Within the last two months Atlanta has announced two acquisitions that will build its car insurance footprint, product base and brand range in the form of Marmalade and Be Wiser.

As part of The Ardonagh Group, Atlanta is not a name many consumers will recognise. But it is certainly known to the market having grown through the combination of Autonet, Carole Nash and Swinton to become one of the largest multi-brand personal lines brokers.

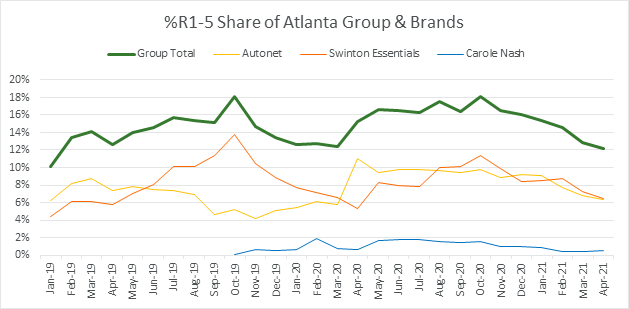

Our Market View tool shows how Swinton’s competitiveness has improved since it was bought by Ardonagh, with its Swinton Essentials product growing from 4.4% Rank 1-5 quotes in January 2019 to a peak of 13.8% in October that year.

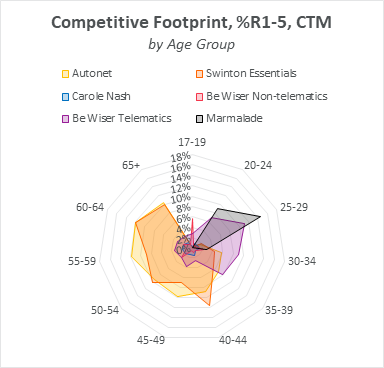

When all products from all brands are factored in, Atlanta has delivered peaks of 18% of the top five quotes on PCWs over the past two years – comparable to leading direct insurers.

The data indicates that the brands operate somewhat independently. Swinton and Autonet have slightly different quoting footprints and panel compositions for car insurance and consumers are therefore unlikely to see a stack of Atlanta brands within pence of each other in the same way that some direct insurers deliver coordinated quotes.

In that sense, instead of trying to emulate the competitive tactics of direct insurer rivals, Atlanta’s portfolio strategy reflects the conventional strengths of the broker model – a broad provision to meet the specific requirements of a broad range of consumers.

Panel composition

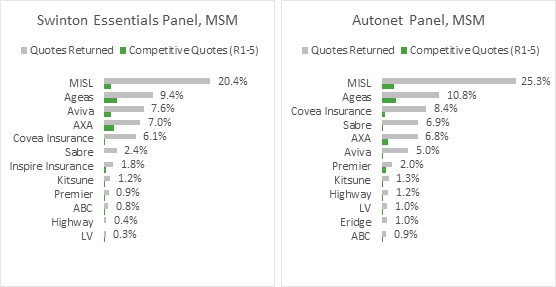

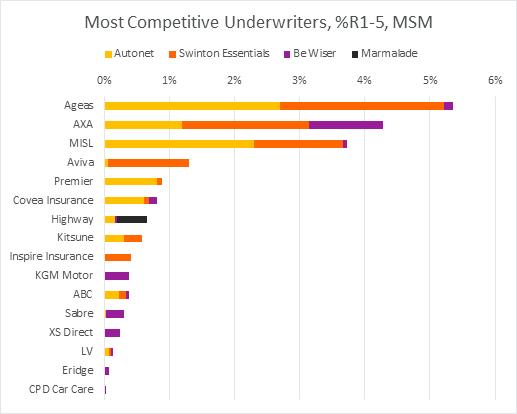

Underwriters Markerstudy (MISL) and Ageas deliver the highest number of quotes for both Autonet and Swinton Essentials. AXA, Aviva and Covéa are also well represented on both panels.

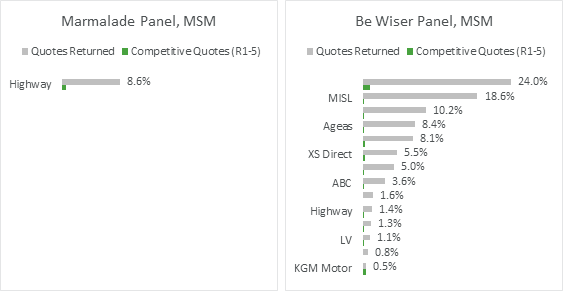

New acquisition, Marmalade, is solely underwritten by LV scheme, Highway, on the PCWs. There is synergy here with the Swinton and Autonet panels, with LV schemes featuring on both.

Be Wiser’s panel has similarly high representation from Markerstudy (MISL), Ageas, AXA and Covéa. However, there are several panel members that Swinton and Autonet do not currently work with.

The three underwriters that return the most competitive quotes for Autonet and Swinton also return competitive quotes with Be Wiser, another potential synergy.

That said, perfect alignment of panels does not appear to be the objective for Atlanta. For example, Markerstudy (MISL) delivers more Rank 1-5 slots for Autonet than it does for Swinton, while Aviva delivers more top quotes with Swinton than with Autonet.

Some simple wins will be within reach early on. For example, Be Wiser does not quote consistently across the PCWs with its 4 products (Be Wiser, Drive Wiser, Street Wiser, Street Wiser Telematics). All four quote on CTM but only the headline Be Wiser product is available on MSM.

What difference will the latest additions make?

The acquisitions of Marmalade and Be Wiser introduces new propositions and panel partners to the Atlanta stable, and with it, the ability to target consumer segments not currently served by the group’s Swinton, Autonet and Carole Nash offerings.

Both Swinton and Autonet target older, more experienced drivers in general. Be Wiser does better with 19-44 year olds and Marmalade is strong with those in their 20s. They both also bring telematics to the group as a new proposition, something which Atlanta has stated it wants to launch with more of its brands.

It will be interesting to see if and how Marmalade and Be Wiser may gain prominence through Atlanta’s panel relationships in coming months.

With a growing number of brands and propositions, Atlanta is certainly one for insurers, MGAs and other brokers to watch.

Optimise your competitive position in a fast-moving market

Understanding and optimising your product mix, particularly in your competitive context, can make all the difference when it comes to winning new business. To learn more about our pricing insights, please click below.

Submit a comment