Of the entirely new outcomes of the new Consumer Duty, tailoring and testing firm communications in order to evidence customer understanding, is perhaps the most difficult.

You are now responsible for how well your customers comprehend, process and retain information about your products and services.

One group of potentially more vulnerable customers you may not have considered in your Consumer Duty planning are the real newbies in your new business acquisition funnel – those buying insurance for the first time.

In our latest Viewsbank survey, we asked 178 first-time insurance buyers about their new policies.

It revealed an alarming level of misplaced confidence.

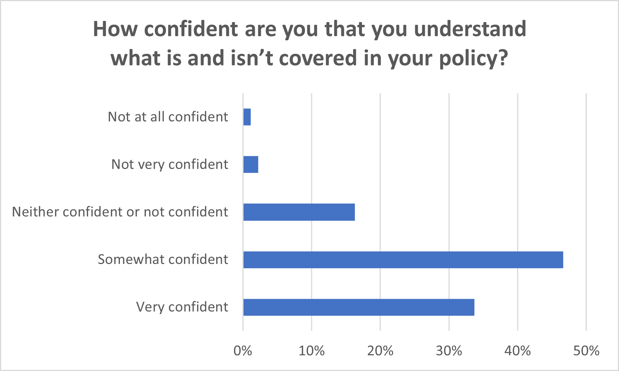

A third of the people who’d bought their first home or motor policy within the last three years were very confident they understood what was and wasn’t covered in their policy, with another 47% saying they were somewhat confident. Only 3% said they lacked confidence.

But digging down further into the details, when they were asked about specific features gaps in understanding began to appear.

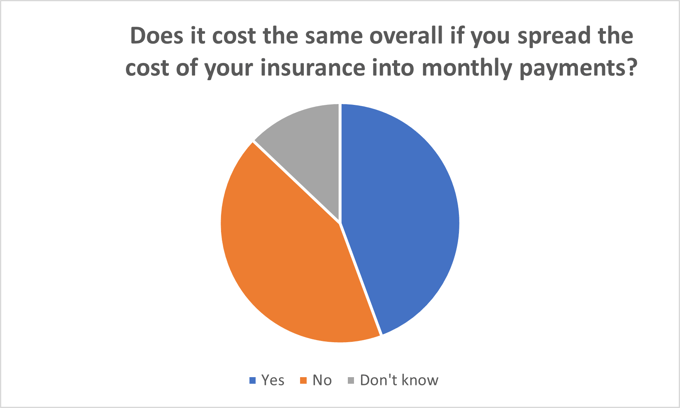

Some 44% believed that paying for their insurance monthly rather than annually would cost exactly the same. Now when we know paying instalments consistently costs more – nearly £100 more for car insurance - that’s very clearly a significant hole in people’s understanding. Some 12% didn’t know if paying monthly might have cost them more or less.

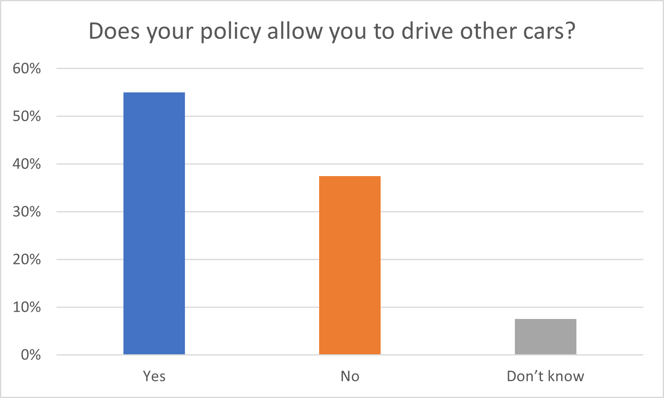

More than half (55%) of new motorists believe their policy allows them to drive someone else’s car under their policy – when this is almost certainly false unless they are a named driver or it’s an emergency.

One-in-ten didn’t’ know if their policy would automatically renew.

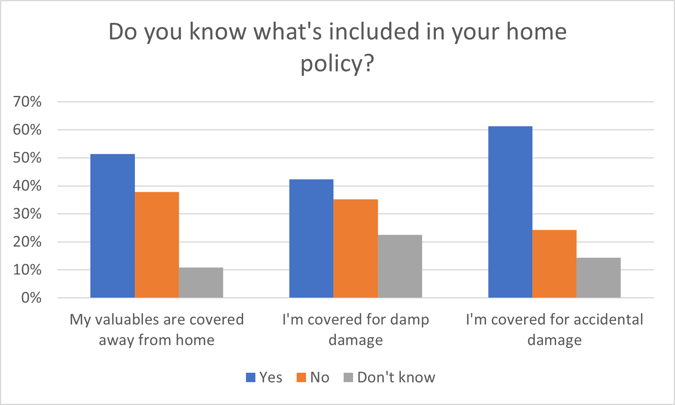

When it came to home insurance, there was further evidence of a false assumption that insurance covers more than it does.

Two-in-five young home insurance customers believe damp would be covered under their policy, when it typically isn’t, with another 23% admitting they didn’t know.

11% weren’t sure if their valuables like mobile phones and laptops were covered away from the house, and 14% didn’t know if they’d be covered for accidental damage if a football smashed into their window, or their TV fell over. Both features are usually options or add-ons, and don’t come as standard – and the confidence in cover shown by so many might not be entirely accurate.

Head of Consumer Strategy Catherine Carey said: “Consumer understanding is a core component of Consumer Duty – and these results show what an uphill battle the industry faces. We know lots and lots of people don’t read their policy documents. We know that price comparison websites – where more than half of first-time buyers go to get their quotes – can only display so much information. And we know that they don’t teach financial literacy in our schools.

“Some estimates put the figure of Brits who struggle to understand basic financial concepts at one third of the population. That means assuming knowledge or experience is a mistake the insurance industry can’t afford to make – not just because of Consumer Duty compliance, but because it is exactly the gap in understanding and expectations that causes dissatisfaction at the point of claim, and the lack of trust we face as a sector.

“There is a huge education and communication job that needs to be done sector-wide, and companies investing in this could find themselves ahead of the curve on customer understanding - as defined in the Consumer Duty. The other side of the coin, of course, is the next outcome, consumer support.”

Human help

Our survey of first-time buyers also highlighted that just under half (46%) of first time insurance buyers had spoken to a real person before purchasing their first policy.

Of those, 38% called because they wanted to check something about the policy that they didn’t understand.

When it came to policy questions during the year, 46% said they would turn to their policy documents, 1 in 4 would call up to ask in person, with 17% likely to turn to ‘live’ online chat. To make policy adjustments, 40% would want to call, and 1 in 3 would chat to a real person online. Only 15% would feel confident to do it all online without interacting with anyone.

Catherine added: “The idea that young people want digital channels and old people want to pick up a phone needs to be dropped. You can’t put all your customer service eggs in automated digital baskets, assuming the customers that want to do inconvenient and expensive things like talk in person about their policy will conveniently die off. First-time buyers of any age are looking for in-person support - and still very much want to be able to talk to a human being.

“Customer understanding and customer support require us to rethink our understanding of vulnerability - and our customer service channels. Remember, if you can get that first-time buyer over the line and keep them happy, you could win their loyalty longer term. Good understanding, good communication and fair value continue to be key.”

Viewsbank is our in-house consumer research panel. It’s a large, responsive and community driven panel that conducts both quantitative and qualitative research.

Our Viewsbank panel helps our customers with a wide variety of projects ranging from detailed mystery shopping to demographically targeted research surveys. The research helps our clients make informed decisions based on true understanding of the consumer’s voice.

Comment on blog post . . .

Submit a comment