The FCA’s proposals to ban price walking look set to usher in the most radical shake up of the home and car insurance market to date.

The FCA believes the new rules, which it intends to publish next year, will save consumers £3.7 billion over 10 years. But from a consumer point of view, this won’t always translate into more money saved for everybody. Nor will it necessarily change consumer behaviour from the beginning.

Here are five of our predictions and the data behind them.

1. Prices will go up

It may not feel immediately to consumers that the FCA’s ban on dual pricing or was a move in their support.

Almost certainly new customers will see prices rising across the market as brands seek to close the gap between their low introductory offers, which the FCA itself describes as “unsustainably low” and the renewal premiums that pay for them.

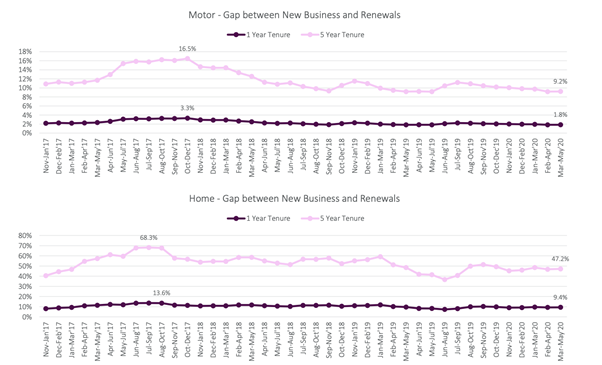

It will be more keenly felt by home insurance customers. Currently those renewing pay 9.4% more in the second year, whereas in motor insurance the average uplift in year two is 1.8%.

Brands have already begun work to close the gap between renewal prices for longer tenure customers, but the data shows that home customers renewing for a fifth year will pay around 47% more than new business customers.

Redressing that balance is going to be the very real work of the next 12 months, as brands work to the Q3 2021 implementation date anticipated by the FCA.

But with the back door firmly closed for making up the revenue difference with add-ons or premium finance – also subject to the new rules – there’s no guarantee brands will be able to take renewal prices down very far to match those unsustainable new business prices.

2. People will still shop around

It may seem logical that enforcing better deals at renewal would automatically stop people from having to shop around - but that’s not quite how consumers have responded so far.

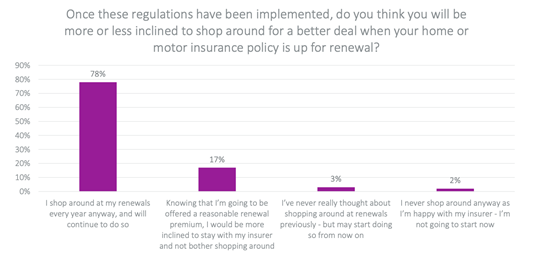

When we asked people if the new regulations would make them more or less inclined to shop around for a better deal, 78% said they shopped around anyway, and would continue to do so. It’s a habit that most consumers have got used to. And it means the barrier to entry for new entrants could be lower, as the number of potential new customers remains high at the same time that large incumbents lose the ability to subsidise new business prices with higher margin back books.

Only 17% said that knowing they were going to be offered a reasonable premium meant they would be more inclined to stay with their insurer.

3. Price comparison sites will evolve

Gloomy predictions that universal pricing rules will mean the demise of the PCWs is somewhat premature, it seems. The insurance industry has very much trained people to shop around, and that attitude is unlikely to shift very far or very fast.

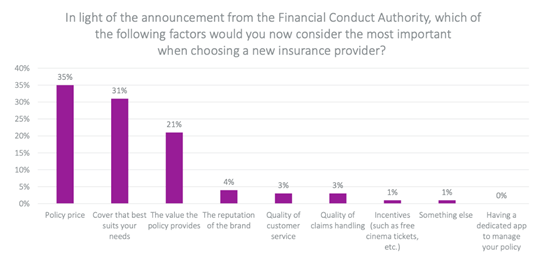

But what they are looking for on their shopping journey may shift. In light of the new announcement, 35% of people said policy price would still be the most important factor in their decision making, but it’s closely followed by 31% citing the cover that suits them best, and 21% the value the policy provides.

This gives price comparison sites a mandate to evolve. They are likely to become CWs – comparison websites. How they assess and rank value is now open to interpretation, and innovation.

4. Brand will grow in importance

Only 4% of people said they considered the reputation of a brand in their decision making when choosing a new insurance provider, but that may be on the cusp of a change.

Insurance was never all about price – or the cheapest policy would just win out every time, and that has never been the case. There has always been an element of value and trust, and those are likely to be the vectors on which brands will now find themselves competing more fiercely. And that makes brand more important than ever.

In the midst of the chaos the FCA dual pricing ban will likely cause in the operational and strategic models of many organisations, insurers and brokers should also be taking the time to ask themselves what they stand for, what their unique selling points are, how and why they are different, and how they can build that into - and convey it through - their brand identity.

5. The industry's reputation will improve

With the best will in the world, insurance does not have the best reputation with its consumers. Covid has been yet another nail in the coffin, with brands criticised for their poor messaging, poor service, and of course the poor coverage now infamously provided by Business Interruption policies.

The best that can be said from our recent surveys is that other industries have fared even worse, meaning insurance is not quite the bottom of the consumer-trust pack, through no merit of its own.

However, there is little doubt that the FCA’s historic ruling has very much scraped the slate clean. There is no room for sleight of hand, especially with the move to require ongoing reporting from a senior manager on the outcomes as well as the implementation of the new rules.

Insurance is being forced to clean up its act in no uncertain terms. Being on the front foot in doing so is going to win long term customer confidence, and long term profitability. Insurance will be what it was always supposed to be – a contract of Trust.

Benchmark your add-on pricing strategy against the leading insurers

The insurance add-ons market is a rich source of income for the UK motor insurance industry, but with changing regulations, differing consumer behaviour and a wide range of insurer strategies at play, it is becoming increasingly difficult for insurers to determine the best approach to market for add-on policies.

For further information, please contact:

Consumer Intelligence

Catherine Carey

PR & Communications Manager

07823 790453

About Consumer Intelligence

Consumer Intelligence is data analytics company that helps businesses execute great customer strategies. For 16 years the company has been benchmarking the insurance market and retail banks in the UK and beyond. The unique combination of benchmark data, consumer research and extensive experience has helped some of the world’s major brands focus on delivering better services to customers and improving their own business performance as a result. For more information, visit the website www.consumerintelligence.com

Comment . . .

Submit a comment