.png?width=711&name=Untitled%20design%20(28).png)

The FCA has proved itself to be surprisingly agile responding to the Covid-19 pandemic, but there’s a paradox on the horizon that needs to be addressed.

The FCA wants insurers to assess credit worthiness before offering credit to allow customers to pay for their premiums in instalments. It has also been clear the industry must do what it can to support the increasing number of customers pushed into vulnerability by coronavirus.

At Consumer Intelligence, our data shows that those two requirements are on a collision course, and that it’s young people who are likely to be most - and disproportionately - affected.

Vulnerability on the rise

The fact is that vulnerability, particularly financial vulnerability, is on the rise. Over the period of the pandemic we saw the number of people who identified as vulnerable double. Twelve weeks since lockdown began, there are now 25% of people who say they are quite worried about their finances, and 11% who are very worried. Those aged 25 to 34 are the most concerned.

45 to 64 year-olds are spending less during lockdown, but younger people are more likely to be spending more or the same, with less wiggle room in their outgoings than their older counterparts who have more ‘disposal’ income to cut back from.

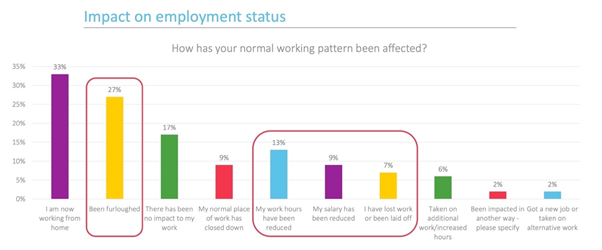

Finances are obviously under further strain from people’s working situations. Our stats show 27% of people are on furlough, 13% have had their hours cut, and 7% have lost their jobs. Younger people are the most likely to have been put on furlough, with over 30% of 18 to 34 year olds on the scheme.

At the moment, furlough is very much masking the true state of people’s finances. And it is not something insurers can easily assess from standard new business question sets.

As the furlough scheme tapers off, it’s likely we’ll see more people lose work as businesses contend with what’s predicted to be the biggest economic downturn in decades.

Motor insurance is a compulsory purchase, and it’s an indisputable fact that these younger groups are the ones who have the highest premiums. Our latest index showed the average premium for drivers under 25s was £1,795, compared to just £402 for drivers aged 50 and over [https://www.consumerintelligence.com/car-insurance-price-index ]

They’re also the least likely to be offered the chance to spread the cost of their insurance into instalments.

Availability of credit

Some 32% of drivers currently choose to pay in instalments and it’s highly likely we’ll see that rise as people – especially younger people - begin to feel the real pinch in their pockets. For those insurers and brokers for whom instalment payments are an integral part of their business model and generate significant income, this could seem like a good thing. But it’s important to understand now how your instalment strategy fits into your pricing strategy, and if it could be putting your young vulnerable customers at an increased disadvantage.

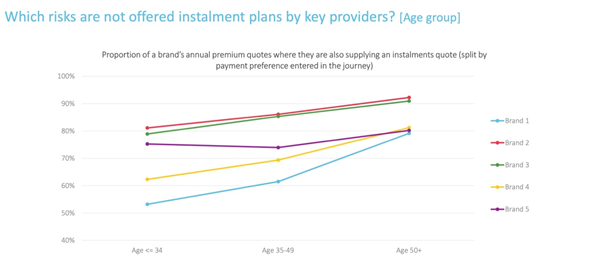

This anonymised graph shows how much less young people are offered instalment plans.

Brand 1, for instance, offers drivers aged 34 and under the option to pay in instalments just over half the time, while older age groups are offered instalment options 61% of the time (35-49 year olds) and 79% of the time (50+ year olds).

With young people more likely to be moving into financial vulnerability and more likely to need to pay by instalments, brands need to be careful they’re not discriminating or denying access to a much needed service based on age.

Cost of credit

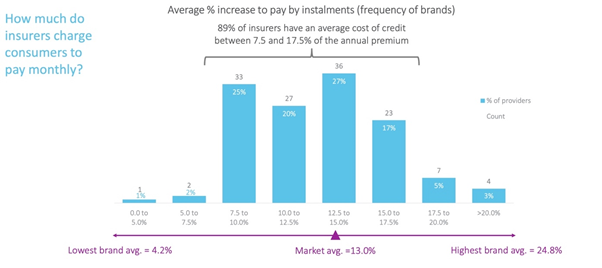

The cost of credit itself varies. We looked at how much more people pay in instalments over and above the cost of an annual premium to calculate the total cost of credit. We found that nearly 9 out of 10 insurers offer an average cost of credit between 7.5% and 17.5%, averaging out at 13%, or around £156.

It varies between insurers and brokers, who in turn have varying degrees of sophistication in their ability to alter the cost of credit by flexing arrangement fees or APR rates.

Some brands were also way above or below average. The maximum cost of credit we found was 65% higher than the annual premium cost.

So how do insurers do the right thing for customers, and balance regulatory advice on risk with regulatory advice on support?

Getting ahead of the credit curve

The first step is understanding your credit proposition and where you sit in the market - and that’s where our new report on the cost of credit could come in handy. For insurance brands there’s an opportunity here. If you make profit through instalments you’re likely to see demand for credit rise, and that could allow you to lower your credit costs to gain a greater market share. Likewise if you target younger customers you need to think about creating products that will work for their changing needs – all of which is of course easier if you do credit in-house.

It’s also worth remembering that on most PCWs your customers will see the total cost of insurance - including credit if that’s the option they pick, and your credit proposition could be costing you the lucrative top spots if you don’t pay it enough attention.

The industry as a whole needs to reconcile risk caution and credit availability, fast, and this is YOUR chance to be on the front foot by understanding your offer, your total cost of credit, your competitors, and at the end of the day – your customers.

Vulnerable Customers in the Insurance Market

New ground-breaking report reveals never before seen insight into the changing vulnerable customer landscape, plus actionable advice from former regulator, Michael Sicsic.

The issue of vulnerability isn’t a new one for the insurance industry – however it is one that’s yet to be overcome. Since 2015, the FCA has been calling for firms to ensure they act in best interests of vulnerable customers, while applying fair practices across the board. The FCA made it the second of their five objectives for 2020-2021.

Now, with vulnerability on the rise in the wake of the ongoing COVID-19 pandemic, it is vital that the industry starts to act, and fast.

To support swift action, Consumer Intelligence has conducted pioneering research using its unique proprietary data to establish:

- Who is “vulnerable” – how can they be defined?

- How has the landscape changed in the past year?

- How do vulnerable customers behave?

Comment on blog post . . .

Submit a comment