Yesterday lunchtime, Boris Johnson led a minute silence to mark one year of Covid lockdowns and remember the 126,127 people who have died during the crisis.

As the nation entered the first lockdown on 23 March 2020, there was no predicting what was to come. “It’ll be over and done with in a few months”, people said. No one expected we would still be in lockdown 12 months later.

Amid the uncertainty and anxiety of the first lockdown, we at Consumer Intelligence developed the COVID Consumer Behaviour Tracker – a survey launched on the very day we were locked down that would enable us to track changing consumer behaviour and attitudes over time as we traversed the pandemic and the fluctuating restrictions that came with it.

Over the last year, we have tracked everything from changes to working patterns and consumers’ concerns over financial security, to the perception of the insurance industry’s response to the pandemic and renewal behaviour changes. The resulting data has shown some aspects of consumer behaviour stay consistent throughout the pandemic, such as expectations of post-lockdown driving habits and requirements of new home and motor insurance policies. Whereas other factors, such as consumer anxiety levels, have been more fluid.

Ian Hughes, CEO of Consumer Intelligence says “The COVID tracker has been invaluable in helping us to understand the context around changes in shopping, switching, and buying behaviour when it comes to home and motor insurance. It has also played an important part in identifying where the industry needs to step up to meet changing consumer needs.”

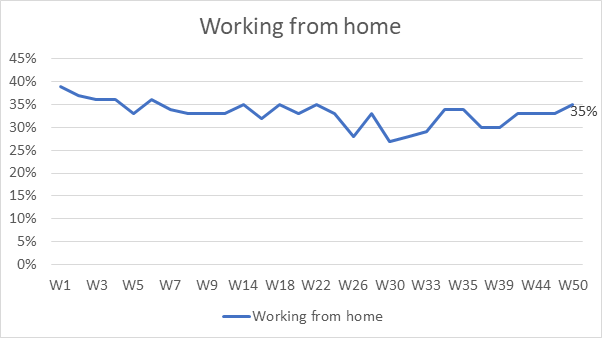

Transition to working from home

The biggest change that we have seen as a result of the pandemic is the shift to home working. This has been a steep learning curve for both employers and employees. Our latest data shows that the proportion of people working from home has settled at 35%. When asked how they expect their working patterns to continue after lockdown if lifted, 13% say they will continue to work from home all the time and a further 29% say they will work from home more than they used to.

Consumers under financial pressure

Since the start of the pandemic, 18% of people have had their work hours reduced, 14% have had their salary reduced and 7% have been laid off or lost work. Unsurprisingly, this has resulted in increased financial pressure among consumers, with 11% very concerned about the financial security and 9% very concerned about affording necessary outgoings. All of these figures have increased since the survey began.

Spike in vulnerability

In March 2019, we asked consumers whether they self-identify as vulnerable, as per the FCA definition. At that time, 13% said they did. In March 2020, we repeated the same survey, and the figure had doubled. 26% said they self-identified as vulnerable. That figure has slowly lessened over the course of the pandemic, however, remains elevated at 16%.

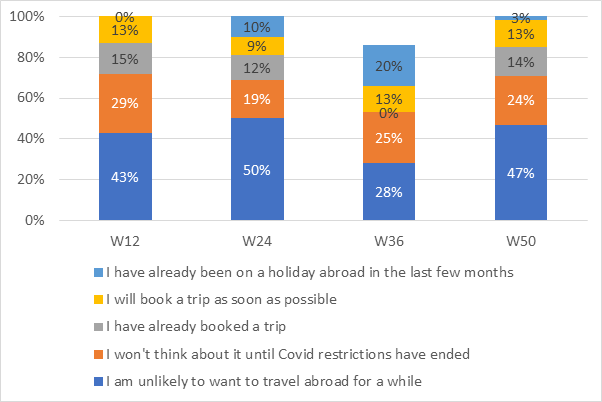

Travel industry misery

According to Travel Weekly, 2020 was widely predicted as a year of growth for the travel industry. Instead, it became one of the most severely impacted industries, with thousands of airline staff laid off, planes grounded, and cruise ships stranded.

Typically, Brits love an annual holiday abroad. But for many, travelling outside of the UK became a thing of the past in 2020. The impact of Covid-19 has also had a huge impact on consumer confidence when it comes to travel. Three months after we first went into lockdown, 43% of people said they were unlikely to want to travel abroad for a while and a further 29% said they wouldn’t think about travelling until Covid restrictions had ended. The picture doesn’t look much more promising today, with 47% still unlikely to want to travel.

Coming out of lockdown

Finally, after a gloomy 12 months, there is a glimmer of light at the end of the tunnel. The government has laid out its roadmap for taking us out of lockdown, returning us to something close to the life we once knew. But of course, some of the adaptations we have made to the way we live over the last year may well be here to stay. At Consumer Intelligence, we plan to continue to monitor changing consumer behaviour over the coming months to help the insurance industry understand where opportunity exists to meet changing consumer needs and expectations.

You call the shots for our latest COVID-19 tracker

Our COVID-19 consumer behaviour tracker is back, and we want you to call the shots. To make sure we’re tracking the things that you care about, we're taking suggestions from you. And if your question is included, you'll receive the data and insights it generates for free!

Comment . . .

Submit a comment