My car insurance came up for renewal, and I happened to get around to looking at it on a Friday night. And what better time is there to set about buying car insurance than when you’re settled down for an evening spent relaxing with a glass of wine in hand?

Well, I think I now have my answer, having woken the next morning to find I had agreed to a credit agreement that left me paying £50 extra for the privilege of paying in instalments.

This was not ideal.

And it occurred to me that if I, as a (supposed) professional working in the insurance world, could not make head nor tail of my options when ever-so-slightly merry, then a person properly vulnerable (by factors possibly not including half a bottle of wine on a Friday night) probably didn’t have a hope in hell.

Trying to look back at where I went wrong and why my cost to pay in instalments was so high, I couldn’t figure it out. I was toggling between annual and monthly views which might have confused me. I don’t have a credit card, so perhaps my credit score is low, but other elements should make me a safe bet for repayment.

The fact is that it was suddenly stunningly clear to me that it should be easier than this to get a fair price.

Which is probably exactly why the FCA made sure premium finance is in scope for its pricing remedies, outlined in the final General Insurance Pricing Practices market study.

The FCA view

Not only must the renewal price of premium finance be no higher than the equivalent new business price, but the relevant price should now be the Annual Percentage Rate of interest (if it’s a regulated credit agreement), or if not, the total price paid by the customer.

While risk factors can still affect pricing, they clearly want to stop artificially hiked credit costs that only have the purpose of creating extra profit for providers.

In Annex D and the Conduct Business Sourcebook, it’s made clear that providing the customer with the choice between paying monthly or annually will not be sufficient to show they’ve made an active decision to obtain retail premium finance. People must be made aware of exactly what they’re signing up to.

What’s more, ‘a firm must not propose or arrange the use of any particular retail premium finance where that would be inconsistent with the firms’ obligations in the FCA Handbook, including the customer’s best interest rule.’ Which basically means that you can’t push customers onto a premium finance deal with yourself or your preferred partners if there’s a better deal on the market that better aligns with their needs.

So is ANY of that already happening in the market today?

Today’s instalments market

Our data shows that intermediaries still have the edge over insurers when it comes to securing the top spots on Price Comparison Websites.

Across the 3,600 real risks we tracked the prices for in May, intermediaries won 52% of the rank 1 positions on PCWs.

However, direct brands are 4% more likely to deliver the cheapest premium for a customer that wants to pay in instalments.

In our instalments analysis we often see higher costs to pay by instalments from intermediaries. This looks to be limiting the likelihood of some intermediaries positioning at the top of the results page when prices are ordered by total instalment cost.

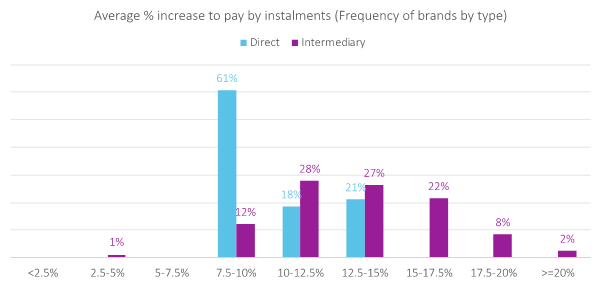

Cost of Instalments % calculates the difference between the annual premium and total instalment cost from a brand per same risk. Here we display the average cost of instalments % by provider type.

It’s interesting to see a broader range amongst intermediaries, whose credit deals range from 4.3-25.8% of the premium. Meanwhile 61% of direct brands charge between 7.5% and 10% for credit.

Seven of the top ten brands for annual premiums (in rank 1 positions) remain in the top ten for instalments, with some notable exceptions. GoSkippy and Admiral LittleBox each drop out when moving to instalments, with QuoteMeHappy and Esure moving up to fill the gaps with their below market-average credit costs.

Of the 39 direct providers, 64% have similar T5 shares for annual and instalment premiums (within +1-1%). 21% are more competitive for instalments (including Esure and Aviva groups), 15% less competitive (including AXA and DLG).

Of the 92 intermediaries 85% have similar T5 shares across both premium types. Only 11% are more competitive for instalments (including Lloyds Group), and 8% see rank 1-5 shares reduce (including Hastings, Somerset Bridge and Autonet).

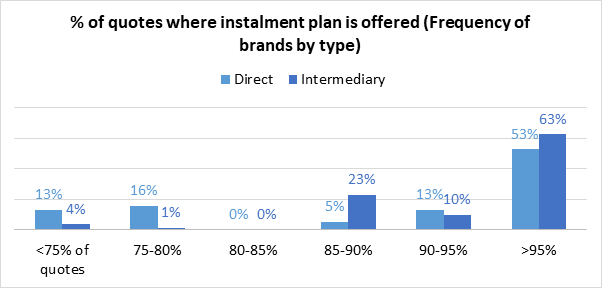

What’s really interesting to see is that while intermediaries cost more, they’re also more likely to give people the option to pay in instalments. 60% offered instalment options for 95%+ of their premiums, compared to just over half of direct providers. In fact 13% of directs were not offering an instalments option for more than 25% of their annual premium footprint. (Only 4% of intermediaries were this selective).

What does it all mean?

At the end of the day, the only thing we can reliably predict is change. And make no mistake, the FCA is determined to drive better credit behaviour that puts customers first.

The implementation of the General Insurance Pricing Practices rules will challenge the premium finance strategy of many if not most providers – but particularly those intermediaries who effectively discount the risk premium for customers paying monthly in order to secure the lucrative instalment income.

As organisations get to grips with the sharp of end of what ‘fair value’ really means in practice, benchmarking will be key. Only by watching the market and your place in it carefully can you understand the value of your product, and how fair it looks against everyone else’s.

I'm lucky. I can afford the extra £50 and the lesson I’ve learned that it essentially paid for: watch your APR if you’re hitting the bar, and don’t drink and PCW drive.

But there are people out there who can’t.

And they are precisely the people who most need monthly payment options, and who most need the insurance industry to treat them not just fairly, but kindly.

And that’s very much the approach the FCA are determined to drive across financial services.

[UPDATE: They cancelled my policy! I didn’t check my Bluetooth connectivity monitoring my driving, and didn’t check my spam folder for the warning emails. So don’t get me started on digital exclusion, telematics, and the vulnerable offliners missing out on the best insurance deals… Probably another blog.]

Understand consumer behaviour throughout the renewal process

Enhance decision making, performance monitoring and planning by understanding consumer behaviours, attitudes and intentions at insurance renewal.

Insurance Behaviour Tracker (IBT) is the most comprehensive insurance focused consumer survey in the market. It provides insight and understanding of consumer behaviour throughout the renewal process, giving you a view of market trends, and brand performance. This will enable you to make informed decisions to allow you to build robust marketing and business plans and track results.

Comment . . .

Submit a comment