-2.png?width=704&name=Untitled%20design%20(6)-2.png)

There’s no doubt that once the dust settles after the coronavirus pandemic the insurance market will look very different. Customers will have been changed by their experiences and how you compete for them will have to change too.

For a start, they may well be looking for more from their insurance company than just the cheapest premium. While the predicted recession will undoubtedly make people conscious of price, it’s also likely they will also be more wary of risk.

Many won’t be able to afford something big going wrong at home or with their vehicle. That might mean they look for more security in terms of quality of cover or even extra cover - like home emergency. Peace of mind will be more important than ever.

This means many customers, consciously or unconsciously, will be putting more weight in their trust of a brand when it comes to purchasing decisions. How insurance companies have engaged with customers – the user’s experience over this period – will be a factor in that trust for years to come.

Engagement begets engagement

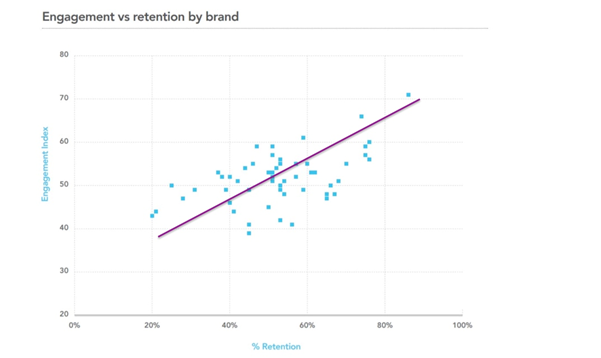

At Consumer Intelligence we proved back in 2018 the link between engagement levels and loyalty to a brand.

Put simply, the more you engage with a customer, the more engaged they are with your brand in return, and the less likely they are to leave you.

For insurers, the ultimate ‘engagement’ with a customer is of course a claim - and it’s true that those who have had a good claims experience are more likely to stay put. But even without a claim, the users’ experience of engaging with an organisation can and will influence trust, and retention.

The Six Ps of User Experience

So what can we learn about user experience from this period, and what can insurers do to improve and prepare for the future?

Here are six Ps to think about.

Pace

Agility and flexibility are key. It can no longer take insurers two years to redesign their user journey and question sets – they need to be able to move fast and respond to both customer needs and environmental factors.

Similarly it’s been those who’ve been able to make swift, customer-focussed decisions on what can and can’t be done in terms of support measures - and then communicating them well and fast on websites, by email, and through call centre training - that have come out smelling of roses. Insurance is always going to be a careful industry by its very nature, but it doesn’t have to be slow or ponderous.

Performance

Perhaps the biggest issue for many insurers in the last few weeks has been business continuity. While grappling to make systems and staff work remotely and deliver a basic service, value adding ‘engagement’ with customers has clearly fallen by the wayside.

Investment in infrastructure and ensuring websites, call centres and back office systems can perform under pressure will not only reassure customers, but allow you to be present for them when they really need you next time.

Priorities

Insurers will have to continue prioritising certain customers, including high value customers, complex cases, and - as per our recent recent report - vulnerable insurance customers. These are the customers that need your extra attention and resource.

Most customers can and should still be directed to online routes, but these will need more attention. Digital journeys have too often been sold to Boards as cost cutting exercises and not – as they could be – OPPORTUNITIES for engagement and good customer experience. Now is the time to change your perspective, consider your priorities, and invest accordingly.

People

It’s no coincidence that we’ve seen many organisations, including financial institutions, put their people front and centre of their coronavirus advertising and communications. Your people are key in leveraging value and creating empathy and intimacy – especially with your priority groups.

Turnover in call centres is typically high, but your frontline staff really are one of the best ways you have of engaging authentically with your customers. That makes training and retention a priority in your engagement strategy moving forwards.

Proactivity

If the last few weeks and months have taught us anything, it’s that you want to be on the front foot rather than the back foot. Being proactive in looking at your user journey and engaging with customers means you won’t have to scramble to respond reactively, and create new communication channels.

Having established roots to your customers and a relationship with them, it’s likely they’ll be warmer to receiving your key messages in the future. Imagine how much easier it would be to ask customers to use online channels instead of calling you in a crisis, or offer advice on what to do if they’re struggling to make payments, if you already had their ear and their trust.

Personality

People don’t want their insurance brands to be kooky or clever - or bombarding them with spurious information. But they do want them to be useful, and most of all to be HUMAN.

Understanding your customers, responding and relating to them in simple, human terms is the baseline you need to aim for in all your future engagements.

Vulnerable Customers in the Insurance Market

Did you know around one in four customers are potentially vulnerable? This is a group insurance brands cannot afford to ignore, especially given the recent FCA communications.

The protection of the most vulnerable people in society falls not just to government but to the organisations and businesses they need to interact with – especially fundamental financial services. The coronavirus pandemic has only put more financial pressure on individuals, pushing some into vulnerability and exacerbating existing problems for others.

To help you understand vulnerable customers, the relevant risk and regulatory advice and get actionable insights we have launched our latest industry report for Home and Motor Insurance.

Comment . . .

Submit a comment