It goes without saying that, to date, younger drivers have benefitted most from the introduction and adoption of telematics. In fact, the majority of telematics providers have specifically targeted the under 25s as the demographic stands to gain the most from their policies.

It goes without saying that, to date, younger drivers have benefitted most from the introduction and adoption of telematics. In fact, the majority of telematics providers have specifically targeted the under 25s as the demographic stands to gain the most from their policies.

However, as that market becomes saturated, it appears providers have started moving up the age scale, targeting older drivers.

We have seen prices consistently increase for older drivers by more than they have for younger drivers and now that prices are coming down, they are coming down faster for younger drivers (down by 11.9% in the last 12 months).

And although over 25s are experiencing a slower pace of price reduction, the Consumer Intelligence car insurance price index shows they are still making those all-important savings with drivers aged 25-50 seeing a 5.1% fall and the over-50s a 2.5% reduction.

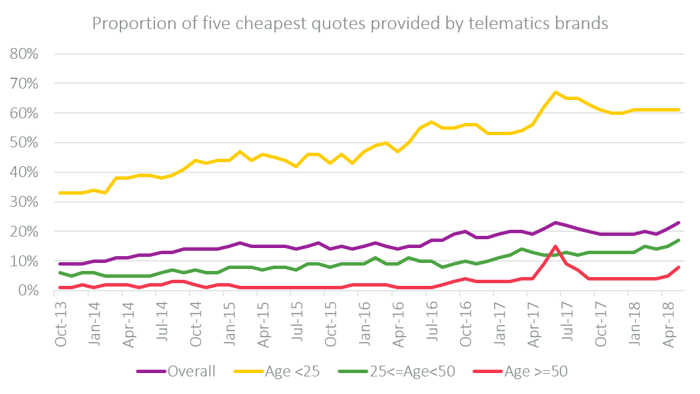

What appears to be contributing to this downward pressure, is an appetite among telematics providers to engage that over 25s market. Whilst, as you would expect, 61% of the five cheapest quotes for under-25s come from telematics-based policies, the 25-49 and over-50 markets are seeing 17% and 8% (respectively) of the top five cheapest quotes come via telematics.

As the dominance of telematics in the under-25s appears to be plateauing somewhat, the increase of use amongst older drivers shows a long term upward trend.

Some 8% of the cheapest quotes provided to over 50s came from telematics brands in May 2018, compared with 1% two years ago.

And as providers increasingly target older drivers and the use of technology in all aspects of life is normalised, we could see that proportion of cheapest polices coming from telematics providers increasing.

The brands offering the cheapest quotes on aggregators were Hastings Smart Miles, Wise Driving Black Box, Admiral Little Box, Insure The Box and Smartdriverclub Insurance but there appear to be brands which are specifically targeting an older demographic.

When we look at purely over-50s, Coverbox, More Than Smart Wheels and Co-Op start breaking into the top five cheapest quotes. And while over 30s are getting the cheapest aggregator quote from Hastings Smart Mile, the Admiral Little Box takes the top spot for the 20-24s with Smartdriveclub leading for the 25-29s across most aggregator sites.

Although it looks like telematics is making some inroads into the over-25s market, it is by no means a foregone conclusion that older drivers will adopt the technology en masse.

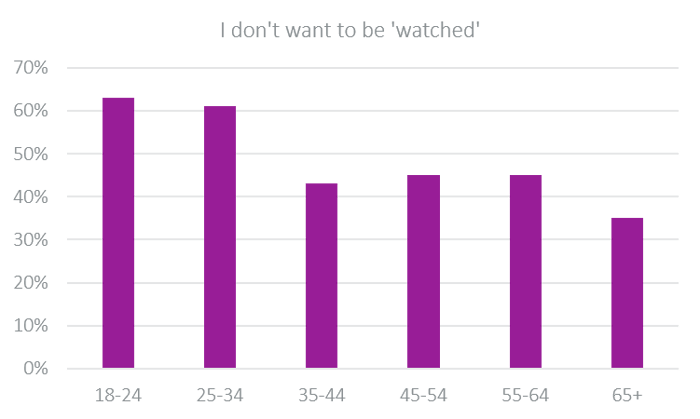

There is still a great deal of suspicion when it comes to people bringing tracking technology into their day to day life but interestingly, it is younger drivers who harbour most suspicion. When asked why they didn’t have a telematics policy, 63% of 18-24 year olds said they ‘didn’t want to be watched’. This attitude softens the older the driver gets with only 45% of 45-64 years olds and 35% of over 65s objecting to being monitored.

Viewsbank poll of 1,053 drivers. Online poll conducted 4-7 July 2018

The real disparity between the age groups comes when asked if they had been offered a telematics product. All respondents under the age of 25 had been offered a telematics product compared to the 69% of over 65s who hadn’t. This is mirrored all the way down to the 35-44 age group with the majority of respondents reporting that they had not been offered a telematics product.

It seems that while the telematics market is broadening its underwriting appetite, it hasn’t yet got the attention of the older age groups. But our research suggests that when they do grab that attention, there are age groups far more prepared to embrace monitoring than their younger counterparts.

Insight that will enable you to optimise your pricing strategy

Download our Car Insurance Price Index to gain insight into market movements, benchmark the major van insurance brands and help you understand the data behind the results.

Submit a comment