There has been an injection of new brands in the traditionally staid home insurance market this year.

Getsafe launched buildings and contents in April, joining fellow Urban Jungle in extending from contents only insurance for renters to targeting first time (and other) buyers.

And make no mistake, these new brands are highly competitive. As we showed earlier in the year, Getsafe was behind over a third of R1 quotes on MoneySuperMarket in its first full month trading.

It all means that habitual price comparison website users will likely be presented with a different leader board when they shop around at renewal.

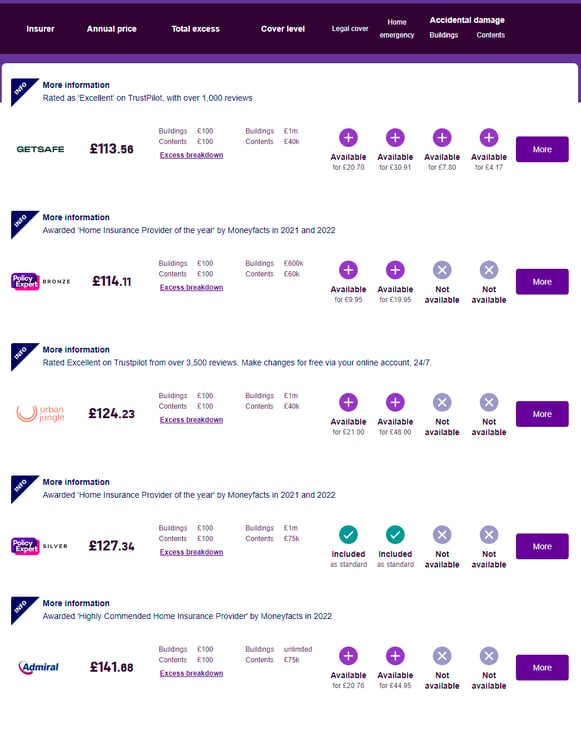

So our research and consumer insights team put it all to the test, showing a panel of 789 consumers a real results screen and asking which brands they would choose at renewal, and why. They were asked to assume that the cover is the same for all policies shown.

Here are the key results:

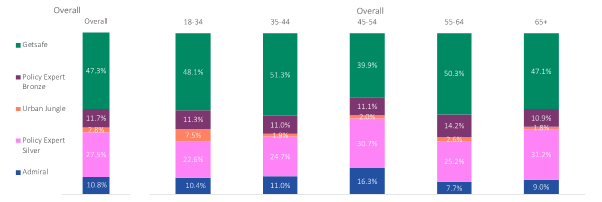

Assuming that the cover is the same for all the policies shown, which would you choose?

Price matters…

The headline is nearly half (47%) would choose Getsafe when it was in Rank 1 position, indicating a substantial ability to convert those prices into customers.

However, the comments given by consumers and differences between age groups underscore that choosing insurance has more to it than price.

… but it’s not the only show in town

When we asked those who chose Getsafe for their reasoning, 38% mentioned “cheap” or “cheapest” and 3% “best price”.

But the flexibility of cover was another big draw. As many as 16% cited the ability to add accidental damage cover when asked for verbatim comments about why they chose Getsafe. Of the top 5 brands, this was something that only Getsafe offered.

Getsafe:

Why would you choose this policy over the others?

“It was the cheapest and offers flexibility with the added extras”

“Because although I may not use them all the options are available whereas they aren't on the other providers”

Brand and ratings matter to younger buyers

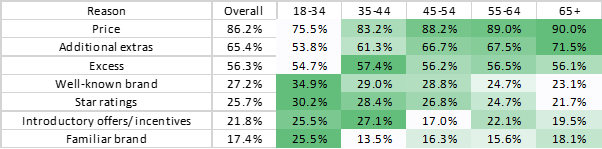

We also asked the panellists to choose the three most important factors when comparing home insurance policies and deciding what to buy.

The answers showed that younger, less experienced customers, were more swayed by star ratings such as Trustpilot and Defaqto and spotting a familiar brand.

This is good news for Urban Jungle, which did particularly well with 18-34 year-olds. Some 7.5% of this younger age group said they would choose them over Getsafe, which was £10.65 cheaper.

Originally a contents-only brand, they may be recognised more by this age group who have used them in rentals. Comments also noted the high number of Urban Jungle’s Trustpilot reviews and the ability to make free online changes.

Urban Jungle:

Why would you choose this policy over the others?

“Free online changes; 3500 excellent reviews. Not much more expensive than other providers.”

Older customers want add-ons

Twice as many people choose fourth place Policy Expert Silver – the only T5 policy to include legal cover and home emergency as standard – over second-cheapest Policy Expert Bronze.

And almost a third of homeowners aged 65+ opted for Policy Expert Silver, compared with 22% of 18-34-year-olds.

Many of the comments noted that these additional covers seemed like good value, while others believed they were offered “for free”.

Those who liked Policy Expert Bronze appreciated that the optional add-ons were much cheaper than Getsafe’s, and brand strength also persuaded them to scroll down.

Policy Expert Bronze:

“It's almost as cheap as the first but the add-ons are cheaper so I might consider having the legal assistance.”

“Know the firm & liked them before when had a policy”

Policy Expert Silver:

“Well respected company includes legal expenses and home breakdown cover and low excess charges.”

“Good coverage plus extras I consider necessary”

Brand values

Admiral, in this example, didn’t offer much extra by way of additional cover, and its fifth placed quote was £28.10 (or 25%) more than Getsafe.

What it did offer, however, was a nationally recognised brand with a strong reputation. And that was the draw for 11% of our panel. Of those who selected Admiral, 16% mentioned trust and reputation, while another 16% mentioned that Admiral was the only brand they had heard of.

A couple of consumers said they liked the certainty of unlimited rebuild value, something only Admiral offered as the others gave a limit.

Admiral:

“It's a well-known brand and it's not much more expensive than the others”

“I think the buildings cover is better as house prices can increase and this has no ceiling in comparison to the other options”

“It’s a name l am familiar with...”

It all shows that price plays a big role, but flexibility and trust matter to many. Insurance is, at the end of the day, a promise.

Track insurance pricing movements faster

Our insurance price benchmarking service will help you understand daily movements and enable you to quickly identify pricing changes you need to make.

Comment . . .

Submit a comment