Covid might have slowed down the housing market, but being locked in their homes has left more than a quarter of Brits thinking seriously about upping sticks and moving...

Only 12% of us managed to move in the last 12 months, for pretty obvious reasons, but there could be a massive moving boom coming just down the line as restrictions continue to lift and people get to grips with their new post and parallel Covid lives.

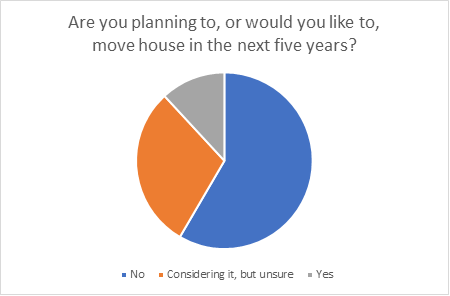

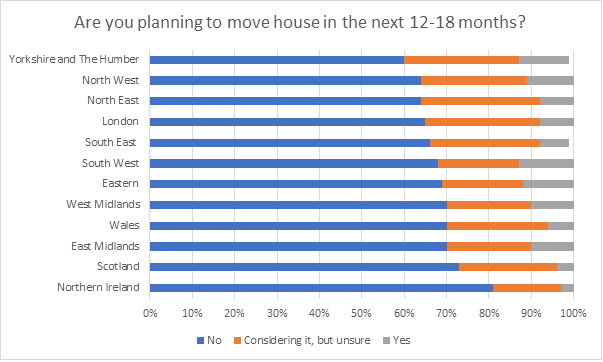

In a recent Consumer Intelligence survey, 9% confirmed they were definitely moving in the next 12-18 months, with a further 23% saying they were considering it. When it came to longer term plans, a further 43% of Brits were thinking about moving house in the next five years – nearly half of us.

The survey also revealed that the death of London is greatly exaggerated – more people in the North East and North West are thinking about moving than those in the capital in the next 12 months. And of the Londoners planning to move, 40% plan to stay in the city.

Lockdown legacy?

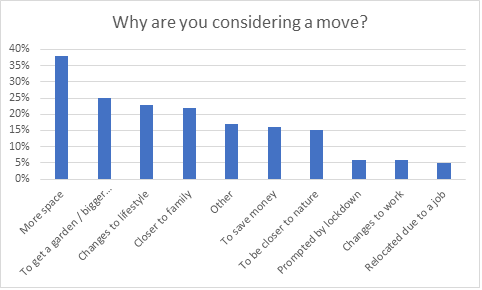

When asked about their motivations only 6% of shorter-term planners said their itchy feet were a result of lockdown, but 38% cited the desire for more space, with 25% looking to get more outdoor space and 15% wanting to be closer to nature. Nearly a quarter also said they were considering a move due to changes in their lifestyle (23%), or to be closer to their family (22%).

It’s telling that the highest things on people’s wish lists are more space, more garden, and more connections – possibly indicating that spending more time at home has helped hone people’s priorities, and clarified what’s really important to us about how and where we live.

Interestingly, though, the rise of home-working has had less of an impact on moving plans than might have been expected, with only 6% feeling that changes in how and where they had to work after the pandemic had freed them up to live further away from their jobs.

Location, location, location

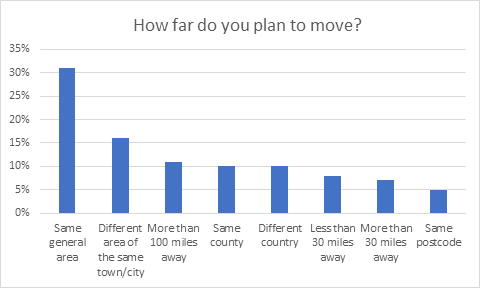

For both longer-term and shorter-term planners, the goal for around 30% is to stay in the same general area, with 16% wanting to move to another area of the same town or city. Just under 10% wanted to move more than 30 miles away, and just over 10% wanted to move more than 100 miles away.

14% of potential movers said their long-term goal was to be out of the town or city altogether. Looking at the fact that more than a quarter are prepared to move quite far afield - and that so many are looking for more space and specifically green space - that trend might be stronger than the 14% suggests… There might not be a mass exodus from big cities – not least because so many won’t be able to afford it – but we might well see demand for city living take a dip.

Thinking of finances, a quarter of people who moved last year were promoted to do so in order to save money, and another quarter due to changing circumstances. Meanwhile, longer term moving goals are about looking for change (25%), up-sizing (21%), up-grading to a better area (22%) and getting/growing that all important outdoor space (25%) – so people are thinking aspirationally about their property futures.

Those with the itchiest feet are the 18-24s, with 35-44s coming next, and over 65s more likely to be staying put or thinking about a downsize.

Insuring freedom

For the home insurance industry, there’s some key insights here to take into consideration. When there’s changes in people’s priorities and behaviours, there should be should changes in policies, products, and acquisition strategies.

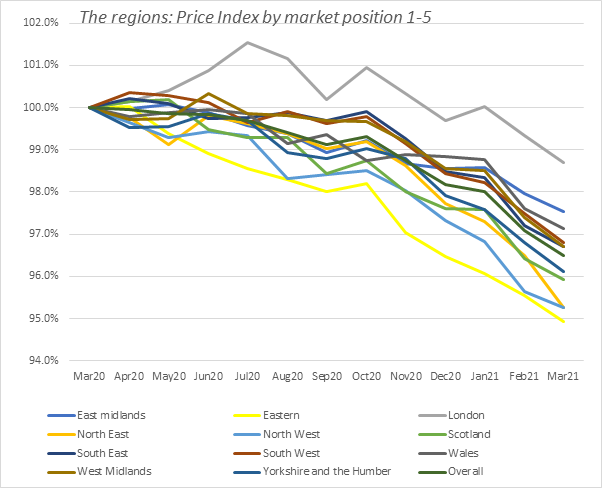

Our Home Index stats show that urban building and contents insurance costs more, for example with Londoners are paying almost 50% more for their home insurance when compared to the UK average of £145. And the gap is widening, with the cost of insurance in London falling by only 98.7% in a year, compared with 94.9% in the East of England.

Meanwhile younger people are still paying more than the over 50s - £153 versus £132 for an average annual policy.

There could be an opportunity to target the post-Covid aspirational movers, young professionals and families moving green wards, and catch the wave of locked-down holed-up home-makers as they start to spread their wings in the winds of property market change.

Understand the needs and motivations of your customers or target audience

Viewsbank is our in-house consumer research panel. It’s a large, responsive and community driven panel that conducts both quantitative and qualitative research.

Our Viewsbank panel helps our customers with a wide variety of projects ranging from detailed mystery shopping to demographically targeted research surveys. The research helps our clients make informed decisions based on true understanding of the consumer’s voice.

Submit a comment