Everyone’s lockdown experience is unique, complex and multi-faceted. Some have enjoyed time at home. Others have suffered, worried about job security, home schooling, health and finances.

And so it comes as little surprise that consumers are not behaving as one homogenous group when they consider how their lives and driving patterns will change in the future.

Whilst 71% of people have driven less than they would have before the pandemic, not all of them are set to return to the roads.

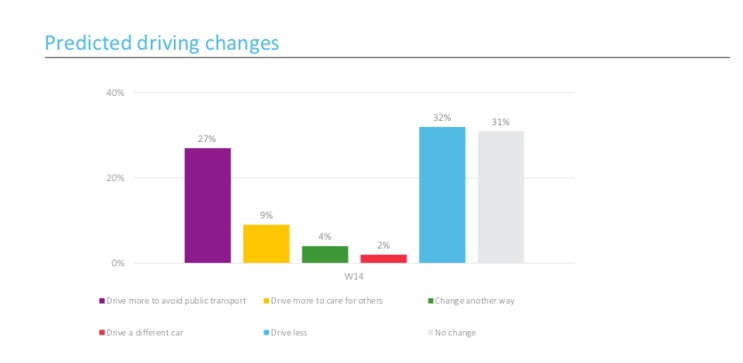

Our Covid-19 consumer behaviour tracker shows that people’s plans divide into three more-or-less even blocks – those who plan to drive more (largely to avoid public transport), those who will drive less than they do now, and those whose driving won’t change at all.

The challenge for insurance providers here is to understand how their own customer base (or target customer base) is prone to answer this question and react accordingly.

This change is part of the broader question the industry faces around changing risk profiles and behaviours. As working patterns change, for example, and the traffic dense, accident prone rush hours are reduced or lost, what does that do to risk modelling? What about the growing number of new cyclists and e-scooter users sharing the roads?

Pricing

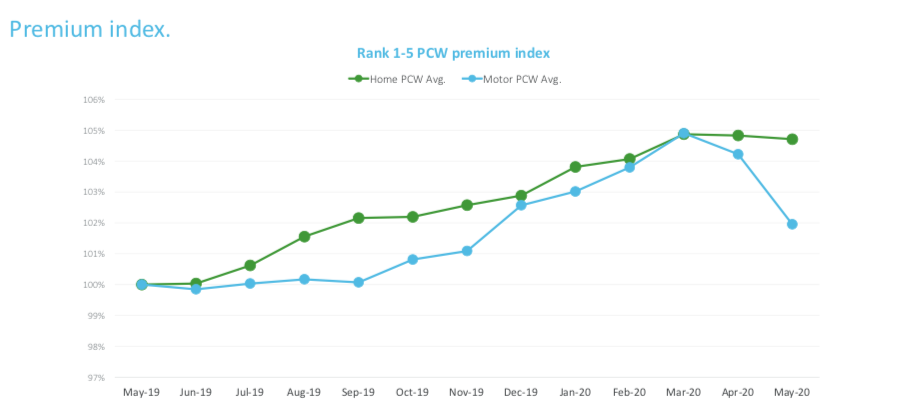

As it becomes clear that 2021’s risk cannot be modelled in the same was as 2019’s, attention turns to pricing.

Last week we published our car insurance price index, which showed prices have fallen by 1.4% in the last 3 months.

But this headline fall after months of inflation is once again not uniform.

For younger drivers prices rocketed in April as telematics providers and others targeted at young drivers withdrew from the market, pausing as they evaluated the safety of black box installation and reacted to the lack of new drivers coming to the market as driving lessons and tests were suspended for all but key workers. Prices fell again in May as many of those brands returned.

There are also some gloriously non-Covid reasons for this pricing volatility. These include capacity providers withdrawing from the young-drivers market, and the entrance of new brands, helping Groups with a brand stacking approach on Price Comparison Websites.

Just last week new brands have joined PCWs offering much lower rates for 20 - 24-year-olds. Whether that is down to deliberate strategy or a something that will need correction remains to be seen.

But one thing is for sure: in this highly competitive market, where no brand has more than 10% of the customers, more change and fine tuning are afoot. Understanding your customers and where your brand wins and loses is critical.

Track changing consumer trends

Understanding how the looming recession, as well as a potential second peak of the pandemic, will impact consumers through the rest of 2020 - and beyond - will be key for insurers.

To follow the changes to come, gain insights into the next stage of the pandemic and examine how they affect consumer behaviour and attitudes, we have launched version 2.0 of the Covid-19 consumer tracker, which is now available to purchase.

Comment on blog post . . .

Submit a comment