The FCA’s intervention on home and motor pricing has been the biggest upheaval in the industry in decades as firms have had to align new business and renewal prices, ending the ‘loyalty penalty’ once and for all.

Media scrutiny has been high against a backdrop of rising consumer inflation. Indeed a report in The Mirror found that the cheapest price for a single motor policy had soared by £100 between 31 December and 1 January when the rules entered into force.

It was never going to be a smooth ride. The FCA itself recognised that new customer discounts could lead to price rises for those who habitually change providers.

But with great change comes great opportunity for brands to deploy different strategies, revisit their products and react to everybody else doing the same.

So has the reaction so far been cohesive across the sector – or chaotic?

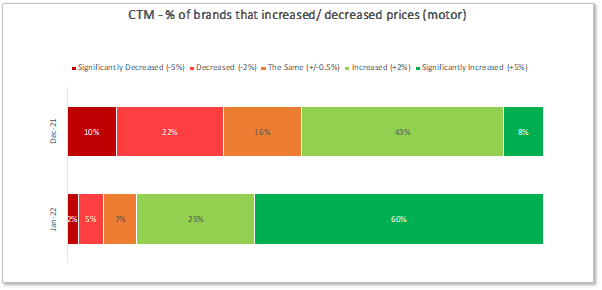

At Consumer Intelligence we tracked prices in December and January, too. We found that while few pricing changes took place in the final weeks of December, throughout the month more than half of brands were already increasing prices, and 8% were doing so significantly. Meanwhile 32% were actually decreasing prices.

In January by contrast, 85% of brands were increasing prices, 60% significantly, and only 7% were lowering them.

*Data to 19 January 2022

It’s very obvious where the pain point is and everything goes green. But it’s less obvious who’s making the biggest cuts, and where, and it looks like size matters.

In motor, December showed the beginning of a divergence in pricing between providers with smaller and larger back books. Brands with a longer-standing customer base increased premiums for new customers whilst those with a heavier slant towards new business very slightly reduced them.

That trend was far greater for home insurance where some brands increased new home insurance business prices by over 50% in December.

In a single month, home premiums from providers with a larger back book went from deflationary with November premiums down on the previous December, to an inflation-beating 9.4% annual increase.

The battle of the multi-brands

But the picture is not as clear cut as those with big back books losing the price war, customer trust, and new business.

Brands are coming back with some very different strategies.

Those with smaller back books might still be cutting prices to grab market share, but others are adapting their pricing strategy for different distribution channels, and evolving their brands to create new tiers of platinum/gold/silver cover that can keep them high on the PCWs and prompt a conversation about cover.

Others are refining their footprints between different brands within the same group.

From the providers perspective they are offering greater diversity of choice and showcasing product features, but consumers may be faced with less diversity of providers at the top end of PCW results pages…

Hearts, minds – and pockets

The great unknown is really how customers will react to all this.

Not everyone will see their next insurance bill go up – some will see it decrease. But will people open their renewal letters and be happy with the price drop, or feel cheated over previous premiums? Will the promise of a brand’s ‘best price’ at renewal reduce shopping and switching rates? What role will brand and brand-trust play in decision-making now price is less of a differential? And will people be willing to sacrifice cover elements to secure lower premiums?

In our webinar on 3 March we’ll be looking at GIPP from all of these perspectives, through a commercial, compliance and a customer lens.

With two months of post GIPP data, we’ll be examining the different strategies at play, and the impact we’re beginning to see on the market - and in consumer behaviour.

If you want to know where your brand sits, what your competitors are doing, and how the landscape is changing, join our own CEO Ian Hughes and data guru Mike Miskelly, and By Miles’ CEO James Blackham, to find out more.

WEBINAR: GIPP: The £4bn question

We have already seen a significant change in the general insurance market when it comes to price and product, but in our latest webinar on Thursday 3 March, we'll be endeavouring to find out what's next for home and motor insurance in the coming months and years. We have some excellent content lined up, so sign up and secure your place now.

Comment . . .

.gif?width=770&name=GIPP%20webinar%20GIF%20CTA%20(1).gif)

Submit a comment