Comment . . .

Submit a comment