There’s little doubt that these are hard times in a soft market for motor insurance brands.

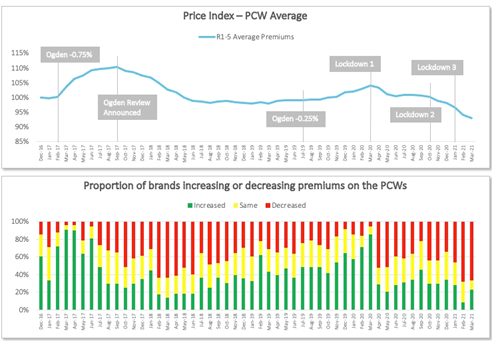

We’ve seen the market contract and prices drop faster than at any time in the last four years, under any external influences - including the Ogden rate change and the first two national lockdowns.

Two thirds of brands are decreasing premiums on PCWs right now, in what feels a bit like a race to the bottom. Of course it’s rather more complicated than that. Insurers have been under enormous pressure to pass on savings from fewer claims, pressure from the FCA in the move to ban price walking at renewal and enforce fair value trading, and pressure from the wider post-Covid economic downturn, trying to predict and respond to changing consumer behaviours and driving habits.

At Consumer Intelligence, we’re seeing a range of strategies in response to these circumstances and behind these price drops, and we’ve profiled four distinct groups and patterns of insurer behaviour: the cats, pigs, sheep and ferrets.

So which one are you?

Cats

Pick your battles

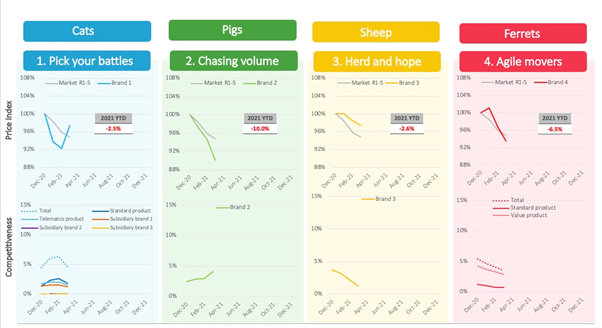

The Cats are confident that they’re in the right price position, they know how to win and when to win, and they’re prepared to curl up and tuck their feet neatly underneath them and wait it out rather than trade their way through the changes. Volumes and overall market price aren’t going to impact them; they’re going to follow their strategy, and pick their battles when they need to.

In blue we can see a real Cat brand as an example, and the interrelationship between pricing movement and competitive share. This kitty has gone strongly into the new year with large price decreases and a corresponding lift in their competitive position. Hitting the end of the quarter they’re clearly happy with what they’ve caught, they’ve hit targets, and they’re going to relax, have a wash and a nap, and not try and follow the market any further.

Pigs

Chasing volume

The Pigs are hungry, they want to get bigger – and they’ll eat pretty much anything. They’re chasing volume right now and getting as much business in before more change hits – for instance the FCA’s pricing practices guidance later this year.

In green we can see a group that’s seen an opportunity and really gone for it in March, dropped prices, and got it right – reflected in their competitive position.

The thing about Pigs is that they’re clever, and they can also snuffle out truffles… They’re the ones getting their snouts into new markets and meeting new and changing demand first. We’ve seen a whole slew of investments in the market, from new players and established brands with expander propositions introducing things like usage based and basic or essential products.

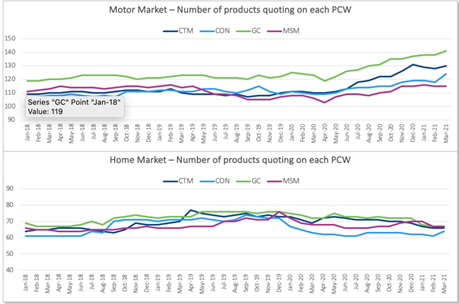

As a result, we’ve also seen an increase in the number brands appearing PCWs that just isn’t part of the picture in the home insurance space.

Sheep

Herd and hope

The sheep are following what everyone else does, and doing the same. They’re certainly not stupid, because there’s certainly safety in the flock, even if by definition you’re always going to be slightly behind the curve of change. They’ve seen the rates drop out of the market, they’ve seen their conversions fall away, and now they’re weathering further change by keeping pace with competitors and following the herd.

Our yellow brand isn’t sure about aggressive deflation but have had to preserve their position in the market - and are reluctantly doing what everyone else does in an attempt to ride it out.

Ferrets

Agile movers

The ferrets can turn on a sixpence and dart in a whole new direction in the blink of an eye. It’s a strategy that sees brands not going all the way into the market but thinking ahead, picking out areas of expertise and opportunity and following their noses smart and fast.

In the red corner we’ve got an insurer that’s clearly confident, and slightly ahead of the curve. They’re being aggressive on price but within their own competitive footprint, and are poised for changes. They’re participating in the market but without taking on too much competitive risk, watching and waiting with their whiskers twitching.

So who’s doing it right and who’s doing in wrong?

Well, no one.

There are so many unknowns in the market today, so many influences, and so much fluctuation day-to-day there’s no right and wrong - the best most brands can do is to just do YOU.

If there’s an animal to emulate at all it’s probably the chameleon, being adaptable enough to switch between strategies – and that’s something we’ve seen some brands do, moving from pig to sheep, ferret to cat.

What we do know is that the market won’t be soft forever – or even for the rest of this year. More change is around the corner, and ALL brands need to be ready for it.

To hear more about these strategy profiles and Consumer Intelligence’s predictions for the future of the market, watch the Hard times in a soft market webinar here, or contact us.

Catch up on all the great content you've missed

Did you know that we now have a webinar hub?

It's a central space on our website where you can browse the archive of Consumer Intelligence webinars, and access (for free) all of our past recordings, presentations, and additional media content.

Pinpoint the topics that matter to you and catch up on what you've missed, whenever suits you.

Submit a comment