One month into the insurance pricing shakeup of a lifetime, and the data is in.

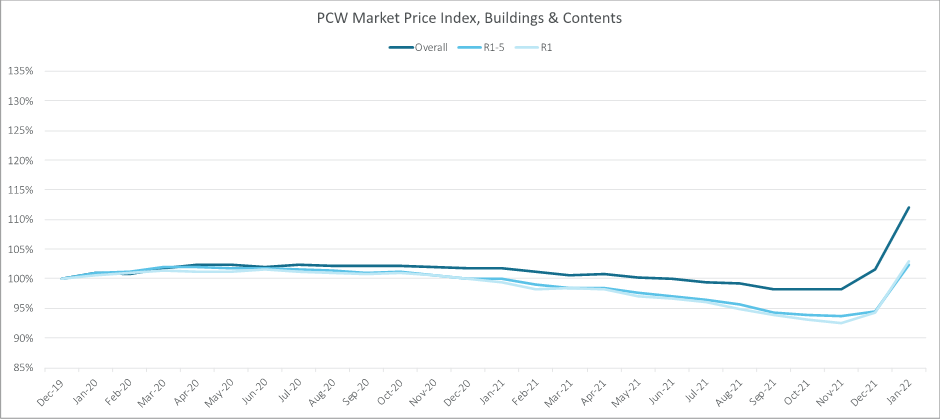

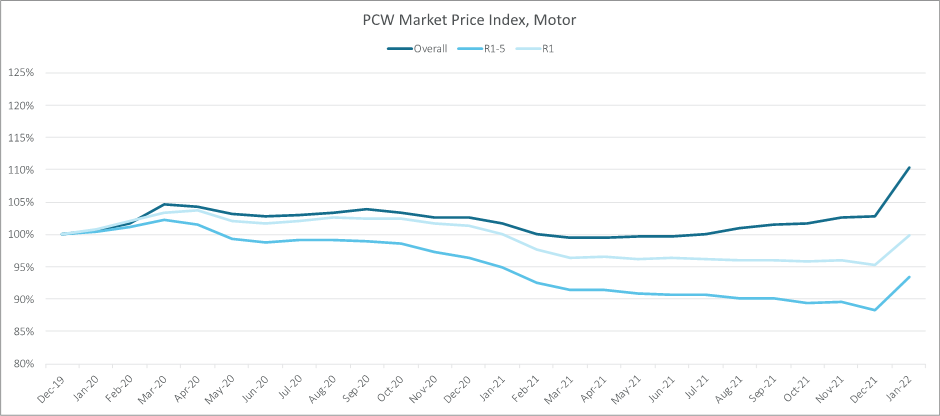

In the PCW market, new business prices have risen in January, confirming many expectations that a ban on introductory offers and price walking would see new business premiums rise.

In home, the average R1-5 new premium quoted for new customers rose by 8.4% and in motor by 5.7%, representing the single biggest monthly changes on record.

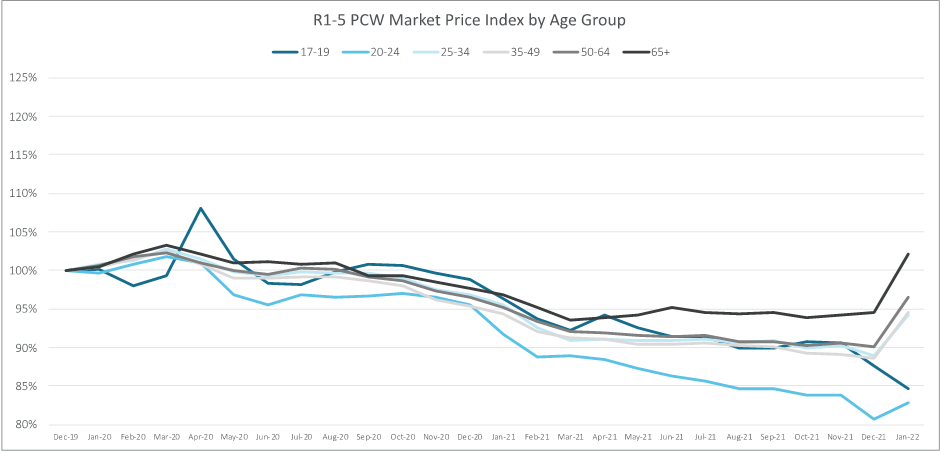

However, the rises have been far from homogeneous. In car insurance it has been a case of the older the driver, the greater the price rise. Indeed the average R1-5 premium on PCWs for drivers aged 17-19 fell by 3.4% in January while for over 65s they rose by 8.1%. This reflects a growing number of established players deepening their appetite for young drivers as well as the proportion of telematics products targeted at this age group.

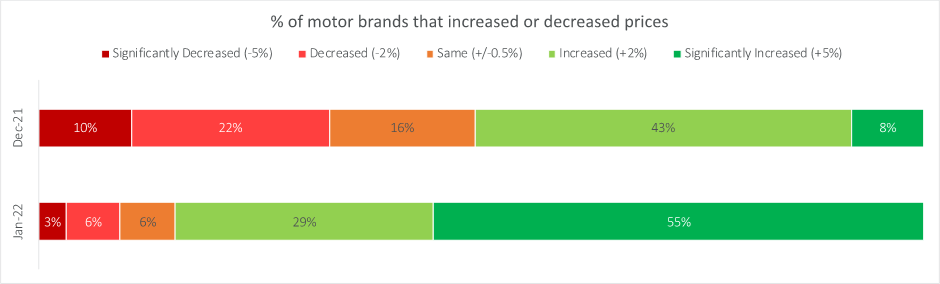

In terms of brands, more than half the motor market increased new business prices by over 5% in January 2022, and a quarter by over 10%.

Telematics and usage-based insurance featured heavily among the minority that decreased prices, including Ticker, By Miles and telematics propositions from big providers including Admiral and More Th>n. Telematics providers base renewal pricing on driving behaviour data and have by nature avoided the lifetime pricing models that perpetuated dual pricing. Therefore unincumbered by a big back book, they are able to price competitively to gain market share.

However, the biggest price cuts in January came from Marshmallow, the insurtech targeted at harder-to-insure risks such as drivers with low credit scores, unemployed people, and expats with non-UK driving licenses. Having raised $85 billion in a Series B round in September, Marshmallow has big growth ambitions - and is able to use its scale-up status to invest in lower pricing.

Home rises make space for newcomers

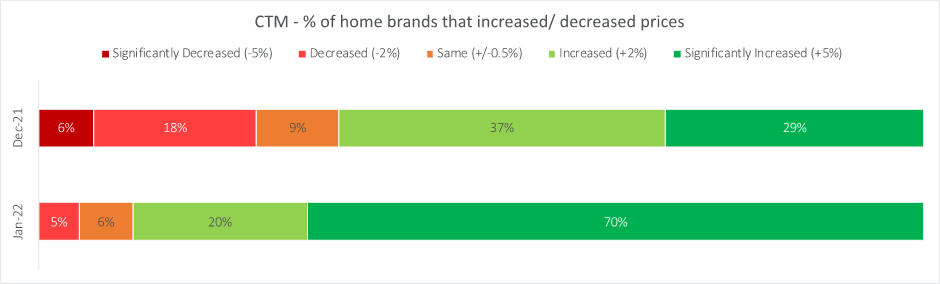

In home some 70% of brands increased prices by more than 5% in January, the soft cycle turning and those with bigger home back books raising new business prices to align their portfolios. One brand increased new business prices by an average of 36%.

Newcomer Urban Jungle was one of only three brands to offer lower prices in January than December, again underscoring the opportunity seen by new market entrants, although others put through price reductions in December, with a total of eight brands or products across five providers recording an overall decrease since November 2021.

With the business model that saw many make a loss in the first year or two due to high acquisition costs and introductory discounts upended, new entrants should also theoretically find it easier to become profitable sooner, thus lowering the barrier to entry for the sector.

Extreme as the price rises may sound, none of this should come as a surprise or cause alarm that the policy isn’t working.

The FCA itself predicted “new business prices may rise for some customers, particularly those who shop around.” Rather, the intended beneficiaries were those who have been price-walked and all those who will longer be in the future. After all, the FCA found no evidence of excess profits in the sector and expects its intervention to reduce costs overall in the longer term, as market distortion is removed and switching becomes easier. More newcomers such as Adiona and Peppercorn are planning to launch this year, which could create more downward pressure on prices.

Jumps of January’s magnitude are unlikely to be repeated en masse, and February so far is showing a degree of recalibration and finetuning by brands.

The FCA’s remedy is, of course, a long term one. The bulk of the £4.2 billion consumer savings it anticipates over the next ten years will come from lower renewal prices - and it won’t undertake its evaluation on the long-term effect on the market until 2024 after the completion of two renewal cycles.

Until then, brands will continue to refine and test their pricing strategies and the cut through of different products in the new, shaken up, world.

WEBINAR: GIPP: The £4bn question

We have seen a significant change in the general insurance market regarding price and product. In our ‘Gipp- £4bln question’ webinar (recorded March 2022), we discussed the industry impact so far, how the new rules have affected the price, the different strategies at play, and much more. To access the recording, click here.

Comment . . .

Submit a comment