The FCA expects £4 billion of insurance savings for consumers over the course of 10 years as the result of its General Insurance Pricing Practices (GIPP) rules, the pricing part of which came into force at the beginning of the year.

Changes and savings of such magnitude will create big waves and plenty of ripples afterwards. In our recent webinar, ‘GIPP: The £4bn question’, we looked into how brands are weathering the swells and riding out the first part of the storm.

Pricing waves

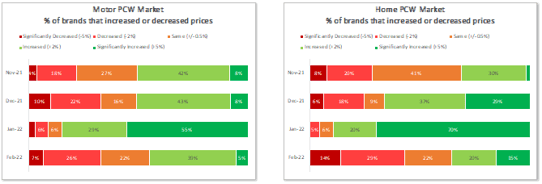

We’ve seen the first wave of GIPP impact in sharply rising prices, and the choppy waters continue. We’ve already covered the stark price rises in January where 84% of car insurance and 90% of home insurance brands put through price increases for new business to bring them in line with prices quoted to customers at renewal.

February saw a little bit of recalibration with a third of motor brands and 43% of home brands putting through price cuts while others put through more measured increases than the previous month.

What also stands out is the pace of the reactions. Some brands have been putting through pricing changes once a day – and in some cases hourly. This means that some of changes brands put into the market won’t have the intended outcome as the conditions they are reacting to are volatile and changing themselves. Watching and measuring is key.

Preparing for the storm

GIPP strategies began well before January, and we can see different brands had been preparing with some very different tactics in anticipation of changing market conditions.

Using a combination of analytical tools, including our Insurance Behaviour Tracker and Market View, we can see different elements in play.

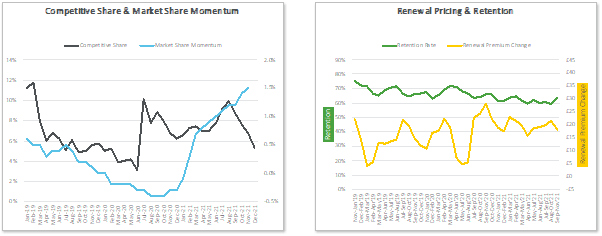

One brand, for example, made a concerted push for new business and has gained market share – but it also suffered from a fall in retention and had not addressed price walking ahead of the deadline.

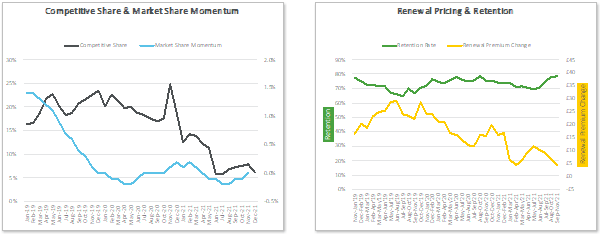

Another was ahead of the regulations on weaning itself off dual pricing, boosting its retention rate as it headed into January and shoring up its back book for 2021. Its less competitive position on new business cost reduced its market share momentum, but it is in a good place to wait for the dust to settle and formulate a ‘new’ new business plan when market dynamics are more stable and predictable.

Brand 1 - Building the front book

Brand 2 - Protecting the back book

Small fish vs big fish

When it comes to the food chain, size usually wins out. But post GIPP it may actually be a good time to be a smaller fish in a big pond.

Newcomers clearly don’t have a big back book to balance with new business pricing. They also tend have a key advantage of new technology that allows them to watch and act on volatile market changes – something those with clunky legacy systems might not be able to do.

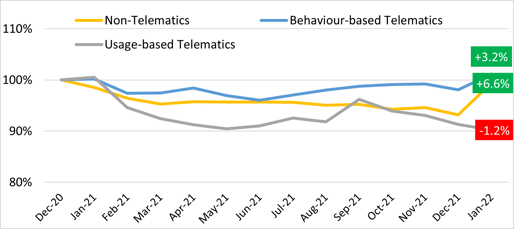

GIPP is also an opportunity for new propositions such as telematics products - where premiums have been less impacted and inherently won’t have a big back book.

It’s an area that could well get a stronger foothold in the market as insurance prices add to the wider cost-of-living crunch - and customers who wouldn’t have chosen telematics before consider it as an option when they see a larger price differential on the PCW results page.

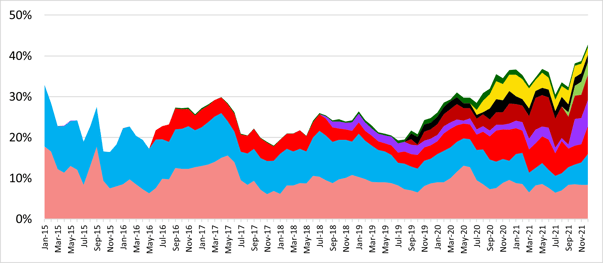

Price index of different proposition types

Telematics products – both behaviour-based and usage-based – have certainly gained competitiveness in the market, and become a real threat to traditional propositions.

However, it’s not all about the small fish. Established brands are also branching out into new markets, going for instance from motor into home, or coming in with differentiated product brands in bronze/silver/gold tiers designed to keep driving sales volumes.

The number of corporate groups placing 3 or more propositions in ranks 1-5 has exploded from the Autumn of 2021, and keeps going up. From being the preserve of a handful, it is now adopted by 40% of the market.

Breakdown of corporate groups placing 3 or more propositions in rank 1-5

How innovative tiered versions of standard products really are remains to be seen - as does whether stripping out cover will ultimately constitutes ‘fair value’ for the regulator as the rest of the GIPP changes come into force.

Customer reaction

Perhaps the biggest question, certainly worth billions, is what customers will do.

In a hardening market there’s normally an increase in shopping around, and a reduction in deflationary markets - but GIPP price rises and the end of price walking represent a disruption to ‘normal’ pricing cycles.

What we do know is that shopping around for insurance is a very ingrained, established behaviour – with 81% of motorists and 74% of home insurance customers shopping around in 2021, half of whom when on to switch providers.

The GIPP changes should make it easier to cancel policies and turn off auto renewals.

And this all comes at a time when households face the worst squeeze on disposable income in 30 years and an unprecedented rise in energy prices in April. Seeing even a price reduction on a renewal notice may not be enough to deter savvy shoppers for checking if a better deal or more suitable product is available.

There are waves like this which have nothing to do with GIPP but which nonetheless change the seas for insurance brands.

Until one of the PCWs breaks out into value-ranking and helps customers pick the features that are relevant to them, price sensitivity is probably here to stay. But the first of the big 4 - or a new comparison site OR insurer - that innovates to sell on quality of cover, service and claims experience, could well be the one who ultimately rules the waves...

This could be the perfect storm, or a perfect opportunity.

WEBINAR: GIPP: The £4bn question

We have already seen a significant change in the general insurance market when it comes to price and product, but in our recent webinar, our panel discussed what's next for home and motor insurance in the coming months and years.

Click here to catch up on what you missed.

Comment . . .

Submit a comment