Personal lines brokers have attracted substantial Private Equity investment in recent years, with strategies to add scale and breadth across product types showing no sign of Covid-related or recessionary downturn.

Atlanta, the retail arm of the Ardonagh Group backed by Madison Dearborn Partners and HPS Investment Partners, has become a multi-brand, multi-product £266 million turnover business since adding Carole Nash, Swinton and others to Autonet.

Howden Group acquired A-Plan in March 2021 to add retail personal lines and SME to an advisory and specialty business, with vendor Hg Capital going on to invest in the enlarged entity together with long-term backers CDPQ and General Atlantic. And Markerstudy, which is backed by Pollen Street Capital and Qatar Insurance Company, kicked off the year with the acquisition of BGL Insurance.

All in all, we’re seeing personal lines brokers and MGAs getting bigger, gathering up niches and brands, spreading their footprints, and extending their propositions.

But how have the new additions to their families settled in? Have they changed their New Business Acquisition strategies? And will these emerging powerhouses start to build flagship brands and PCW presence that ultimately challenge large direct players?

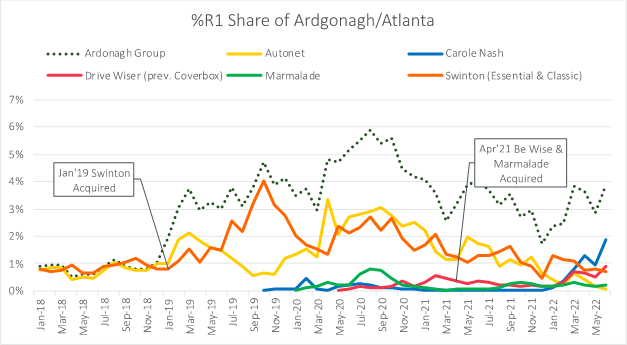

Ardonagh/Atlanta

The Ardonagh Group’s personal lines brands are grouped underneath Atlanta. In the motor market, that includes Autonet, Swinton, Carole Nash, and the more recent additions of Drive Wiser, Be Wiser and Marmalade.

Ardonagh’s launch presence in personal lines was Autonet in 2017, with Carole Nash following in 2018. Ardonagh/Atlanta acquired Swinton in January 2019 from Covéa and it quickly gained more R1 share. Since then, they’ve pushed Carole Nash, a brand best known for motorbikes, ahead of Swinton and Autonet for private car pricing.

But not everything is a PCW play. The acquisitions of Be Wiser and young driver brand Marmalade have had minimal impact on R1 share are more likely to be serving niches through other distribution channels.

Motor

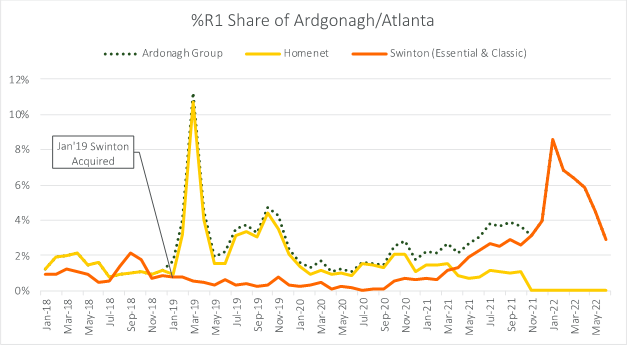

In Home, Homenet, a spinoff of the Autonet brand, was phased out in late 2021 before stopping quoting entirely in November 21. Swinton came to the fore in 2021. Into 2022, Swinton has become more competitive than ever under Atlanta’s ownership, aided by new panel members which helped the performance of its tiered products.

Home

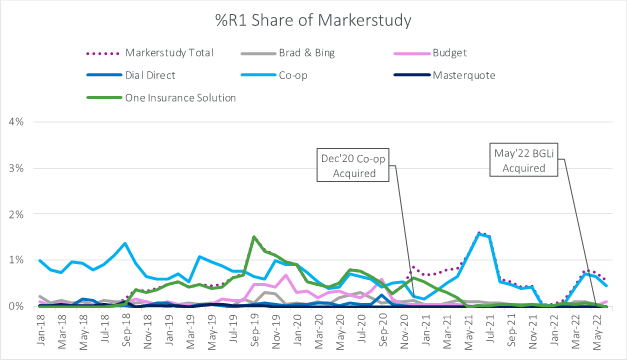

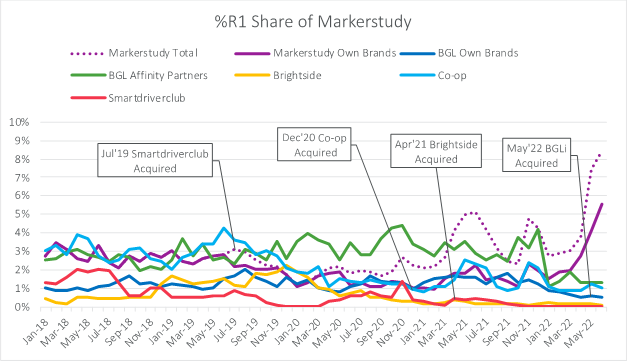

Markerstudy

Managing General Agent Markerstudy has built a relatively strong presence in the motor PCW market, especially in 2021 when it invested in Co-op Insurance and became its motor and home underwriter through an affinity partnership.

A significant proportion of its aggregated R1 share remains through broker partnerships, while its own brands, Zenith and Geoffrey, have performed particularly strongly since the start of the year.

The acquisition of BGLi, which completed in May, will add further strength in motor.

Home is slightly different story for Markerstudy. Co-op was its first big step away from motor, with a solid brand offering with mass market potential. However it’s had limited competitive success since Markerstudy took over the distribution and post GIPP implementation. Markerstudy’s performance has been stronger via its presence on Swinton’s panel with capacity from Accredited.

While home seems in its infancy right now, it could become a real growth engine for Markerstudy in coming years if the business can seize the opportunity thrown up by GIPP and the adjustment of new business market prices as it appears to have done in motor.

Motor

Home

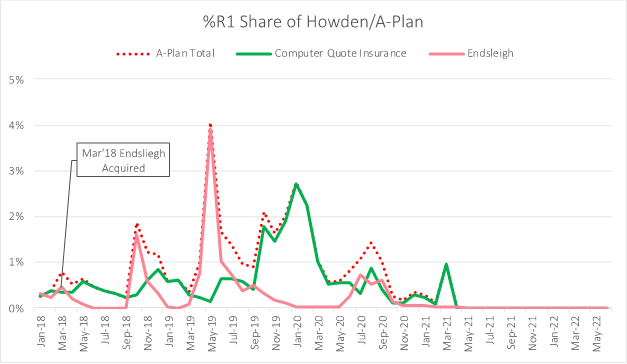

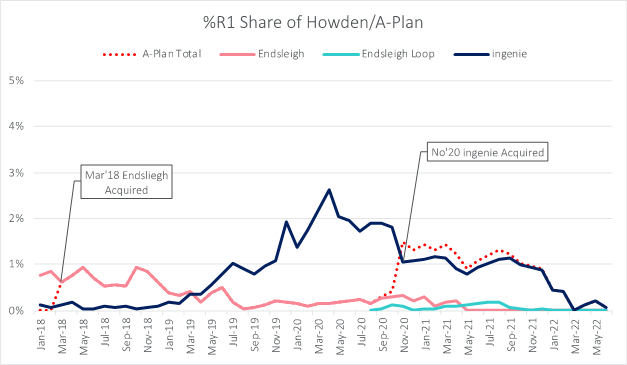

Howden/A-Plan

Howden and A Plan’s PCW presence is minimal at present. Endsleigh, a brand targeted at students which would have been especially impacted by lockdown, has been withdrawn almost entirely, with only the telematics ‘Loop’ offering and ingenie still active in the motor PCW market.

Even with its MGA brands KGM and Eridge on third party broker panels, competitive presence is relatively small. The strategy at present seems focused on niche customer segments and traditional distribution channels like phone and its high street branch network.

Motor

Home

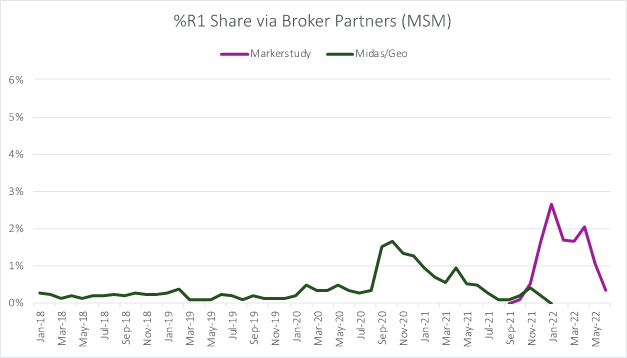

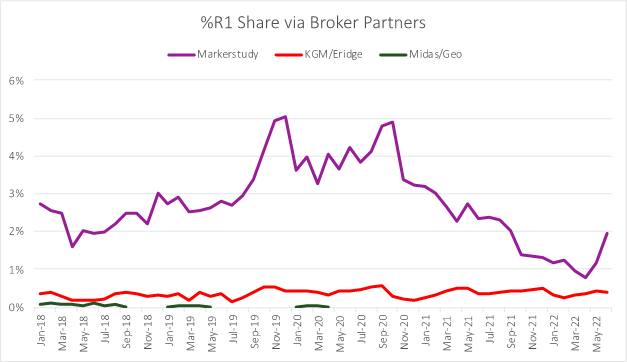

MGA competitiveness on broker panels

Motor

Home

Consolidation will continue to draw in smaller propositions and brands. How well they come together with a united strategy and operational model is in the gift of the acquirers. They have the potential to change the shape of the personal lines market and challenge its current direct writer leaders.

We could find that their broader and more flexible risk appetites and range of capacity arrangements give them an edge in the longer term – especially as consumers look for niche, bespoke or alternative cover as the cost of living starts to bite.

Optimise your competitive position in a fast-moving market

Understanding and optimising your product mix, particularly in your competitive context, can make all the difference when it comes to winning new business. To learn more about our pricing insights, please click below.

Comment . . .

Submit a comment