- Average motor premiums drop 6.7% in a year but are now rising

- Brexit uncertainty could be a driver behind a recent uptick in premium rises.

Drivers are benefiting from premium falls of 6.7% in the past year, but the tide is starting to turn, new analysis1 from insurance data analytics expert Consumer Intelligence shows.

Across the market, average prices rose 0.3% in the past month and by 1% for the over-50s. The company suggests that Brexit fears could now be causing premiums to rise once more, driven in part by heightened concerns around imports for spare car parts.

Younger drivers aged under 25 continue to benefit from the largest premium reductions. The demographic has seen a price drop of 11.3% in the past 12 months, though still attracts the largest premiums (£1,928).

Despite suffering the most expensive premiums of the cohorts, younger drivers have most control over price, with the proportion of telematics providers within the Top 5 cheapest premiums currently sitting at 59% for the under 25s.

For the middle band, the 25-50s, average car insurance prices are now £663 – a drop of -6.2% over 12 months. Again, for this demographic, premium falls have also slowed in the past three months – to just -0.5%.

John Blevins, Consumer Intelligence pricing expert said: “Over the past few years, the motor insurance sector has seen a plethora of premium-impacting events. However, the last 6-12 months have been fairly benign with claims experience driving costs. Time will tell the impact of Brexit and how it will affect the overall market and claims costs moving forward.”

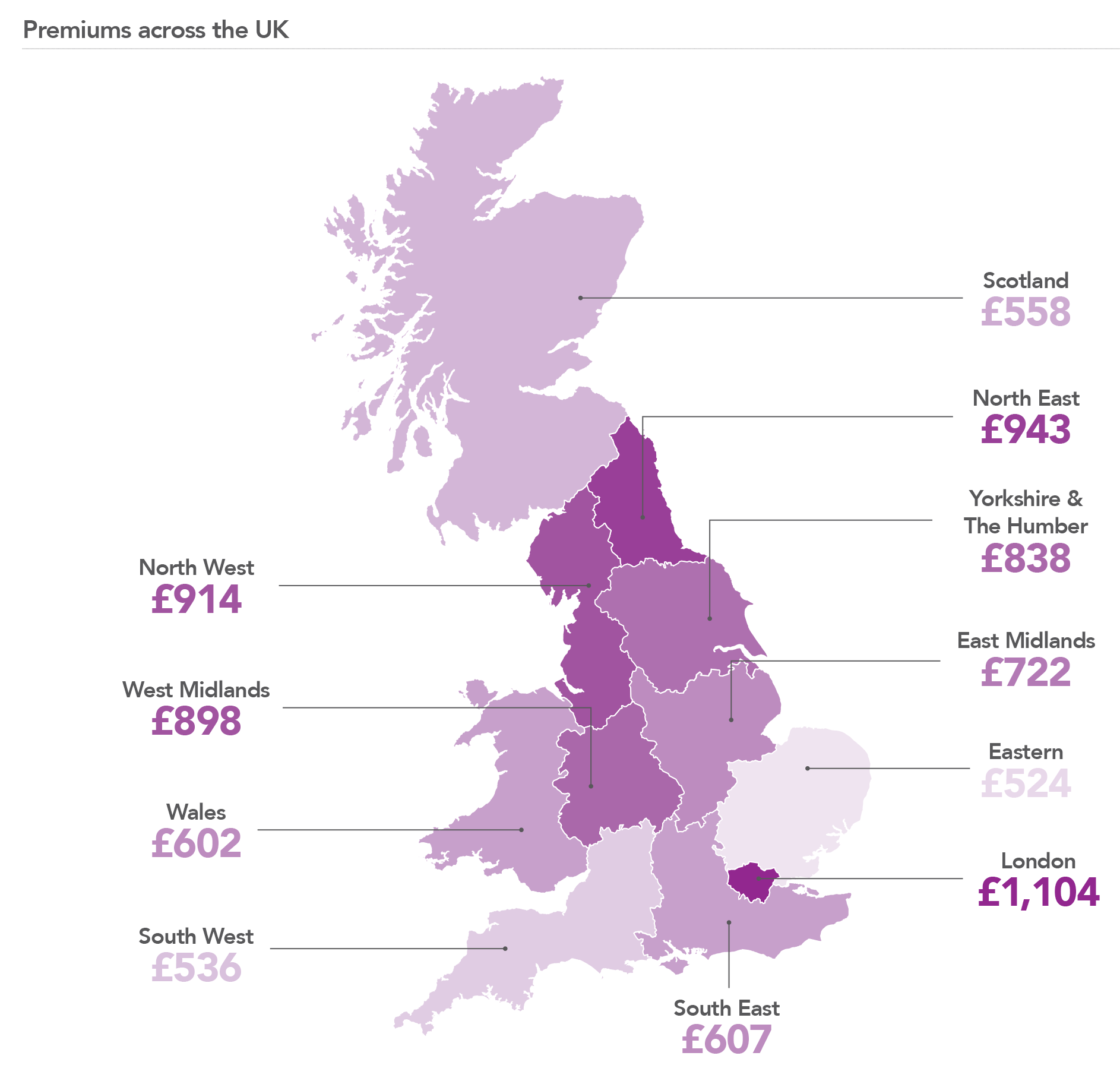

The table below shows the average premiums across the country. Over the past 12 months, all regions have witnessed premium reductions – ranging from -4.3% in London to -9.5% in the East Midlands. However, over the last quarter, it’s London (0.7%), the South East (0.9%), Wales (0.7%) and the North West (0.1%) that are all showing signs of an uptick in car insurance prices. The rest of the country, meanwhile, continues to see dwindling premiums – the largest faller in the last three months being the Eastern region (-2.0%).

Insight that will enable you to optimise your pricing strategy

Download our Car Insurance Price Index to gain insight into market movements, benchmark the major van insurance brands and help you understand the data behind the results.

Ends

Notes to Editors

1The cheapest premiums were calculated by comparing the prices offered for 3,600 people by all the major Price Comparison Sites and key direct insurers. The top 5 prices for each person were compared to the previous month’s top 5, then these variations averaged to produce the index.

For further information, please contact:

Consumer Intelligence

Catherine Carey

PR & Communications Manager

07823 790453

Citigate Dewe Rogerson

Kevan Reilly / Jonathan Flint

020 7638 9571

About Consumer Intelligence

Consumer Intelligence conducts consumer surveys and benchmarks price and service performance providing unique insights into competitor pricing and customer experiences, their attitudes, opinions and behaviours. For more information, visit the web site www.consumerintelligence.com

Post a comment...

Submit a comment