Urban Jungle announced a £8m fundraise in June 2021 and with it, big ambitions to expand from renters insurance to buildings & contents.

Its origin is insurance for renters and house sharers including younger customers and those with low income who it believes are underserved. There are over 4 million private rented properties but only half their tenants have insurance – a much lower market penetration than homeowners who must buy buildings insurance as a condition of their mortgage.

In June it said it had 40,000 contents-only customers having doubled in size through the pandemic.

The average age of a first time buyer in the UK is now 34. Urban Jungle wants to keep its contents customers as they become homeowners and use its platform to win new ones too.

Its first TV campaign takes a pop at not just old school ‘man in suit’ insurance but also pseudo-insurtech offering ‘same old insurance with whizzy app’.

Founder and CEO Jimmy Williams commented: “We are looking to expand quickly into several new markets and to shake up the insurance industry. It’s still dominated by big names and I’m enjoying giving them a run for their money.”

Urban Jungle’s quote journey is notable for the questions it doesn’t ask. Nothing about roof materials, types of lock, age or occupation. It returns monthly payments in first instance and has a headlining offer of contents from £5 per month. There is no cost of credit for customers who prefer to pay annually. Adjustments and cancellations can be made online for free. That alone is a challenge to those who make a turn on premium finance and mid-term adjustment fees.

So how is it deploying its latest cash injection?

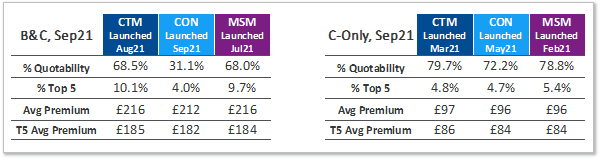

Buildings and contents, underwritten by Wakam, launched in July with a rollout to the largest Price Comparison Websites completed last month.

Our Market View tool shows the impact of its investment rollout on the competitive landscape of PCWs. As of September it achieved a Top 5 quote for 10% of risks on MoneySuperMarket and CompareTheMarket.

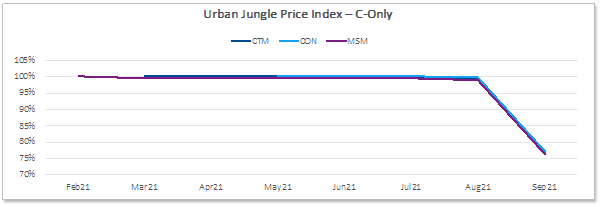

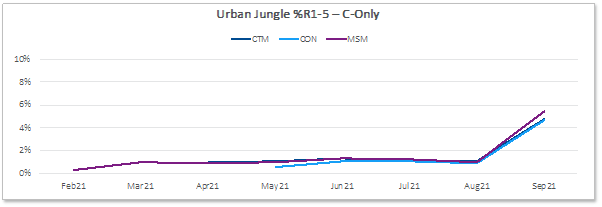

For contents-only policies, underwritten by Ageas, it cut new business prices by 20% in September, delivering it a top 5 position for around 5% of quotes.

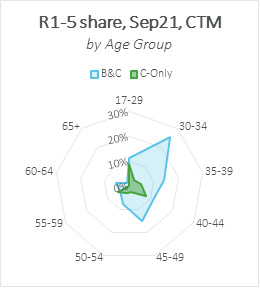

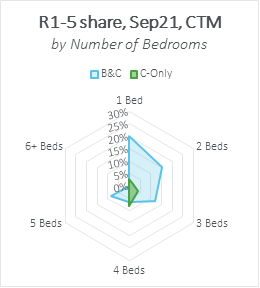

Urban Jungle’s competitive footprint is already much larger for combined B&C policies than contents-only. It is most competitive for 30-34 year olds, where it has a 26% share of top 5 quotes compared with 15% elsewhere. Viewed by number of bedrooms it wins most with one and two bedroom properties, returning 20% and 15% of rank 1-5 quotes respectively. It does not quote for six-bedroom properties. This all chimes with the first time buyers target.

For contents-only it is in the top five for 8.9% of 17-29 year olds and most competitive with 4 bedroom properties, indicating its contents-only pricing footprint stronger for house sharers than single occupants or renting couples.

That’s right now. Urban Jungle may cut prices again or expand its footprint. There are others targeting the same market too. Getsafe extended its Series B fundraising to $93 million just this month and has applied for its own licence in its German headquarters.

Claims is an area of difference here. Getsafe has an in-app claims guide. Urban Jungle’s claims journey is less whizzy than the sales process. As a broker Urban Jungle refers customers to their individual policy wordings, and advises they have their policy number to hand when calling.

With Policy Expert also cutting prices for larger properties and an opportunity for new entrants to price aggressively without the potential hindrance of a back book, we predict continued competition for home customers on all fronts.

Optimise your competitive position in a fast-moving market

Understanding and optimising your product mix, particularly in your competitive context, can make all the difference when it comes to winning new business. To learn more about our pricing insights, please click below.

Comment . . .

Submit a comment