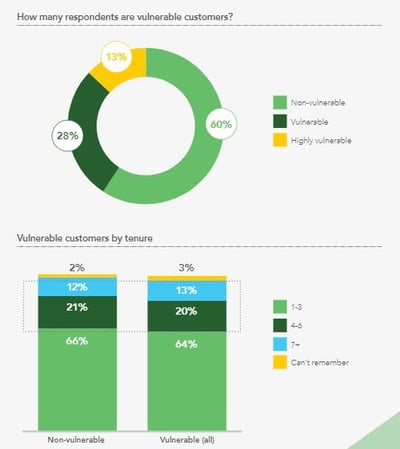

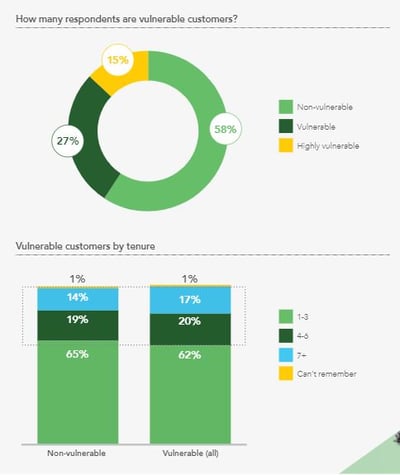

Nearly three out of ten customers now self-identify as vulnerable – and that rises to four out of ten when Consumer Intelligence’s vulnerability criteria is applied.

Latest figures from our latest whitepaper 'Vulnerable customers in the age of the cost-of-living crisis' show that 41% of motor customers and 43% of home customers are vulnerable – through age, socio-economic group, employment status or household income - and are likely to behave, shop, buy and renew very differently to customers with higher levels of resilience.

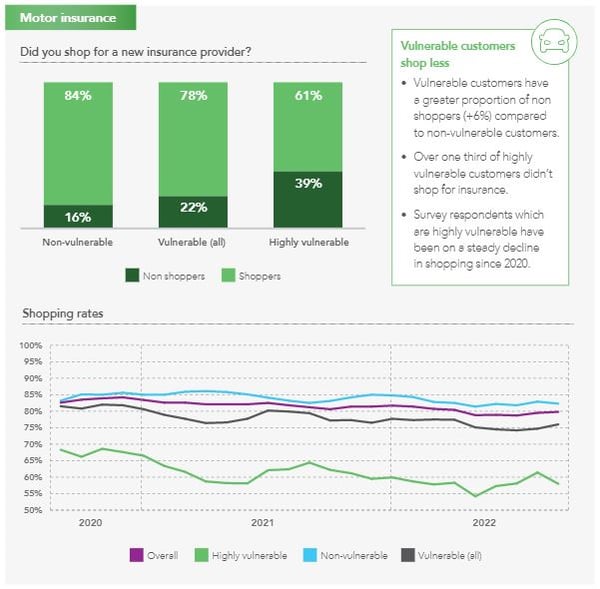

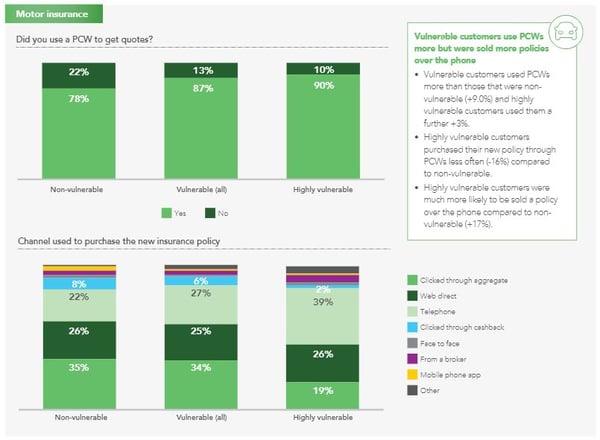

Motor insurance

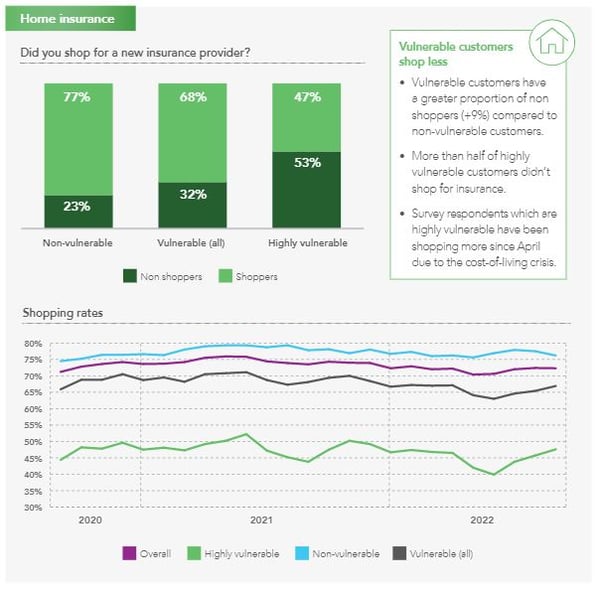

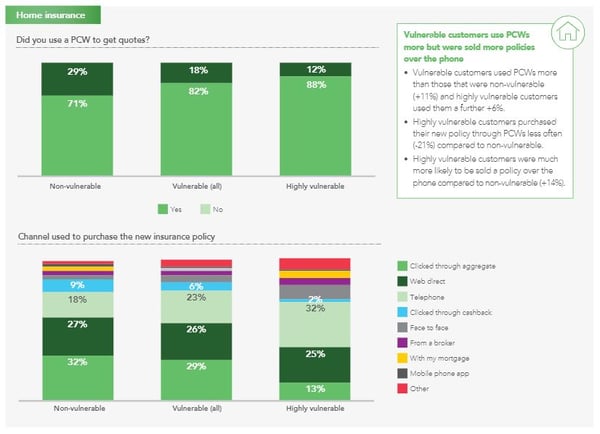

Home insurance

With the deepening cost-of-living crisis set to send even more people over the vulnerability edge over the coming months, no firm can afford NOT to target what could become nigh on half of their customer base.

Identifying, understanding, and catering for vulnerable customers is no longer just good PR, good CSR - or even Consumer Duty compliance. Increasingly it’s becoming a strategic imperative.

The impact of cost-of-living

It’s important not to underestimate the impact of the cost-of-living on even compulsory insurances.

According to our cost-of-living tracker, 67% of customers are now feeling the pinch from increasing costs, and 7% have already made spending cuts on insurance policies – with another 7.5% considering it. On top of that, 29% of consumers say they’re more likely to purchase a lower cover insurance product, and 28% say they’re more likely to pay in instalments.

That’s a changing picture of requirements and behaviours insurers need to take note of – and understand how it intersects with vulnerability.

People losing defacto income and seeing a decline in their financial resilience will clearly be more vulnerable – and there are a lot of people feeling the impact already. Some of your customers may even be choosing between heating and eating this Winter – and that means just when they most need the safety net of insurance, they’re least likely to be focussing on it. This is why we count ‘highly vulnerable’ customers as those of long tenure – because their stasis means they’re further disadvantaged by not checking either their terms, cover or the wider market.

Three vulnerable customer differences to pay attention to

1. They're less likely to shop around

Potentially vulnerable customers are 9% less likely than non-vulnerable customers to shop around at renewal within the home insurance market, and 6% less likely to shop around in the motor market. That rises to 30% and 23% when it comes to highly vulnerable customers.

While shopping and switching have fallen in 2022 after the introduction of the FCA’s new pricing practices rules, the cost-of-living crisis is likely to increase price sensitivity into 2023. Fine motor control of your pricing – and understanding of your peers’ – is going to become more important than ever.

2. They're more likely to use PCWs

When vulnerable customers do shop around, they’re more likely to use PCWs. Within home insurance the vulnerable are 11% more likely to use a PCW, rising to 17% of the highly vulnerable, and within motor it’s 9% more likely, rising to 12% of the highly vulnerable.

That makes your PCW strategy a key part of your vulnerable customer engagement strategy, too. It’s important to be where your vulnerable customers are actually looking for you.

3. They're more likely to want to buy over the phone

Even if they do get PCW quotes, vulnerable customers are more likely to want to purchase a policy by speaking to a real person – particularly over the phone. In home, 27% of vulnerable and 39% of highly vulnerable people purchased their policy this way, and in motor it was 23% and 32%.

While cheaper online-only policy offerings might be part of your cost-of-living response, they may well not work for your most vulnerable customers. Ring-fencing a team who can support vulnerable customers at purchase or renewal could help you improve vulnerable customer outcomes.

The cost-of-living crisis has made more vulnerable customers, has changed consumer behaviour, and has made dealing with them a new priority for the insurance market. Organisations have a responsibility to ensure customers don’t suffer financial detriment because of their vulnerability. Those stepping up now are likely to see the pay off down the line in terms of customer loyalty, brand equity, and ultimately commercial advantage.

[Whitepaper] Vulnerable customers in the age of the cost-of-living crisis.

We address how the cost of living continues to drive the number of those identifying as “vulnerable” and so much more! Helping you understand vulnerable customers, the relevant risk and regulatory advice, and get actionable insights to help create better outcomes for you. Download now!

Comment on blog post . . .

Submit a comment