The protection of financially vulnerable customers is squarely in the FCA’s sights. On Tuesday it launched a consultation on proposed guidance for firms on how treating these customers fairly should work in practice, from policy design through to special assistance phone lines.

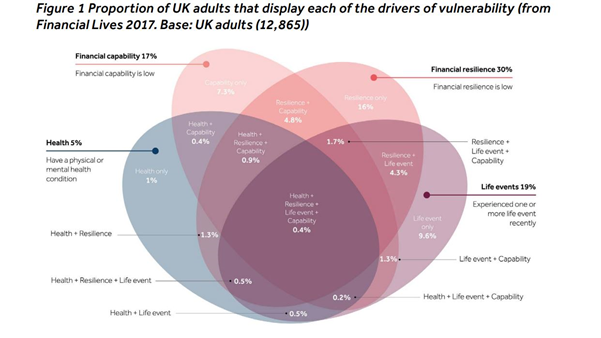

The FCA highlights several characteristics that indicate potential vulnerability in financial services. Many overlap, some come and go. But it is clearly that the types of customers most likely to be vulnerable come from many places. Some of the group which the FCA flags as vulnerable are also protected against indirect discrimination by the Equalities Act. These include customers aged 18-24 and those aged over 65.

Source: FCA

So, what does all of this mean to insurers and the senior managers who work there?

In simple terms, the insurance industry has lagged other financial services markets when it comes to thinking about price and vulnerable customers. Essentially, when the Insurance industry thinks about price it, thinks about the people it wants to attract.

The draft guidance is targeted at all firms the FCA regulates but parts of it will make for uncomfortable reading for many insurance compliance departments and boards as they must consider how policy design and implementation could harm those groups of customers specifically.

Take this passage, for example, on product design:

Firms should understand whether specific vulnerabilities are more prevalent in their target markets, or if their customers have a higher propensity for certain drivers of vulnerability.

So how do those vulnerable groups demonstrate different behaviour when buying insurance?

Our Insurance Behaviour Tracker (IBT), which includes customer market segmentation, shows statistically significant changes in how those potentially vulnerable groups buy insurance.

Shopping around and borrowing money

The FCA has been clear during the dual pricing clamp down that it is concerned that loyalty by the longest-standing customers is penalised.

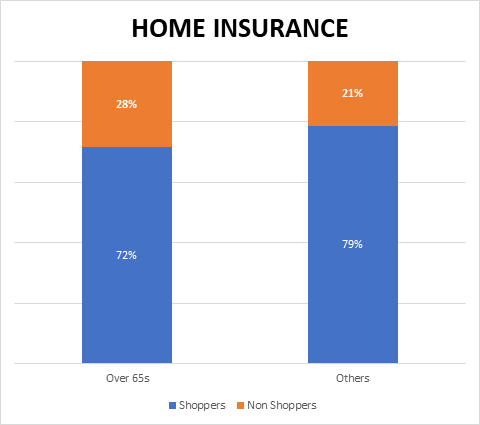

Data from IBT reveals that customers aged over 65 are seven percentage points less likely to shop around at renewal than the general population. For motor it’s 5 points.

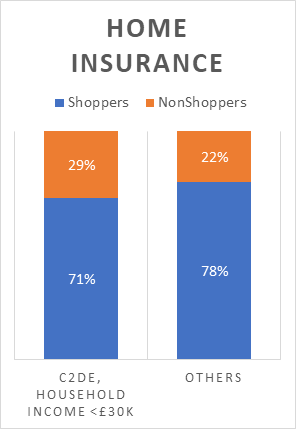

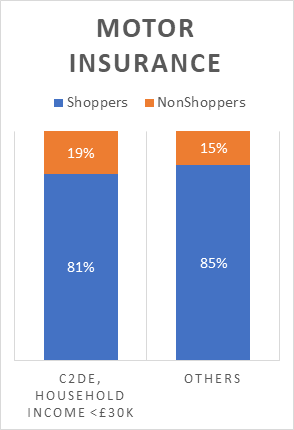

It also shows that customers with vulnerability due to low financial resilience, which we have defined here as those from socio-economic group C2DE with a total household income of under £30k, are less likely to shop around.

Conversely, younger customers – another group which the FCA flags for potential vulnerability – are unaffected and are more likely to shop around at renewal.

Propensity for home insurance customers to shop around at renewal

* Figures based on 20,000 customer renewals in the last 12 months. Consumer Intelligence Insurance Behaviour Tracker.

The differences in age are switched when it comes to paying in instalments, demonstrating that distinct vulnerable groups have different needs.

Paying in instalments is a choice open to all who want to spread their payments. But as our instalment costs research has shown, the cost of doing so can be quite high, especially via insurance brokers.

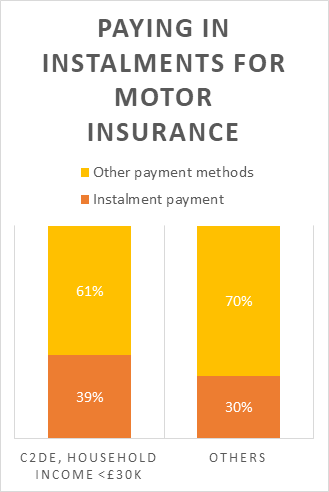

It stands to reason that drivers with a household income under £30k are more likely to pay for car insurance in this way.

And our data shows by just how much: 39% of C2DE drivers with a low household income pay for insurance in instalments, compared to 30% of the general population.

Firms here must give thought (and evidence of thought) to whether the variable cost of credit offered by many isn’t unfairly ratcheted up for customers who can’t afford to pay in one lump sum and balance this with the risky provision of a loan to a customer which may default on payment.

And firms that make vulnerable customers a core part of their business model and target either those less likely to shop around or those most likely to pay in instalments must pay particularly attention to product design and outcome.

Understanding Insurance Consumer Attitudes

Download our guide to learn how research allows you to hear first-hand from those customers what they think, need and do. Beyond the ‘what’, we can help you uncover the ‘why’ and the ‘what next’. Research opens a dialogue with consumers enabling you to continue to delight those who buy from you, and those who don’t but will in the future – which ultimately determines success, resilience and growth.

Comment . . .

Comments (1)