The phone rings. Your heart sinks. Your pulse races. It’s either an emergency, a sales call, or you’re just going to have to talk to a real-life person.

Shudder.

If you’ve ever experienced that unexpected-conversation dread, you’re certainly not alone...

We’ve become so used to texting and emailing, that a phone call feels like a lot of effort - and even something of an imposition. And that’s changing how we’re interacting with brands.

The digital-first revolution

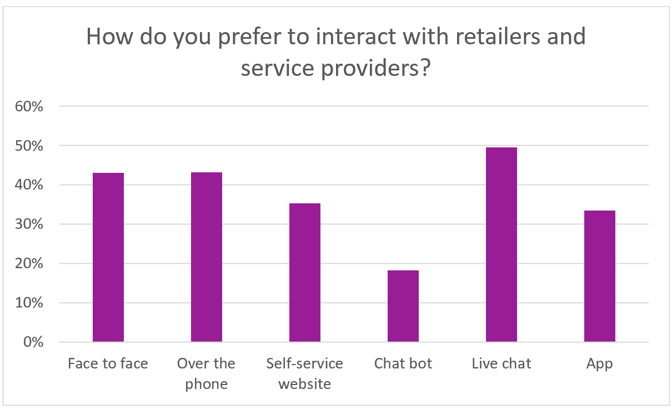

When we asked in a recent Viewsbank survey about preferred methods of contact from organisations, almost half of national representative survey preferred live chat text, while 35% preferred a self-service portal, 33% an app, and 18% a chat bot.

Slightly less than half ticked face to face or phone as preferences.

Viewsbank online survey conducted 24th to the 25th of Sept with 1,049 adults

Viewsbank online survey conducted 24th to the 25th of Sept with 1,049 adults

The overriding feeling towards digital technology was positive. Nearly 4 out of 10 people said they thought digital channels made it quick and easy to get what they wanted as a customer, and nearly 1 in 5 felt it put them in control.

Only 14% said digital technology made things harder or more complicated, and only 7% wanted to talk to a real person, rising to 14% of over 65-year-olds.

Online only insurance

General insurance has been relatively quick to pick up on consumer reluctance to talk to them in person, and we’ve seen a plethora of online-only insurance brands enter the market in 2022, with 1st Central Online, Esure Flex, Flow from LV and Abacai’s Boom the most recent examples of products that only allow policy amendments and management via a website or app.

Most online-only products have a greater percentage of T5 share and often greater quotability than other brands from the same group, suggesting they are a big focus for new business volumes and of growing importance as a multi-brand strategy.

| Online only product | Next group brand | |||

| T5 share | Quotability | T5 share | Quotability | |

| Brand 1 | 11.5% | 50.6% | 8.5% | 47.8% |

| Brand 2 | 7.6% | 44.5% | 7.9% | 44.2% |

| Brand 3 | 7.4% | 70.8% | 5.0% | 70.4% |

| Brand 4 | 5.4% | 57.7% | 2.9% | 57.6% |

| Brand 5 | 2.4% | 76.9% | 1.7% | 76.6% |

So far, the response from consumers to the digital-insurance age seems to be largely positive.

Most people say they’d be happy if their existing motor insurance provider turned online-only – nearly 1 in 4 would be ‘very happy’, and 41% happy. Only 8.5% were worried, and 5.4% very unhappy with the idea.

How happy would you be if your provider went online-only?

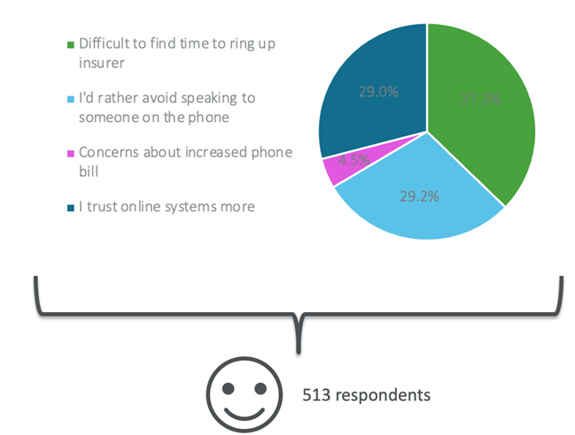

Some 29% of people who told us they were likely to buy an online-only product said they actively wanted to avoid the awfulness of talking to a stranger on the phone. 37% struggled to find time to make a phone call, and another 29% felt online channels were actually more trustworthy.

Digital pitfalls

It’s seemingly a win-win situation. People don’t want to talk in person - and it’s cheaper for brands to operate digitally.

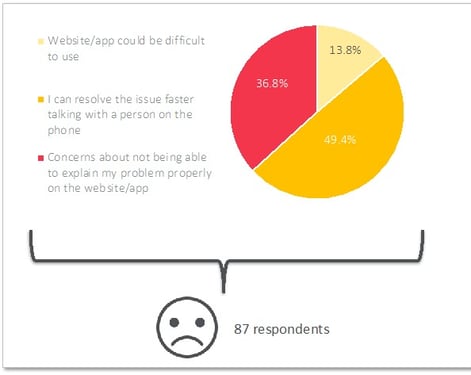

But there are still those disinclined to go digital, and they’ve got some pretty good reasons. Half thought they could resolve issues faster on the phone, 13% worried the website or app might be difficult to use - and 36% were worried they wouldn’t be able to explain problems clearly.

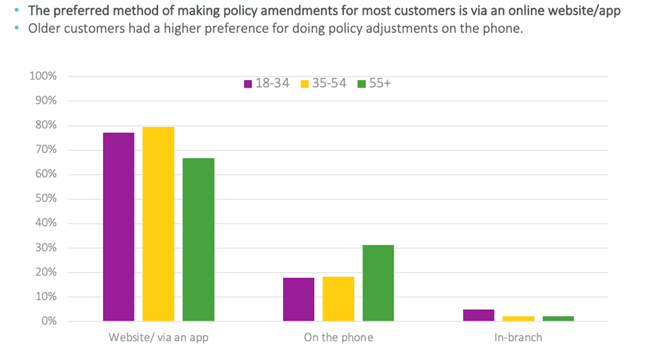

The future, then, may not be entirely one digital way… Tech-first clearly doesn’t work for all consumers – with older people in particular more likely to prefer non-tech methods of contact.

The complexity of the interaction seems to be something that can turn people away from digital channels. For instance, while nearly 70% of over 55s said they’d be happy to buy a policy online, 31% said they’d prefer to make a phone call to deal with something like a policy adjustment.

The claims clause

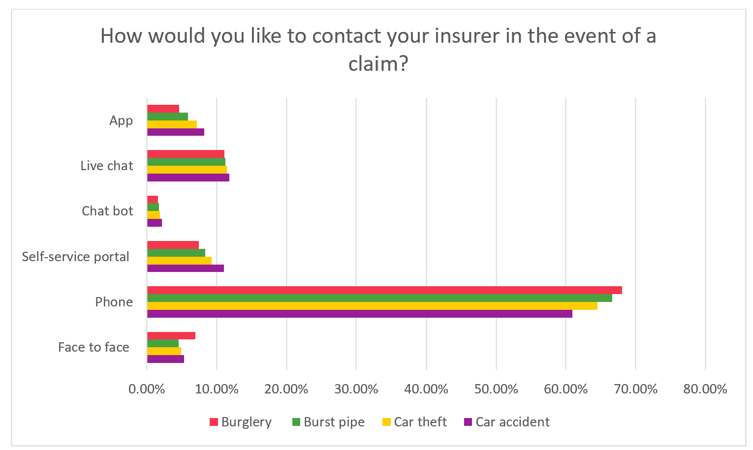

When it comes to the most high-stakes and complex of insurance interactions, a claim, people of all ages are more likely to want to talk directly to their insurer – with phone being the most popular choice.

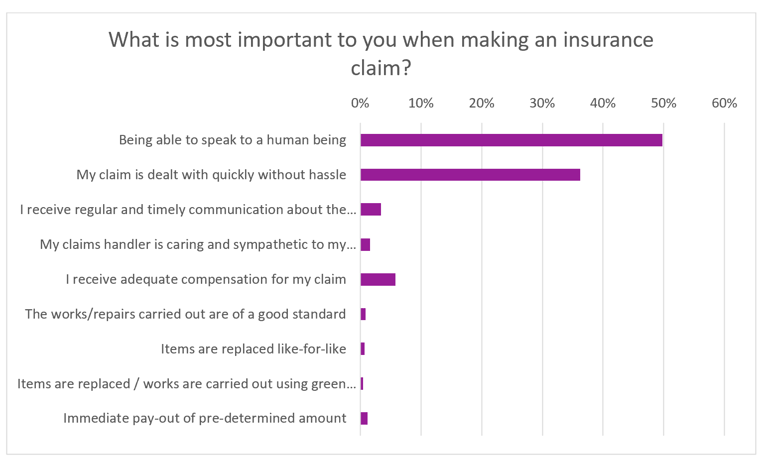

In fact, nearly half of consumers put the ability to talk to a real human being as the number one most important thing to them when it came to making a claim – even over receiving timely and adequate compensation.

Realistically, online-only sales and adjustments are part of the future.

But the brands wanting to win at it - and looking to grow brand strength, consumer trust, and customer retention on the way - will be the brands which are also looking for new ways to bridge the age gap, and fill the claims gap, too.

Viewsbank is our in-house consumer research panel. It’s a large, responsive and community driven panel that conducts both quantitative and qualitative research.

Our Viewsbank panel helps our customers with a wide variety of projects ranging from detailed mystery shopping to demographically targeted research surveys. The research helps our clients make informed decisions based on true understanding of the consumer’s voice.

Comment . . .

Submit a comment