Following the publication of our Motor Insurance Price Index for the past 12 months, we can now reveal that Telematics brands are dominating the market for under 25s this quarter.

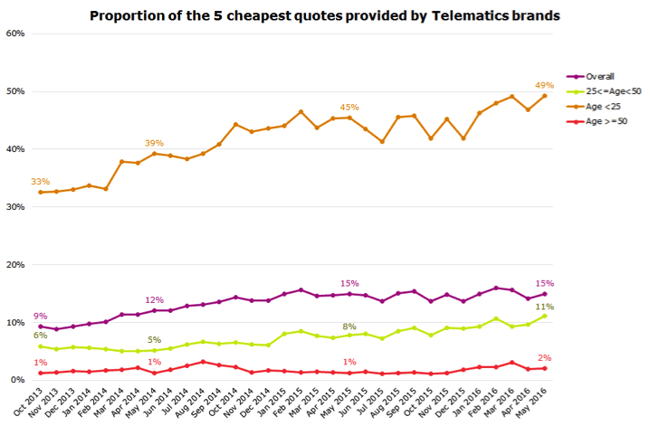

The share of top five motor insurance premium quotes for under 25s has grown 150% over the last two and a half years, and is now at its highest level since we started tracking. Overall, 15% of the five cheapest quotes to be found in the motor insurance market across all age groups are provided by telematics brands. This is as opposed to 9% in October 2013.

For under 25s specifically, this share is a whopping 49%, compared to 33% back in October 2013. This means that roughly half of the cheapest motor insurance quotes available to young drivers are provided by telematics brands. Not only this, but telematics dominated rank ones for younger drivers.

When we use the term ‘rank ones,’ we mean that across price comparison websites (here being primarily Compare the Market, Go Compare, Confused.com and Money Supermarket) telematics brands consistently offer the best and cheapest prices to under 25s. They’re hitting first place, and they’re doing it consistently.

The presence of telematics brands continues to grow

In fact, Telematics brands fill seven to eight positions of each Price Comparison Website’s top ten cheapest insurance deals. Very competitive brands, which hit the top ten best prices in all four major price comparison websites, include Hastings Direct SmartMiles, Carrot, Bell and DriveXpert[1].

Whilst the dominance of telematics is most dramatically apparent for under 25s, the presence of telematics brands continues to grow across the market at a steady pace. For example, people aged between 25 and 49 saw a 2% increase in the proportion of top five cheapest quotes provided by telematics brands in the last month alone.

These results appear to validate Matt Scott’s predictions in May that despite a bumpy start, the telematics industry will only continue to grow.

To find out more about behavioural trends in the motor insurance market over the past 12 months, check out our Motor Insurance Price Index, which was tabulated using a sample of 3,600 people per month over that period.

Improve profit and tighten margins

Improve your sales and profit by understanding how your telematics price compares with other telematics insurance providers. Our telematics toolkit can help you find out how you can improve profit and where you might need to tighten margins to increase policy count.

Note

[1] This data was collected in May 2016, using a sample of 557 people.

Submit a comment