It’s been nearly two months since the biggest pricing shakeup of a generation – and the first data is in. Here are 4 key things you need to know.

1. We’ve seen record price rises

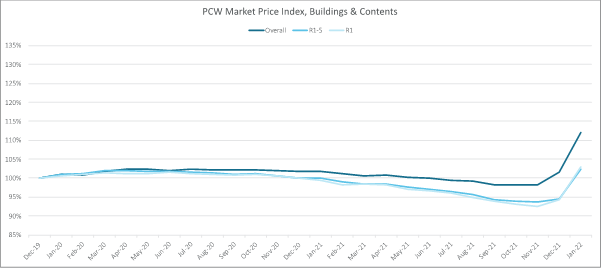

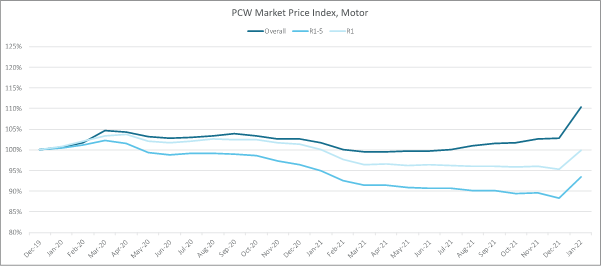

New business prices have risen in January, confirming many expectations that a ban on introductory offers and price walking would see new business premiums rise.

In home, the average R1-5 new premium quoted for new customers rose by 8.4% and in motor by 5.7%, representing the single biggest monthly changes on record.

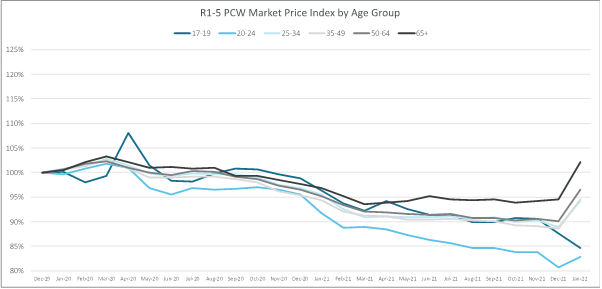

2. Young drivers are getting a reprieve

However, the rises have been far from homogeneous. In car insurance it has been a case of the older the driver, the greater the price rise.

Indeed, the average R1-5 premium on PCWs for drivers aged 17-19 fell by 3.4% in January while for over 65s they rose by 8.1%. This reflects a growing number of established players deepening their appetite for young drivers as well as the proportion of telematics products targeted at this age group.

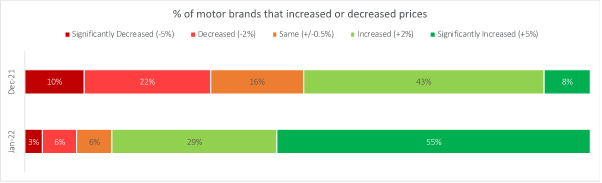

3. Price rises are sharper in home than motor

In terms of brands, more than half the motor market increased new business prices by over 5% in January 2022, and a quarter by over 10%.

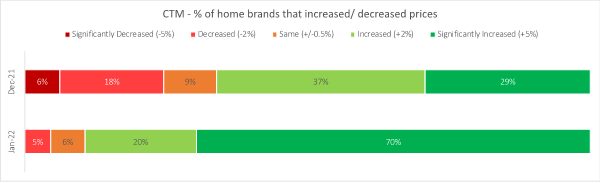

Meanwhile in home, some 70% of brands increased prices by more than 5% in January, the soft cycle turning and those with bigger home back books raising new business prices to align their portfolios.

4. It's all to play for moving forwards...

Extreme as the price rises may sound, none of this should come as a surprise or cause alarm that the policy isn’t working. The FCA itself predicted “new business prices may rise for some customers, particularly those who shop around.”

Jumps of January’s magnitude are unlikely to be repeated en masse - and February has already shown a degree of recalibration and finetuning by brands.

With the end of business models that saw many make a loss in the first year or two due to high acquisition costs and introductory discounts, new entrants should theoretically find it easier to become profitable sooner, thus lowering the barrier to entry for the sector. The planned launch of more newcomers could soon create more downward pressure on prices – and it could be all change again.

The FCA’s remedy was always going to be a long term one, and the impacts will be long term, too. In the meantime, it’s still all to play for - as brands continue to refine and test their pricing strategies.

Understand how the market is changing in response to GIPP

The GIPP Performance Tracker provides you with the ability to track changes across the insurance market and help inform your product proposition and pricing strategy in response to GIPP.

In the form of a report, you'll be able to track the response of the market and your competitors across pricing and competitiveness, product, renewals and retention, offers and incentives, add-ons, and premium finance.

Comment . . .

Submit a comment