Markerstudy kicked off the year with the announcement that it would acquire BGL Insurance (BGLi) from BGL Group (its price comparison business remains where it is).

The deal is subject to completion and regulatory approval, so we won’t see any changes in how the brands managed by each perform yet.

Nonetheless it is interesting to step back and look at what each brings the table in terms of brand presence.

BGLi has 2.9 million customers and £208 million of brokerage and fee income from its distribution and outsourcing activities, according to its latest accounts, filed for the year to 30 June 2021. Announcing the acquisition, Markerstudy said the combined business would have six million customers. Indeed according to our Insurance Behaviour Tracker tool, a combination of all BGLi and Markerstudy brands gives a c.8% share of car insurance customers – on a par with the lines of LV= or Admiral.

BGLi administers car policies for a number of big affinity brands, including Halifax, Lloyds Bank, RAC, and M&S Bank, with the policies underwritten by a panel of insurers. Growing its presence on those panels may be part of the attraction for Markerstudy, one of the UK’s largest personal lines managing general agents.

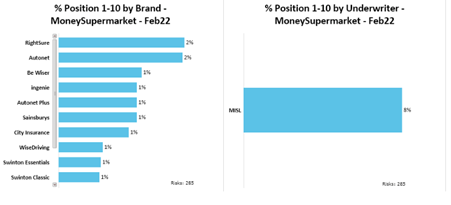

Our Market View tool shows its most competitive panel positions do not currently overlap with BGL brands.

It also already works closely with Markerstudy as the administrator of many of Markerstudy’s direct brands such as Geoffrey and their digital claims support and will own more of its supply chain and customer touch points upon completion.

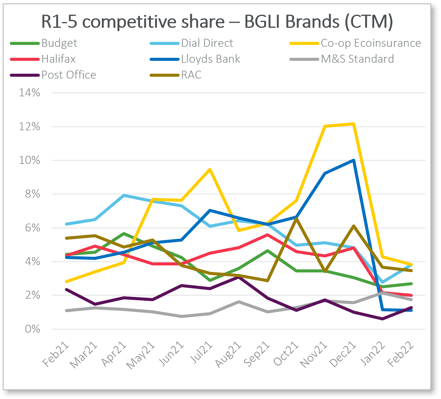

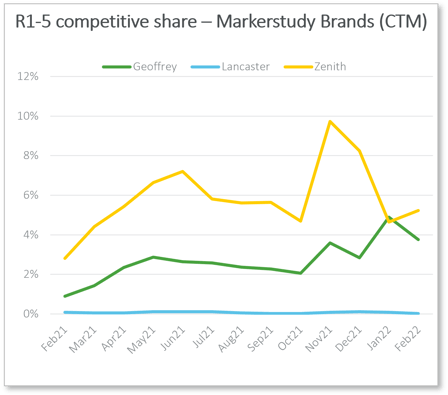

Looking at the motor brands administered by BGL, a GIPP-induced reduction in competitive share is clear. On the other hand, Markerstudy’s Geoffrey and Zenith brands delivered a higher number of R1-5 quotes in February 2022 than a year ago.

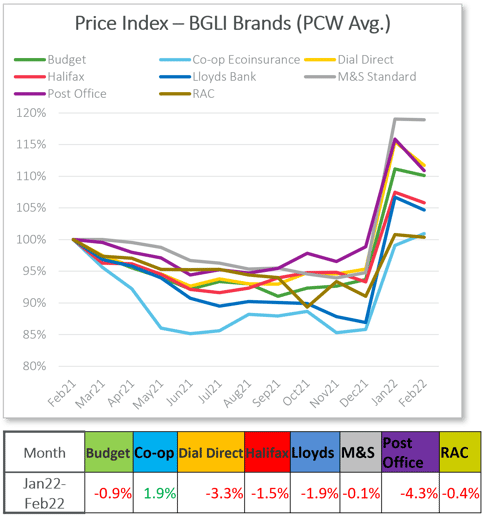

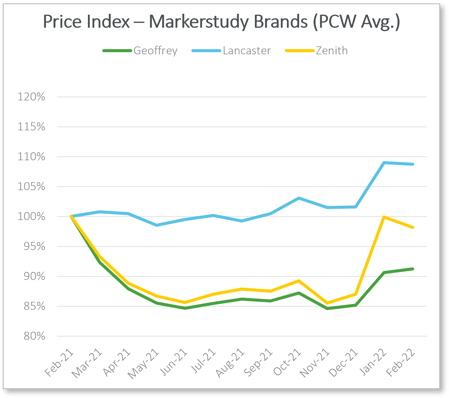

Behind this decline in new business competitive market share were big January price rises across BGL-administered brands, following reductions over the course of 2021. We have seen a degree of correction in these in February, with the majority of brands implementing small or medium price reductions compared with January.

At the same time, Markerstudy’s own brands jumped by less, with both Geoffrey and Zenith keeping average new business quotes lower than they were 12 months ago.

|

Month |

Geoffrey |

Lancaster |

Zenith |

|

Jan22-Feb22 |

0.7% |

-0.2% |

-1.7% |

With some clear shared areas of expertise in administering policies, different pricing strategies for different customer segments and contracts with some top-tier affinity brands, this deal changes the landscape of the intermediary market. That landscape is of course itself changing, with ongoing challenges presented by restricted new car supplies, rising fuel costs, change in commuting patterns and inflation. Markerstudy, backed by Qatar Re, will likely want to move quickly upon completion to make the most of the opportunities and synergies presented by this deal.

It is highly likely that more deals will follow throughout the course of the year as the impact of the FCA’s changes continue to shape the future of the market.

Become more agile. Tap into daily insurance price benchmarking data.

Our insurance price benchmarking service will help you understand the daily movements of your competitors and help you to quickly identify pricing changes you need to make.

Comment . . .

Submit a comment