-1.png?width=704&name=Untitled%20design%20(14)-1.png)

Covid-19 has changed how people live, work, feel and think. All the assumptions the insurance industry made about risk and consumer behaviour that held true this time last year have now completely changed too. Risk forecasts and budget forecasts - even from just 10 weeks ago - can and should be thrown out the window.

So what will the future look like, and what new assumptions can we start to make?

At Consumer Intelligence we’ve been tracking consumer behaviour since the start of the pandemic. What’s clear is that different groups are behaving in very different ways, and understanding that on a granular level will be key in planning for the future.

Looking ahead

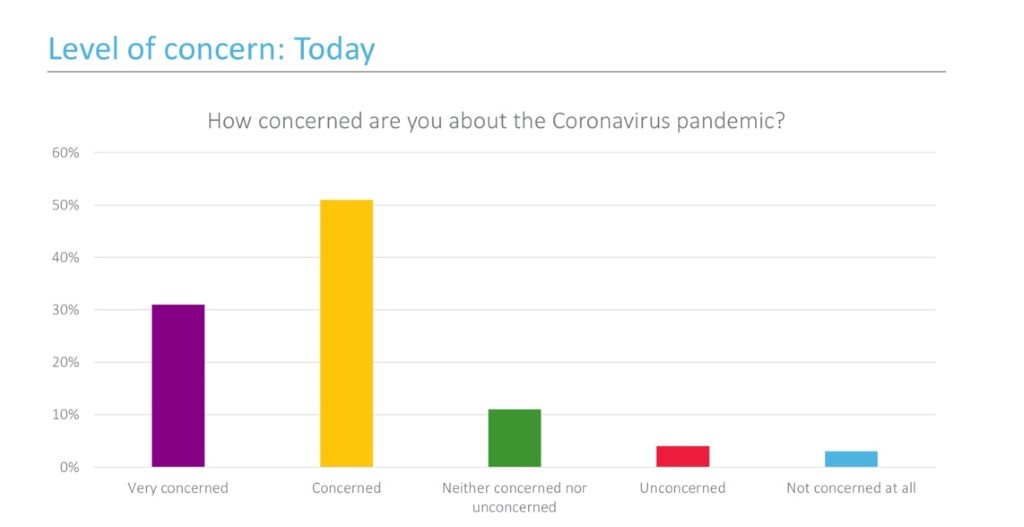

Right now, we know that anxiety about Covid-19 is starting to come down amongst most groups.

This week our tracker showed that those saying they were ‘very concerned’ had dropped from 44% to 31%. That’s already changing people’s behaviour, and we can see from the news both those heading back to work again - and those heading to beauty spots and beaches.

While we can predict anxiety will in all probability rise again with a likely second wave of cases as a result of this behaviour, people are starting to think about the future. That means insurers can get more information about the next stages of life with Covid, too.

Home insurance

From a home insurance perspective, the biggest change we’ve seen from coronavirus has been the number of people literally in their home.

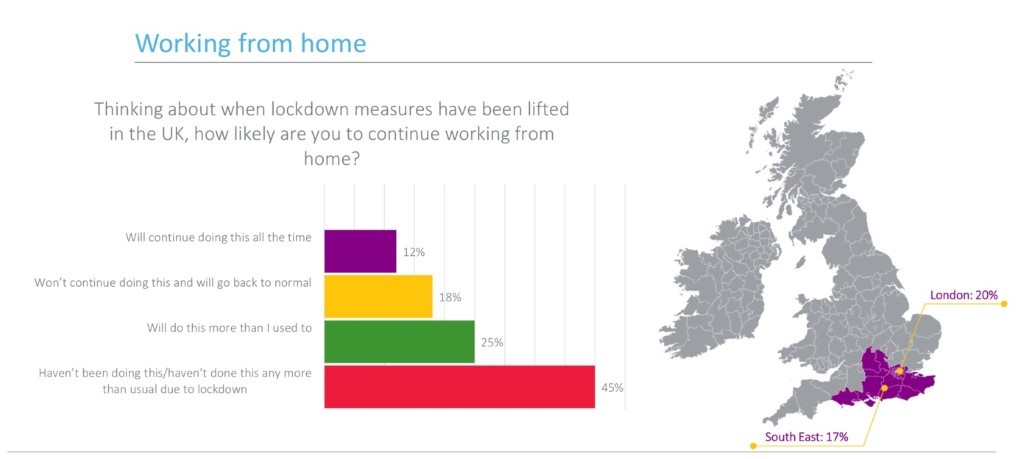

In our tracker we wanted to see how many people would stay working from home, after restrictions are lifted.

12% of people said they would work from home all the time from now on, with a further 25% saying they would do so more than they used to.

It’s worth noting that there’s a class and related regional bias here. You can’t do manual work from home, and in more affluent areas like London and the South East heavy with service industry roles, those saying they’d work from home permanently went up to 20% and 17% respectively.

Location has always been a factor in risk calculations, but how it changes behaviours - and therefore risk - has now changed again.

It’s also interesting to note that younger people are more likely to want to go back to work, and more likely to risk breaking lockdown restrictions, too. This is the generation that most values social interaction, and has clearly struggled with restrictions. Insurers need to know that this demographic will behave very differently, and have a different attitude to their own risk.

For those staying home, evidence from lockdown allows us to predict a rise in the number of smaller claims, with more wear and tear and children tearing round - but possibly a reduction in big claims, with someone always around to catch large issues like escape of water before they escalate.

How people are using their homes might also change what people need insurance for, especially if whole businesses are running from home locations with all the implications that has for security and public liability if customers or clients are visiting the premises.

Predicting and responding to customer needs with new products, add-ons, and pricing strategies will be key.

Motor insurance

The side-effect of more people at home is less people commuting into work. That has huge implications for motor insurance.

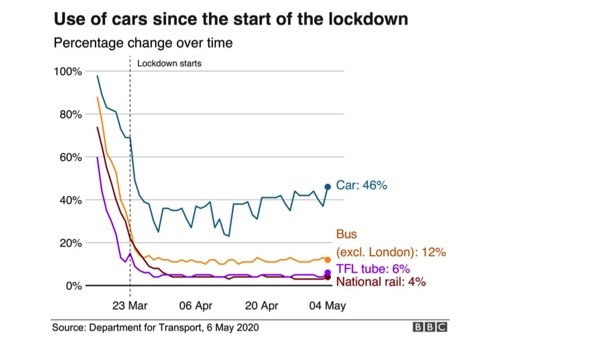

We know car use has dropped off a cliff since the start of the virus, but the evidence is that people are starting to get back on the road.

Where they drive and how will have changed, though. It’s probably the higher-risk individuals that have already been using their cars, and anecdotal evidence from insurers is that empty roads have tempted more people into speeding. Meanwhile those who’ve been off the roads will be getting into vehicles that may have stood idle for weeks, and will be rusty behind the wheel.

It’s likely people will be making shorter journeys for some time to come, although some may be driving more in order to avoid public transport. 27% of people in our tracker said they would use public transport less from now on, and that will reverberate onto the roads.

We might see the shared-vehicle and uber generation congregated in cities also now going for driving lessons and private vehicles, which means insurers could see more new drivers and car owners on their books for the first time.

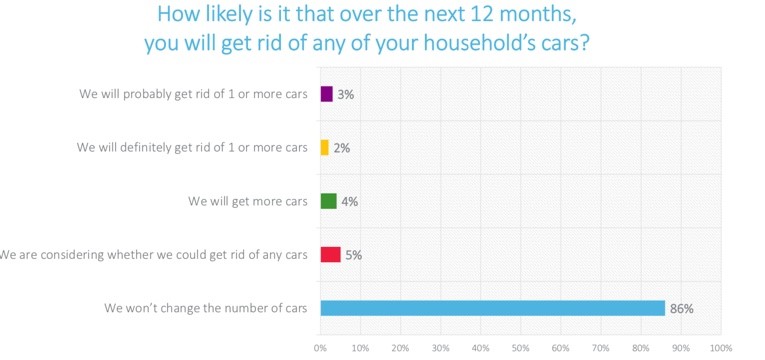

We considered if working from home might also mean people would consider giving up a car.

Our tracker showed us that while a total of 10% of people could be getting rid of their vehicle in the next 12 months, 4% said they’d get more cars, possibly to accommodate new drivers or those who plan to avoid buses and train.

Finally, it’s worth noting that Covid-19 has seen the rise of autonomous vehicles, and the speed with which they’ve received regulatory approval to deliver things like food and medicine. China has accelerated its testing on the roads. The Isle of Wight received medical supplies by drone on 9 May, the first time a non-military drone received permission to fly beyond visual line of site in the country.

This part of the industry has been fast-forwarded 5 to 10 years, and it will have a longer term impact on how people and goods move around. That’s something all insurers in this area should be keeping an eye on.

Travel insurance

The travel industry has been hit particularly hard by coronavirus, and that’s unlikely to change any time soon.

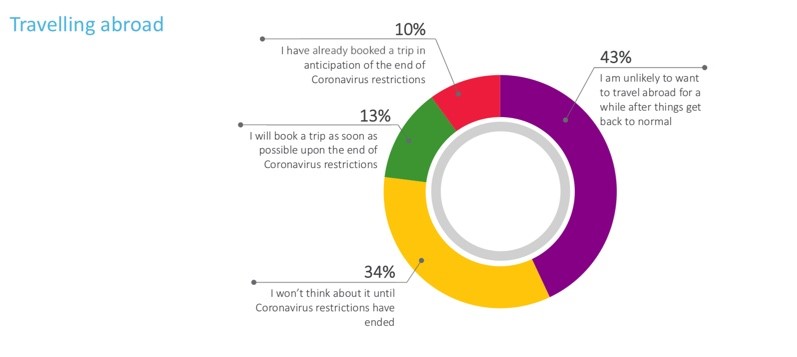

Our tracker shows that 34% of people wouldn’t even think about travelling abroad, with another 43% saying they’re highly unlikely to travel.

Looking to the future, it’s pretty safe to say that travel is going to become something of an elitist privilege.

Airlines are predicting the cost of a plane ticket will go up by 50 - 100% as they try to accommodate social distancing measures, and only those who can afford the quarantine time at either end on top of their holiday – or the £1,000 fine for flouting it - will be able to go at all.

Already we can see 11% of people citing financial reasons as the restriction for future travel, but the truth is that we are just at the beginning of what is predicted to be a deep recession. I think we’ll see that figure go up.

If there’s a bright spot on the horizon, it’s that 4% of people want to go on more adventurous holidays. Again, when we split this down demographically, this is very much from the younger generation. There’s a carpe diem post-corona spirit that sees this group wanting to take on risk for freedom. That’s something travel insurers could help facilitate and accommodate.

Regulatory intervention

As well as a changes in consumer behaviour, it’s also worth taking note of the change in regulatory behaviour too.

Gone is the slow, ponderous monolith we’ve all been used to - instead regulation is now super nimble, super agile, and super interventionalist. There’s no reason to expect that to go backwards again after the peak of the pandemic.

Insurers need to get used to this new regulatory style and speed, and on board with the new emphasis on customer care first.

New risk factors

It is all change in society, and all change in insurance. We’re just a the start of trying to identify and track new trends, and respond to customers’ new needs.

The factors affecting people's behaviours now we’re living with Covid-19 are totally different. They include things like occupation, location, values, ethics, attitudes to risk, personal health, financial security, and even political opinion.

We’re seeing behaviours split along Brexit lines, with those who value freedom (Brexiteers) behaving very differently to those who value care and cooperation (Remainers). Political inclination is a predictor of behaviour, and it’s behavioural science that informs risk profiles across our industry. Certainly it’s one of the many things we’re starting to track in our next version of the Covid-19 tracker.

What’s clear is that it is those on the front foot in understanding their customers and market trends that will emerge as the winners as we move into the next stage of our brave new insurance world.

Introducing the Consumer Intelligence Covid-19 Consumer Tracker

In response to the challenges faced by our clients across the general insurance industry, we have been working hard behind the scenes gathering data and insight that will help personal lines insurers and brokers navigate this difficult and challenging time.

We are pleased to announce the launch of our new Covid-19 Consumer Tracker, focusing on wider consumer behaviour trends during the COVID-19 pandemic but with a specific focus on the general insurance industry.

We are interviewing a nationally representative sample of 1,000 consumers every week to bring you timely insight on what your customers, your competitors’ customers and the general market think and are doing during these uncertain times.

Comment . . .

Submit a comment