Offers and incentives have become part of the natural landscape of insurance marketing. But research from the FCA earlier this year proved they can be distracting to customers, and stop them calculating and spotting the best deal.

It’s why cash and cash-equivalent incentives have come firmly under the scope of the General Insurance Pricing Practices (GIPP) rules – and why clarifications on their use continue to be added – with the latest update addendums published just last month.

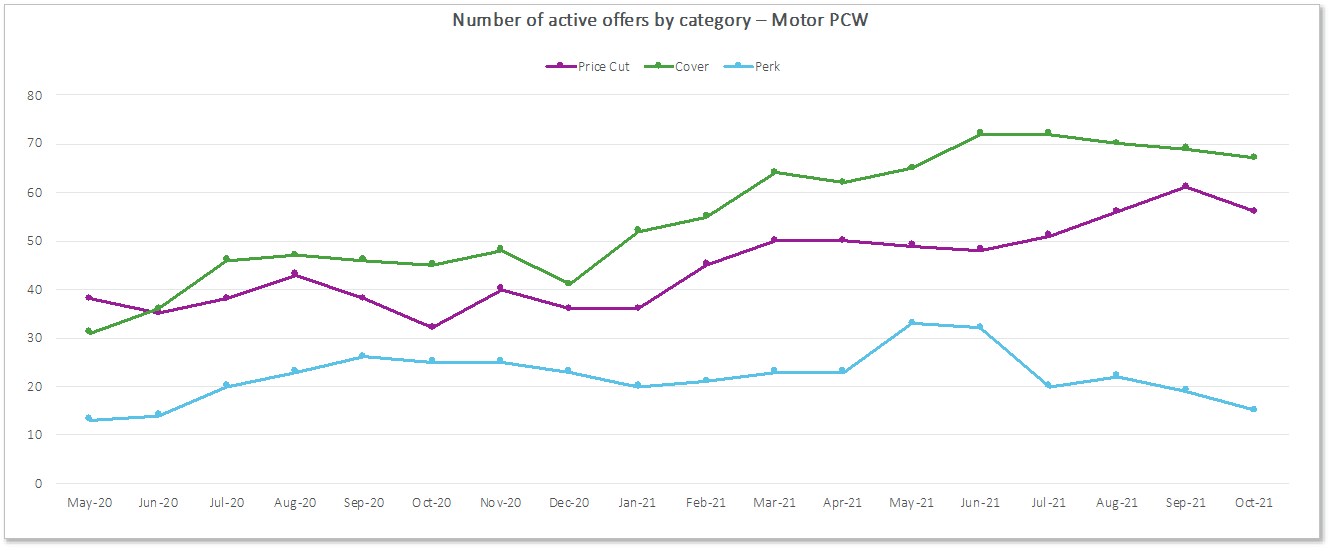

Meanwhile, the number of offers and incentives for home and motor insurance have increased over the last 12 months as brands have competed to court customers in the countdown to the price-walking ban.

There’s a slight dip in activity September to October, with perks like vouchers or gifts showing the biggest decline, halving from 32 from June to just 15 in October.

Cutting prices to win customers

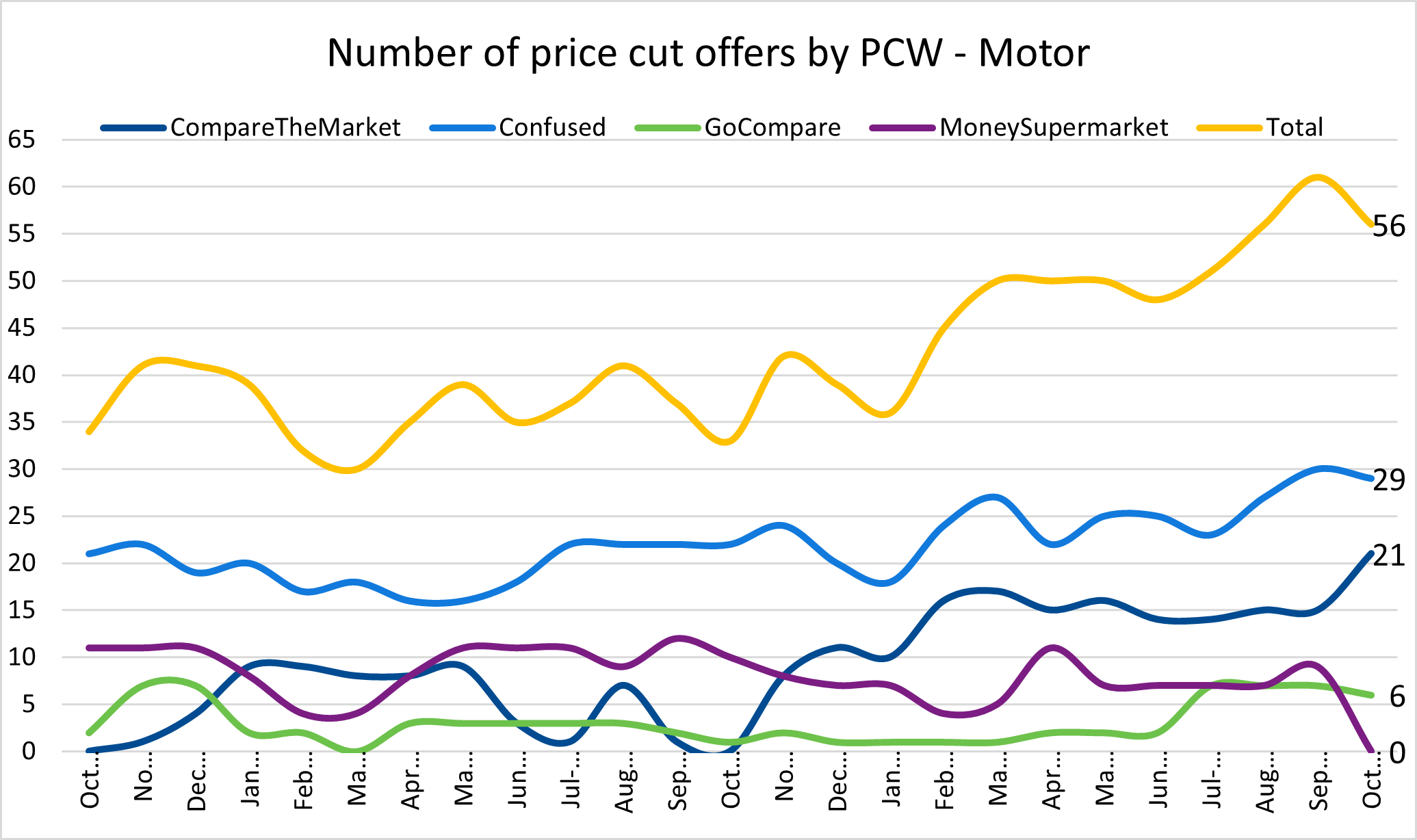

There are clear differences between the approaches of the PCWs.

Price cuts are overall the most common form of offer or incentive, accounting for 63% of motor insurance offers from Compare The Market (CTM), 61% from Confused - but only 21% of Go Compare offers, and 0% of MoneySuperMarket (MSM) offers last month.

In October overall there were 120 offers on the PCWs, and 56 were price cut or cashback messages.

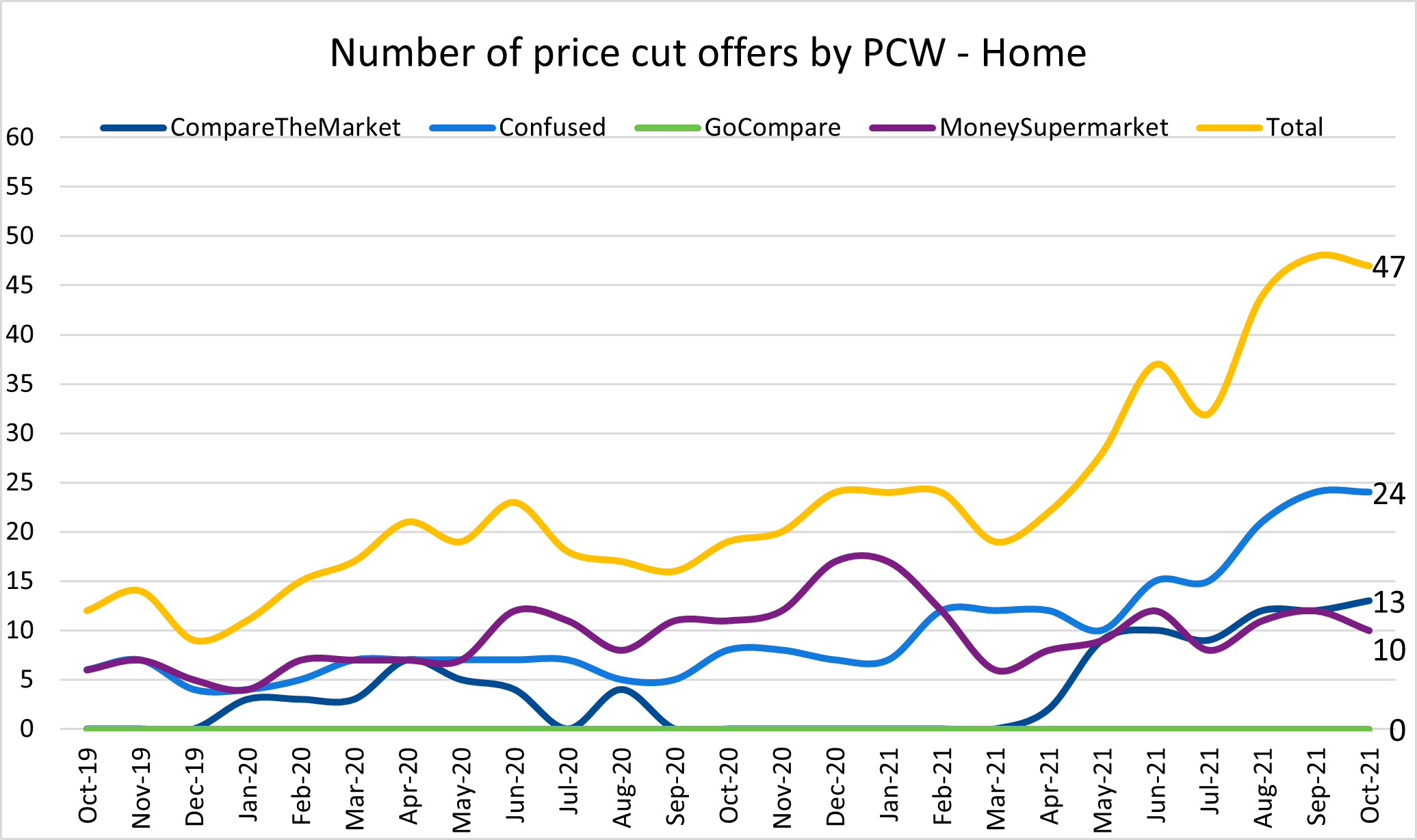

For home, price cuts were even more dominant. There were 73 offers on the PCWs, and 47 were price cut or cashback messages. Price cuts accounted for 59% of CTM offers, 83% of Confused offers, 71% of MSM offers but none of the Go Compare offers.

It’s worth noting that price cuts and cash promotions were found by the FCA’s research to be most attractive to customers (especially with £ or % included) - and also most likely to both obscure prices by increasing their complexity, and misdirect customers’ attention from total costs.

Cash-equivalent promotions like vouchers were found to also misdirect attention and decrease price comprehension, albeit to a lesser extent. Meanwhile non-cash promotions like free gifts were found to obscure prices far less than the other two types of offer and incentives, and worked as a feel-good perk rather than a major influence.

Influencing decision making

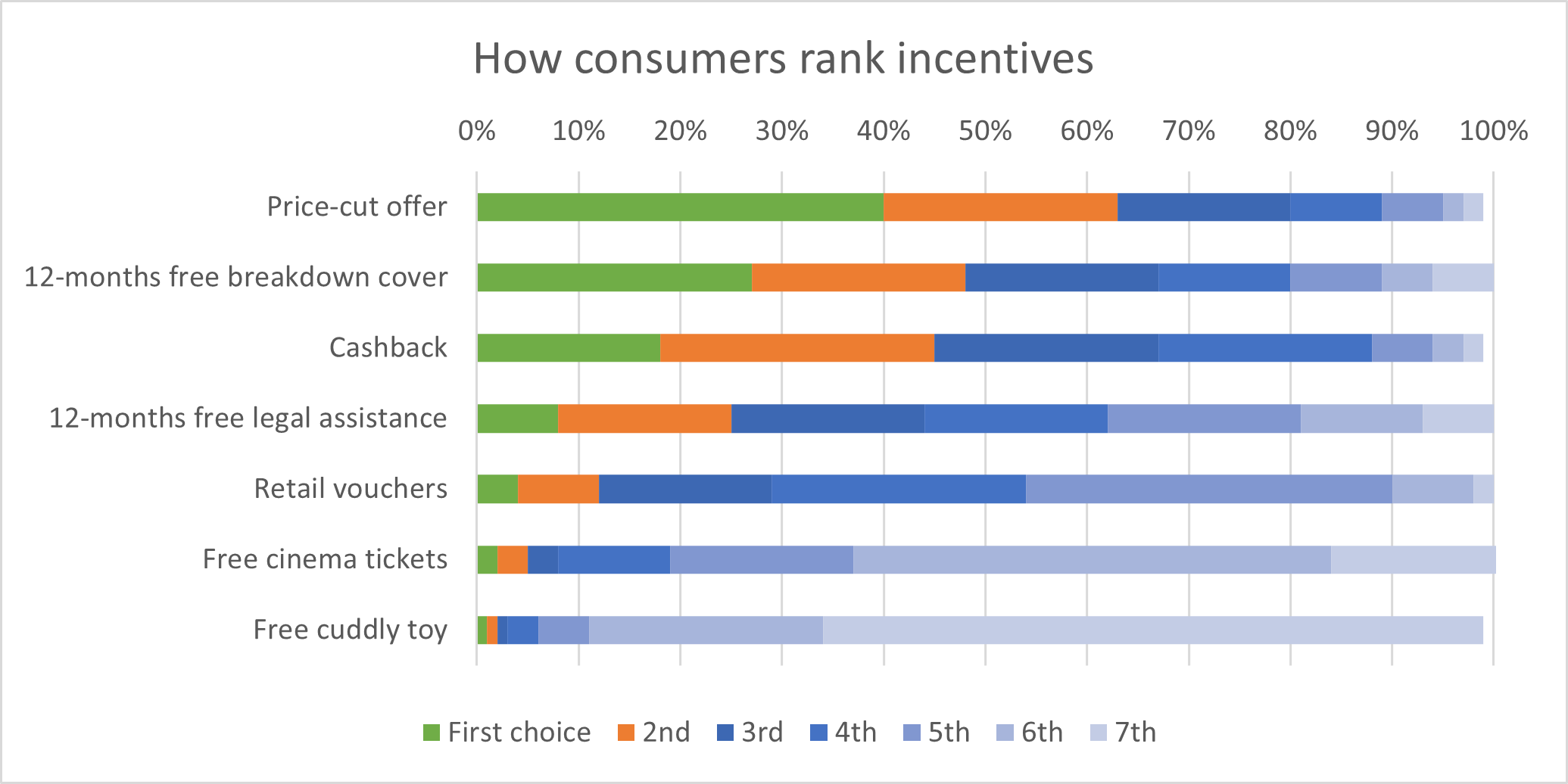

It’s clear from this behavioural study that offers and incentives do have a strong influence on decision making. In our own Viewsbank survey, we asked people to rank seven types of incentives by how much they would influence their purchasing decision.

They rated price cut offers the highest, with 80% putting them in their top 3, and cuddly toys the lowest, making the top 3 for just 3% of consumers. Cashback and free breakdown cover were also highly valued, but legal expenses and cinema tickets failed to make most people’s incentive wish list.

Rank the following in order of factors that would influence your purchasing decision

The future of offers and incentives

So will that all leave offers and incentives in 2022?

Well the GIPP rules make it very clear firms cannot disadvantage existing customers by offering incentives to new customers only. However, it remains to be seen what impact that actually has on marketing strategies and offers and incentives over the long term... We could see, for instance, brands extending offers and incentives to existing customers as part of renewal communications - and we’re certainly likely to see the PCWs themselves continue to incentivise traffic through promotions.

Whatever strategies these brands employ, it’s safe to say the offers and incentives landscape will change. It’s also safe to say the FCA will be watching closely - and will be ready to close loopholes. Already they’ve made it clear firms cannot fund incentives offered by a third party, and have been at pains to stress the need for record keeping to prove brands have included cash or cash-equivalent incentives given to new customers in their calculations of Equivalent New Business Price (ENBP) for existing customers.

What it certainly doesn’t mean, however, is that consumers have yet lost their appetite for offers and incentives. The industry has trained them to shop around, and to look for deals, and for many it’s a point of both practice and pride. Indeed, 71% of people in our survey felt offers and incentives made them more inclined to buy an insurance product.

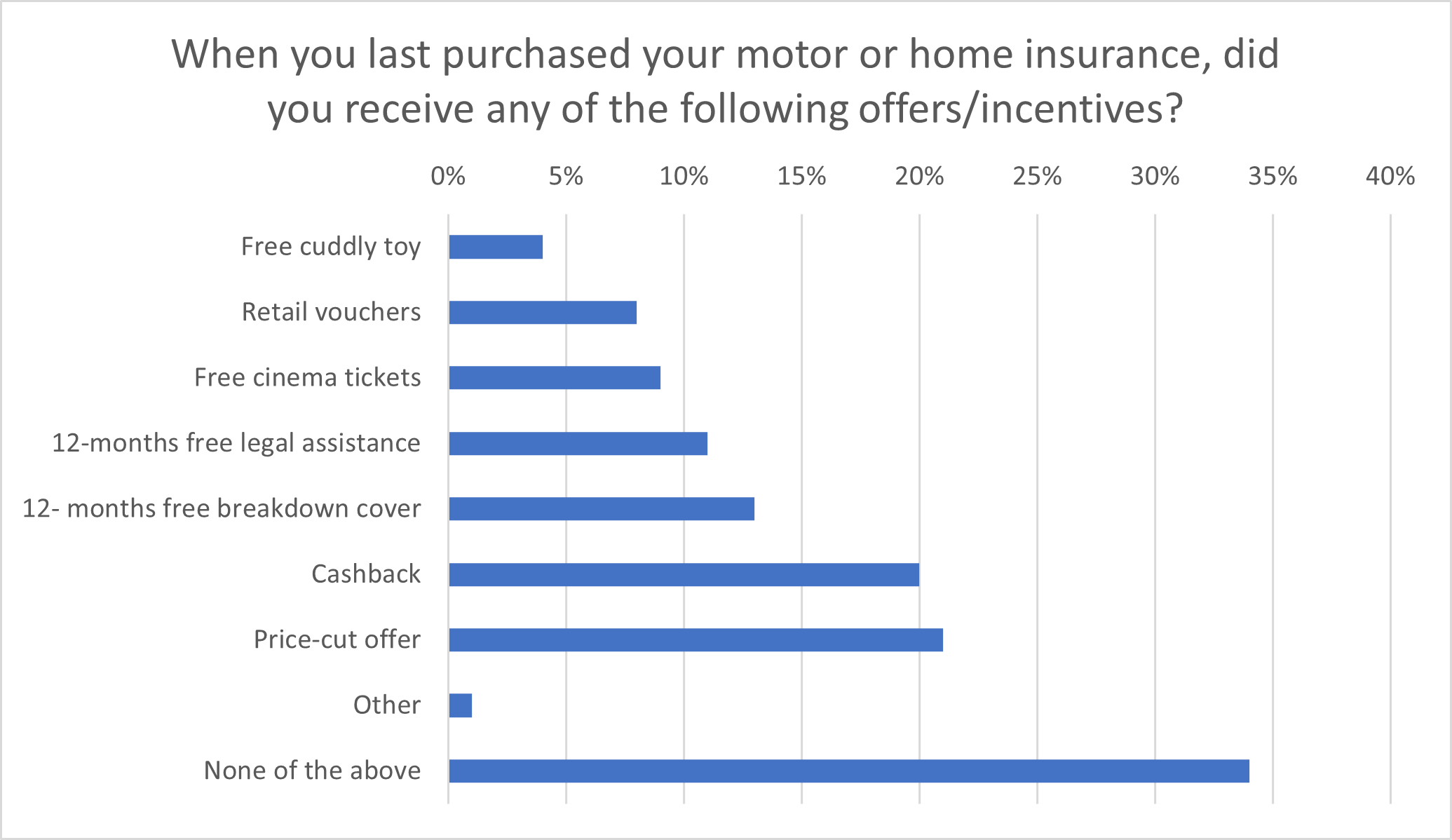

66% remembered receiving an offer or incentive in their last policy purchase.

What’s really interesting, however, are the responses of the 29% of respondents who said they wouldn’t be influenced by offers and incentives. Many were quite vehement these were a rip off, and that they just wanted a fair, low price with no gimmicks or subterfuge.

It could suggest then, that consumers as much as the FCA are ready for some Fair Value - and perhaps brands would do well to listen, incentivise, market and communicate accordingly.

Identify opportunities to maximise retention and acquisition rates

Offers and incentives are just one part of the customer proposition. From pricing to consumer behaviour, we have detailed data on what’s happening, where. Get in touch to find out more.

Comment . . .

Submit a comment